- Germany

- /

- Industrials

- /

- XTRA:SIE

Is Siemens Fairly Priced After 22% Year-to-Date Stock Surge and Energy Tech Expansion?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Siemens stock is truly worth its current price, you are not alone. Today's valuation is on investors' minds for good reason.

- The share price has seen impressive growth year-to-date, rising 21.8%. It is up 25.8% over the last twelve months, although there was a slight dip of 2.9% in the past week. Some may be questioning if momentum will continue.

- Recent headlines have highlighted Siemens' strategic expansion into energy technology and automation, fueling both optimism and speculation in the market. Investors are taking notice as the company signs notable new partnerships and cements its position at the forefront of industrial innovation.

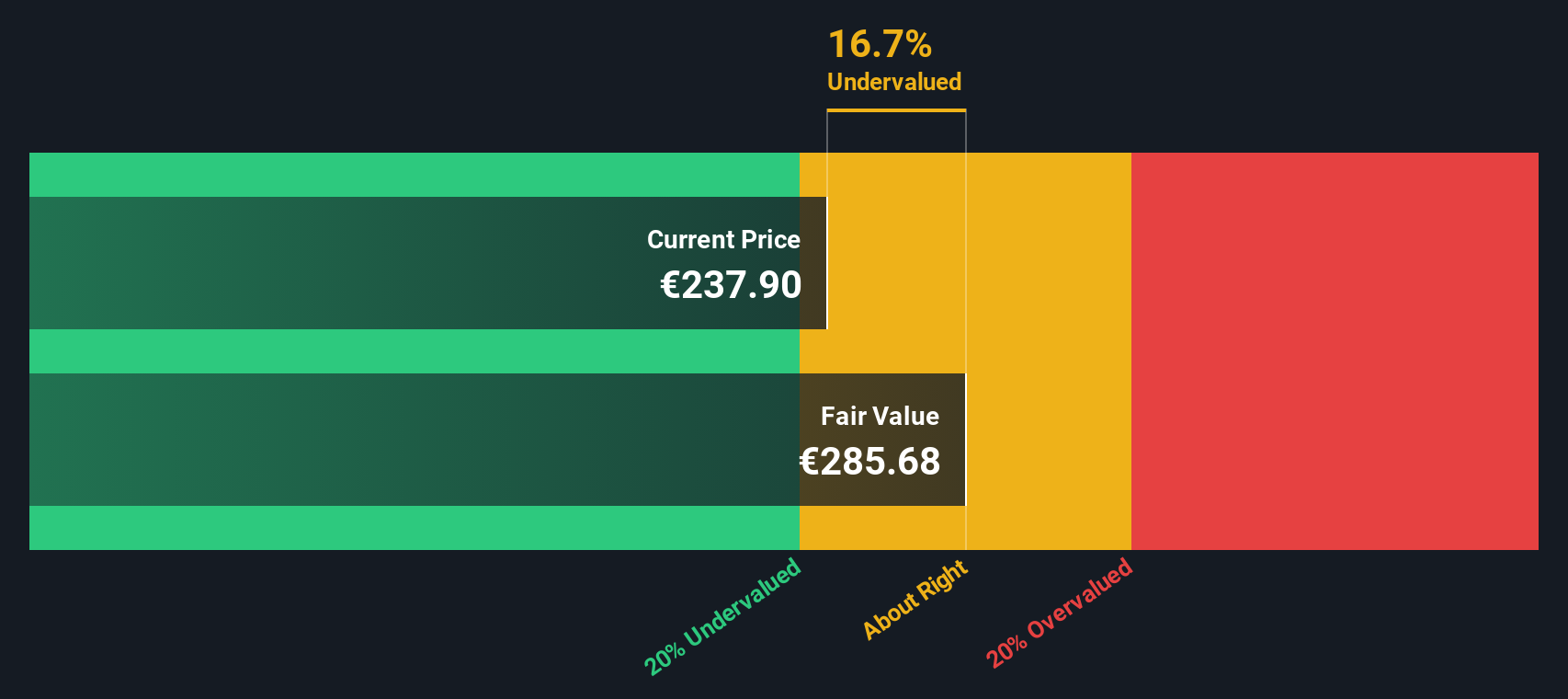

- Based on our latest checks, Siemens scores 4 out of 6 for being undervalued. That is just one way to approach valuation. Stick around as we unpack different valuation perspectives and, later on, show you an even better way to assess if Siemens is fairly priced.

Approach 1: Siemens Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting future cash flows and discounting them back to today's terms. This helps investors understand what the business might be worth based on the cash it can generate over time, rather than simply focusing on current earnings or assets.

For Siemens, the current Free Cash Flow stands at approximately €10.6 Billion. Analysts provide FCF estimates for up to five years, peaking at €11.4 Billion in 2029. Simply Wall St extrapolates these projections forward, with free cash flows expected to reach €11.1 Billion by 2030. All figures are reported in euros, the company's reporting currency.

Based on these cash flow forecasts and the 2 Stage Free Cash Flow to Equity approach, Siemens' estimated intrinsic value is €295.95 per share. According to the DCF model, this represents a 22.2% discount compared to the current share price, which suggests the stock is undervalued at today's levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Siemens is undervalued by 22.2%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: Siemens Price vs Earnings

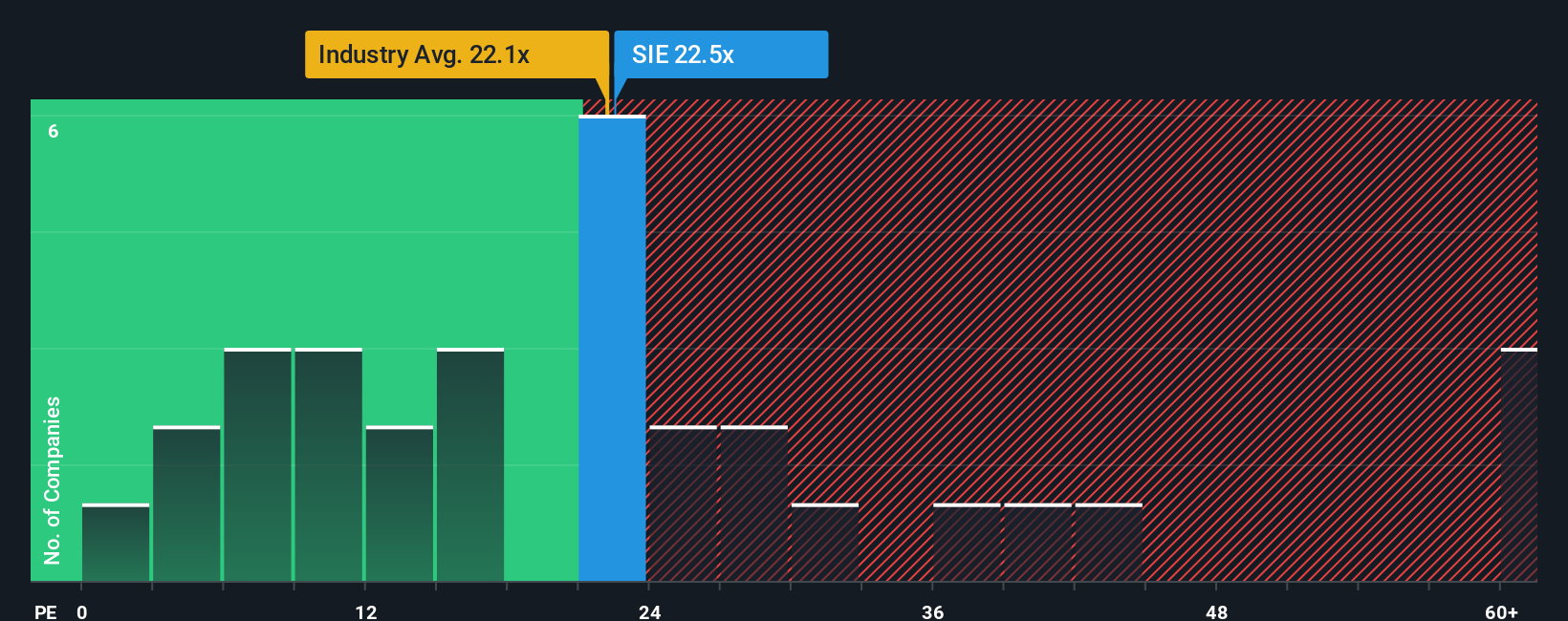

The Price-to-Earnings (PE) ratio is a widely used valuation metric, particularly effective for established and consistently profitable companies like Siemens. It allows investors to assess how much they are paying for each euro of current earnings, making it a simple yet insightful way to compare companies’ valuations.

What is considered a "normal" or "fair" PE ratio often depends on factors such as growth expectations and perceived risks. Companies expected to grow faster or with lower risk profiles typically justify a higher PE ratio than slower-growing or riskier peers. Conversely, stocks seen as riskier or with lower growth may trade at a lower multiple.

Siemens currently trades on a PE ratio of 22.7x. This is notably higher than the Industrials industry average of 12.9x, but lower than the average across key peers, which stands at 57.1x. However, to provide deeper context, Simply Wall St calculates a "Fair Ratio" at 27.8x and uniquely tailored to Siemens. This metric incorporates factors like Siemens’ earnings growth, profit margins, scale, industry, and specific risks, painting a more complete picture than a simple peer or sector comparison.

The Fair Ratio is a more comprehensive benchmark, as it does not just reflect averages but weighs company-specific traits and future prospects. This approach helps identify whether the stock is valued appropriately given its unique growth drivers and risks, rather than just its industry or peers' pricing.

With Siemens currently at a 22.7x PE ratio against its Fair Ratio of 27.8x, Siemens appears undervalued based on this view.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Siemens Narrative

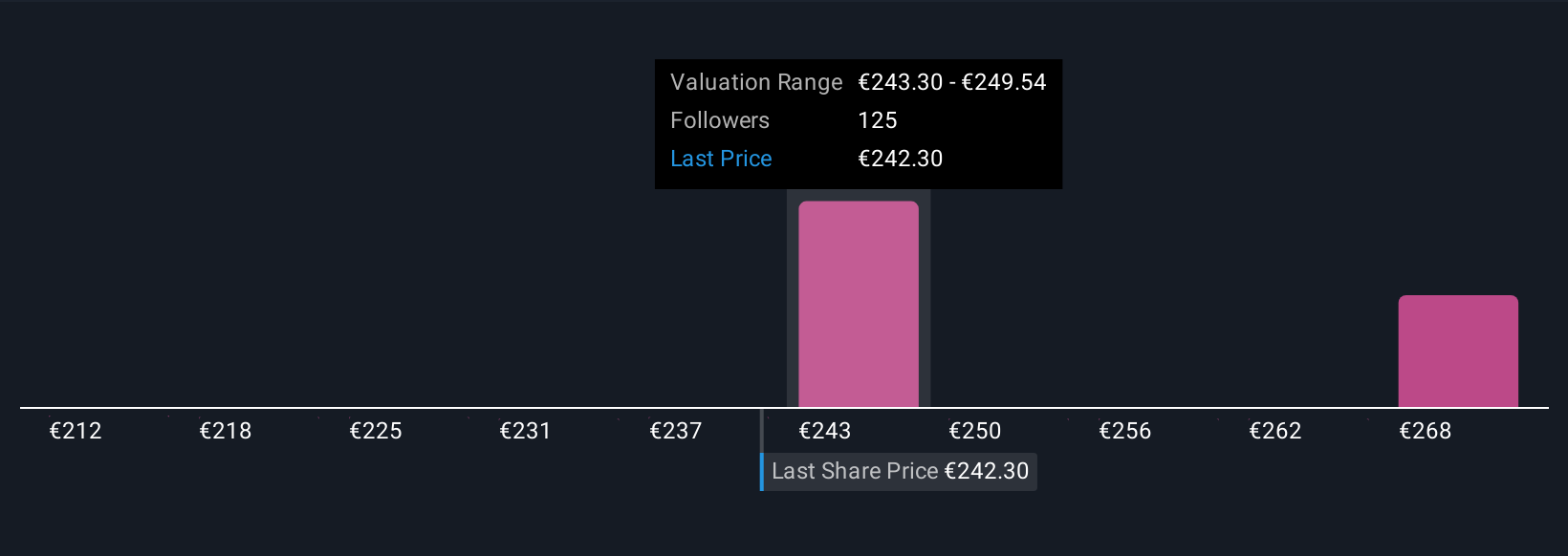

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story or perspective you have about a company, linking your beliefs about its future, such as revenue growth, margins, or big trends, to a forecast for its financials and, ultimately, to a fair value for the stock. On Simply Wall St, Narratives are an easy, accessible tool available on the Community page, used by millions of investors to share, debate, and personalize their investment views.

Narratives empower you to see why investors might disagree about a stock by connecting the company’s story with quantified financial outcomes and an up-to-date fair value. They help you decide when to buy or sell by comparing your Narrative’s fair value to the current market price. Each Narrative is updated dynamically as new information, such as earnings reports or breaking news, emerges. For example, some Siemens Narratives are more optimistic, expecting €300 per share based on long-term digital revenue growth, while others see as little as €185 per share due to concerns over margin pressure and global competition. No matter your outlook, Narratives make it simple to invest based on your own conviction.

Do you think there's more to the story for Siemens? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SIE

Siemens

A technology company, focuses in the areas of automation and digitalization in Europe, Commonwealth of Independent States, Africa, the Middle East, the Americas, Asia, and Australia.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives