- Germany

- /

- Aerospace & Defense

- /

- XTRA:RHM

A Fresh Look at Rheinmetall (XTRA:RHM) Valuation After Recent Share Price Drop

Reviewed by Simply Wall St

Rheinmetall (XTRA:RHM) shares have shown some movement lately, with investors eyeing the recent data on returns and profitability. The company's stock trajectory raises questions about whether its strong revenue and net income growth can continue to drive interest.

See our latest analysis for Rheinmetall.

After an impressive rally throughout 2024, Rheinmetall’s share price has hit turbulence and dropped 18.2% over the past month, even though its total shareholder return for the past year stands at a staggering 138%. This rapid upside, followed by a recent pullback, suggests shifting momentum as investors weigh the company’s remarkable multi-year growth against evolving market expectations.

Inspired by the action in defense and aerospace this year? Now is your chance to discover See the full list for free.

The question now is whether Rheinmetall’s recent dip signals an overlooked value, or if the remarkable gains of the past year mean the market is already factoring in all its future potential growth.

Most Popular Narrative: 82.1% Undervalued

According to EUinvestor, Rheinmetall’s fair value is set far above its latest close, projecting an ambitious future trajectory. This bold outlook is underpinned by standout growth assumptions and recent CEO commentary that point to massive order expansion on the horizon.

On April 17, 2025, Armin Papperger, Rheinmetall's CEO, said he expects orders to grow 450% by 2030. The share price at the time of this information on 17/04/2025 was 1,464 EUR. Price estimate for 2030: 1,464 + 450% = 8,052 EUR.

Curious how this narrative gets to such staggering numbers? The secret ingredient is a series of aggressive revenue and order book projections few are willing to make public. Find out how this valuation balances bold defense growth forecasts with future milestones yet to hit the headlines.

Result: Fair Value of €8,052 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, political surprises such as a truce in Ukraine or new EU tariffs could rapidly shift sentiment and trigger significant volatility in Rheinmetall's share price.

Find out about the key risks to this Rheinmetall narrative.

Another View: Multiples Tell a Different Story

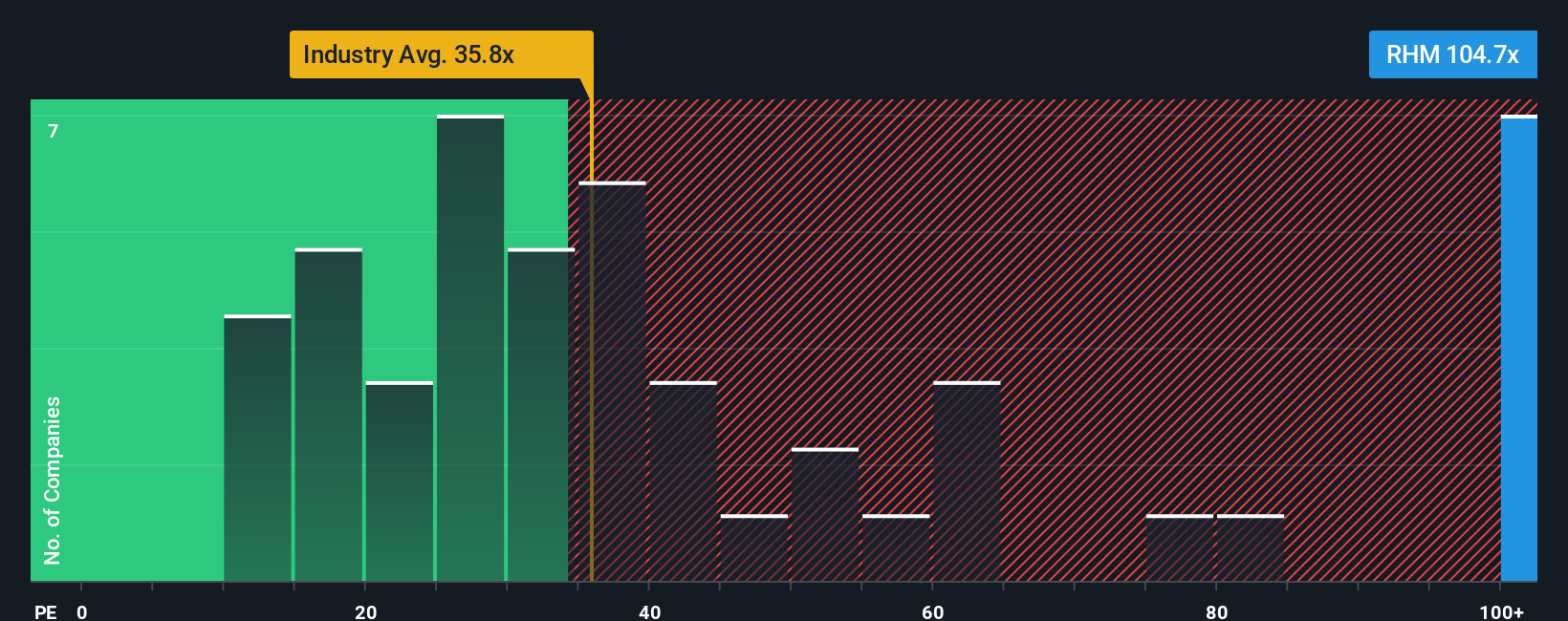

Taking a look at traditional earnings ratios, Rheinmetall appears expensive. Its price-to-earnings ratio stands at 76.8 times, well above the industry average of 31.1 and peer average of 41.8. Even compared to its fair ratio of 54.5, this premium suggests a significant valuation risk if market sentiment changes. Is the optimism already overbaked, or is there more to justify this premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rheinmetall Narrative

If you think there's another angle to consider or want to dig deeper into the numbers yourself, it only takes a few minutes to shape your own perspective. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Rheinmetall.

Looking for more investment ideas?

Smart investors know that opportunity rarely waits. Tap into new markets and future winners by checking out these handpicked investment themes before the next surge leaves you behind.

- Capture major gains by targeting growth potential in AI and automation with these insightful picks: these 26 AI penny stocks

- Uncover high-yield opportunities and steady income streams by exploring these 14 dividend stocks with yields > 3% with attractive yields above 3%.

- Position yourself at the forefront of financial innovation by gaining exposure to digital assets via these 81 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:RHM

Rheinmetall

Provides mobility and security technologies in Germany, Rest of Europe, North, Middle, and South America, Asia and the Near East, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success