How Much Did R. STAHL's(ETR:RSL2) Shareholders Earn From Share Price Movements Over The Last Five Years?

While not a mind-blowing move, it is good to see that the R. STAHL AG (ETR:RSL2) share price has gained 15% in the last three months. But over the last half decade, the stock has not performed well. You would have done a lot better buying an index fund, since the stock has dropped 33% in that half decade.

Check out our latest analysis for R. STAHL

R. STAHL isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years R. STAHL saw its revenue shrink by 2.7% per year. While far from catastrophic that is not good. The stock hasn't done well for shareholders in the last five years, falling 6%, annualized. But it doesn't surprise given the falling revenue. Without profits, its hard to see how shareholders win if the revenue keeps falling.

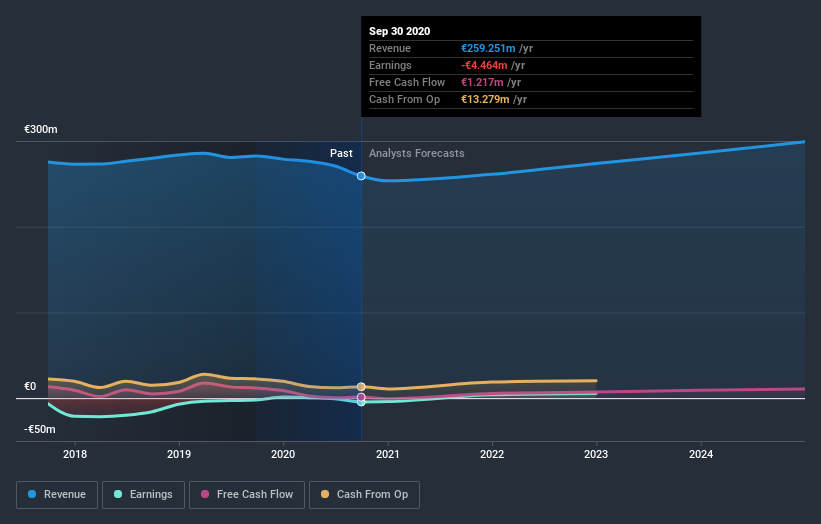

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at R. STAHL's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between R. STAHL's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for R. STAHL shareholders, and that cash payout explains why its total shareholder loss of 30%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

Investors in R. STAHL had a tough year, with a total loss of 31%, against a market gain of about 6.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 5% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

We will like R. STAHL better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

If you’re looking to trade R. STAHL, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:RSL2

R. STAHL

Develops, manufactures, assembles, and distributes devices and systems for measuring, controlling, and distribution of energy, securing, and lighting explosive environments worldwide.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion