- Germany

- /

- Electrical

- /

- XTRA:PFSE

Undiscovered European Gems To Explore In May 2025

Reviewed by Simply Wall St

In the wake of recent market volatility and economic uncertainty, European stocks have seen mixed performances, with the pan-European STOXX Europe 600 Index snapping a five-week winning streak due to tariff concerns. However, amidst these challenges lie potential opportunities for investors willing to explore lesser-known companies that may offer resilience and growth prospects in a fluctuating environment. In this context, identifying stocks with strong fundamentals and adaptability can be crucial for navigating the current landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Dekpol | 70.15% | 14.02% | 14.57% | ★★★★★☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 8.97% | 21.29% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Storytel (OM:STORY B)

Simply Wall St Value Rating: ★★★★★★

Overview: Storytel AB (publ) offers streaming services for audiobooks and e-books, with a market capitalization of approximately SEK7.80 billion.

Operations: Storytel generates revenue primarily from its streaming services, which contributed SEK3.43 billion, and its publishing segment, which added SEK1.16 billion. The company's net profit margin is a crucial metric to consider for understanding its profitability dynamics over time.

Storytel, a growing player in the audiobook and e-book streaming market, has recently turned profitable with net income reaching SEK 15.42 million for Q1 2025, compared to a net loss of SEK 24.82 million the previous year. This turnaround is bolstered by strategic acquisitions like Bokfabriken and investments in AI technology aimed at enhancing user engagement and operational efficiency. Despite facing competitive pressures from giants like Spotify, Storytel's earnings per share have improved to SEK 0.2 from a loss of SEK 0.32 last year, while trading at approximately 57% below estimated fair value offers potential upside amidst projected revenue growth of over 10% annually through strategic expansions beyond its Nordic base.

Mühlbauer Holding (XTRA:MUB)

Simply Wall St Value Rating: ★★★★★★

Overview: Mühlbauer Holding AG specializes in the production and personalization of smart cards, passports, solar cells, and RFID solutions across various international markets with a market capitalization of approximately €627.28 million.

Operations: Mühlbauer's revenue streams are primarily derived from its Automation segment (€230.92 million) and Tecurity® segment (€171.70 million), with additional contributions from Precision Parts & Systems (€53.76 million).

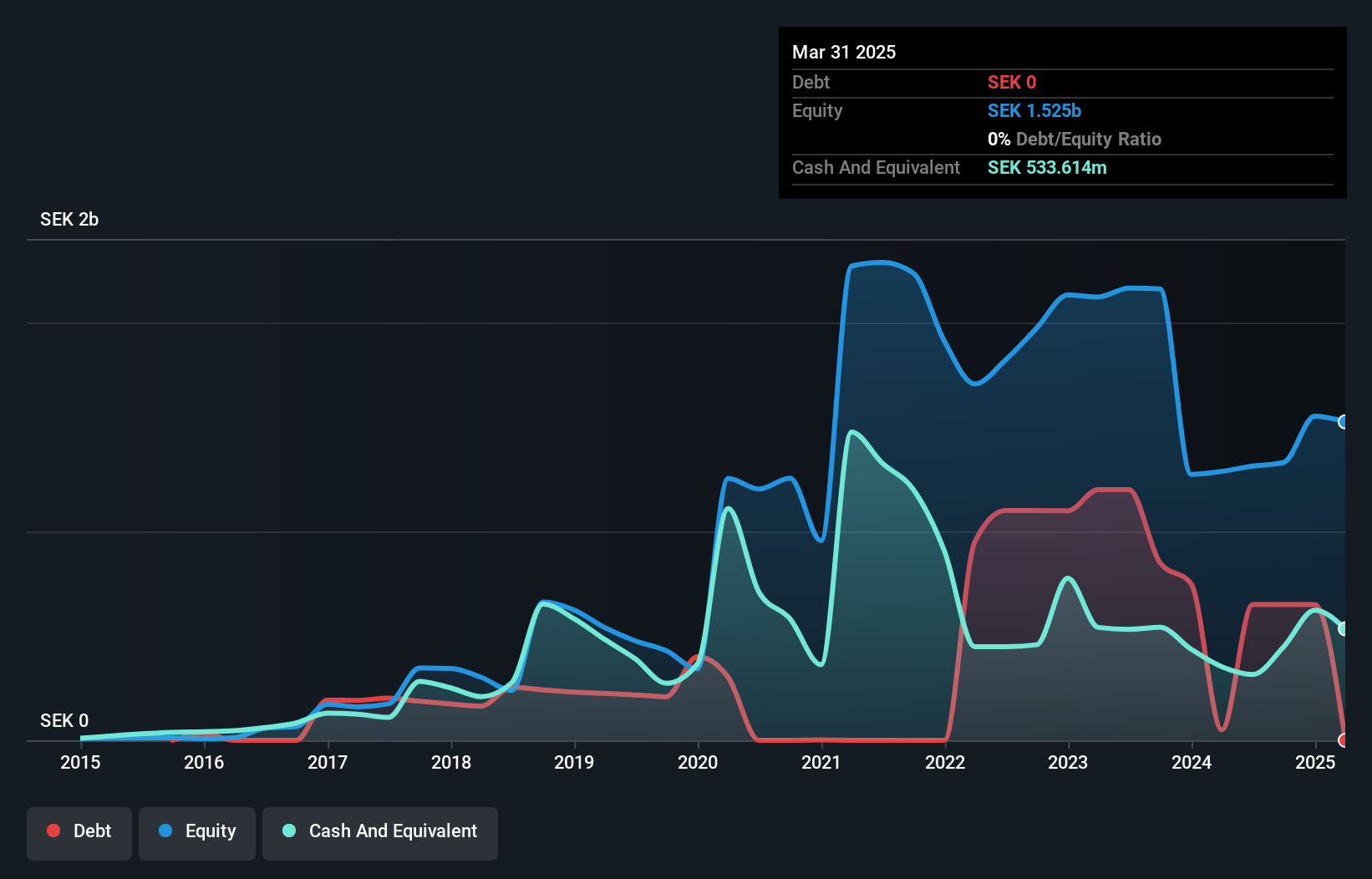

Mühlbauer Holding, a relatively small player in the machinery sector, has demonstrated impressive earnings growth of 174.9% over the past year, far outpacing the industry's -1.8%. Despite this recent surge, its earnings have averaged an annual decline of 12.7% over five years. Notably debt-free for five years, Mühlbauer's collaboration with Sion Power on advanced battery technology suggests strategic innovation in energy solutions. This partnership aims to produce high-capacity lithium-metal cells that could revolutionize electric vehicle performance by doubling energy density and reducing costs significantly—an intriguing development for potential investors eyeing future growth prospects in sustainable tech advancements.

PFISTERER Holding (XTRA:PFSE)

Simply Wall St Value Rating: ★★★★★☆

Overview: PFISTERER Holding SE specializes in the production and sale of cable fittings, insulators for overhead lines, and components for energy networks and renewable energy generation, with a market capitalization of approximately €590.81 million.

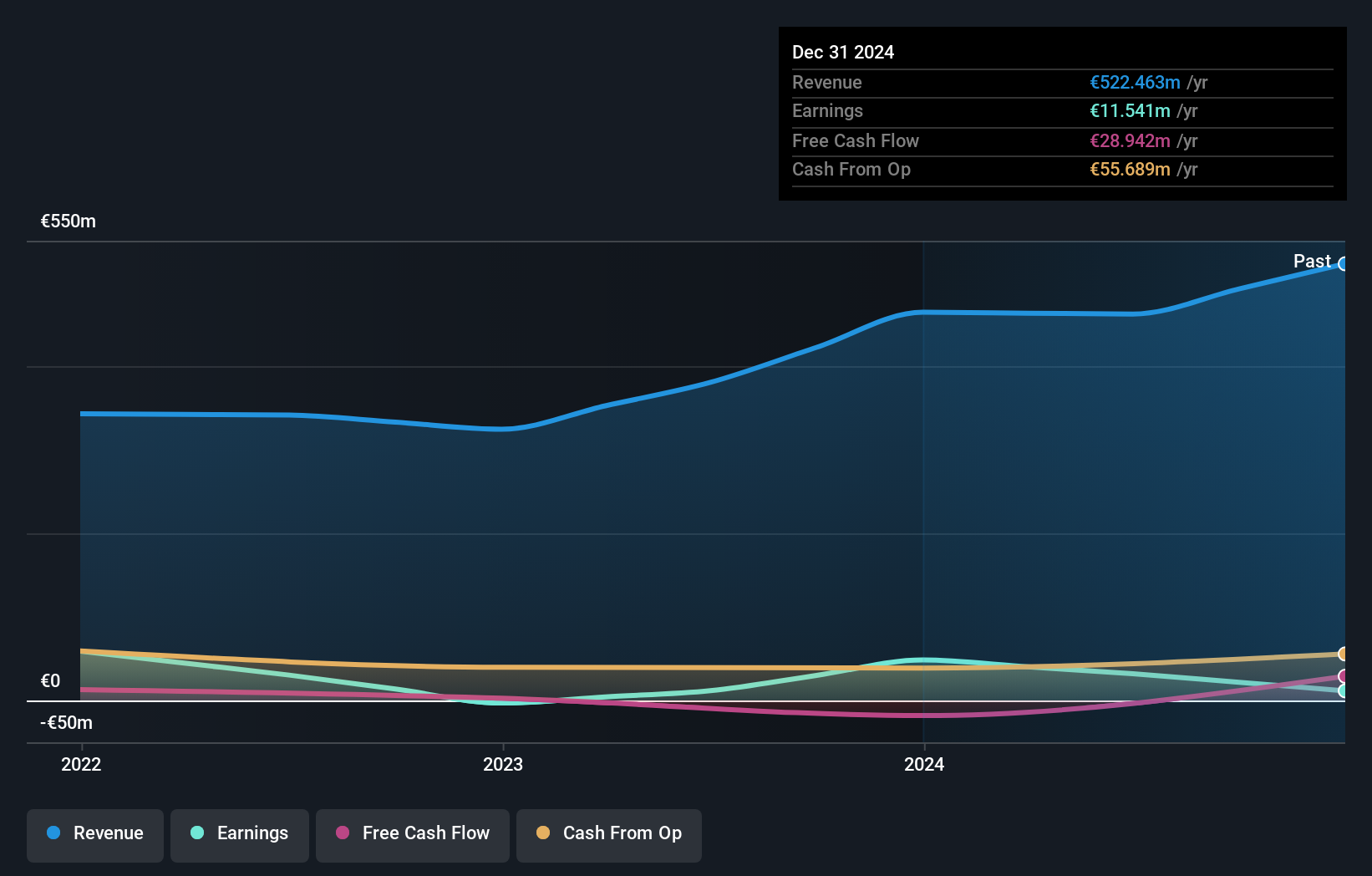

Operations: PFISTERER generates revenue primarily from four segments: Components (€102.70 million), Overhead Lines (€86.90 million), High Voltage Cable Accessories (€144.81 million), and Medium Voltage Cable Accessories (€48.71 million).

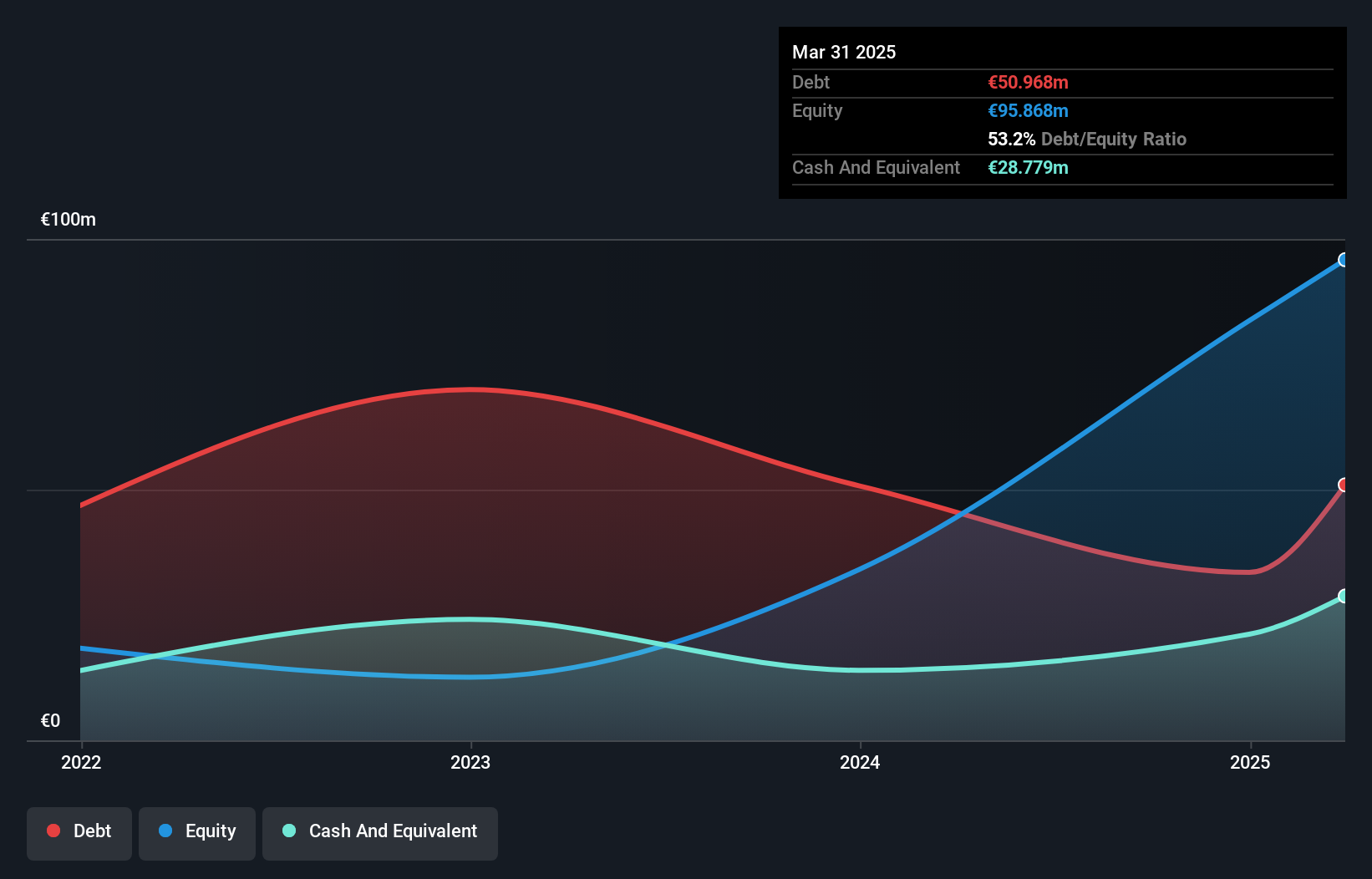

PFISTERER Holding, a nimble player in the electrical industry, recently made waves with its IPO, raising €167.1 million through the sale of over 6 million shares at €27 each. The company is trading at a significant discount to its estimated fair value and boasts impressive earnings growth of 41.7% in the past year, outpacing industry norms. With a net debt to equity ratio of 14.7%, PFISTERER's financial health appears robust while interest payments are comfortably covered by EBIT at 13 times over. Their innovative subsea cable repair solutions highlight their commitment to leading-edge technology and strategic expansion plans are underway using IPO proceeds for M&A activities and capacity enhancement.

- Unlock comprehensive insights into our analysis of PFISTERER Holding stock in this health report.

Examine PFISTERER Holding's past performance report to understand how it has performed in the past.

Taking Advantage

- Reveal the 331 hidden gems among our European Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:PFSE

PFISTERER Holding

Manufactures and sells cable fittings, insulators for overhead lines, and associated components for sensitive interfaces in energy networks and renewable energy generation.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives