As the European market navigates through uncertainties stemming from U.S. trade policies and economic adjustments, the pan-European STOXX Europe 600 Index recently snapped a 10-week streak of gains, reflecting investor caution. However, with Germany and the European Union planning increased spending on defense and infrastructure, opportunities may arise for companies with strong fundamentals to thrive in this evolving landscape. In such an environment, stocks that demonstrate robust financial health and adaptability are often well-positioned to capitalize on these shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Martifer SGPS | 123.58% | -2.38% | 5.61% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Mirbud | 16.01% | 27.19% | 26.48% | ★★★★★★ |

| Moury Construct | 2.93% | 10.28% | 30.93% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Onde | 21.84% | 8.04% | 2.79% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

HOMAG Group (DB:HG1)

Simply Wall St Value Rating: ★★★★★☆

Overview: HOMAG Group AG, with a market cap of €454.95 million, manufactures and sells machines and solutions for the woodworking and timber construction industries globally through its subsidiaries.

Operations: HOMAG Group generates revenue primarily from the sale of machines and solutions tailored for the woodworking and timber construction industries. The company's net profit margin has shown variability over recent periods, reflecting changes in operational efficiency and cost management.

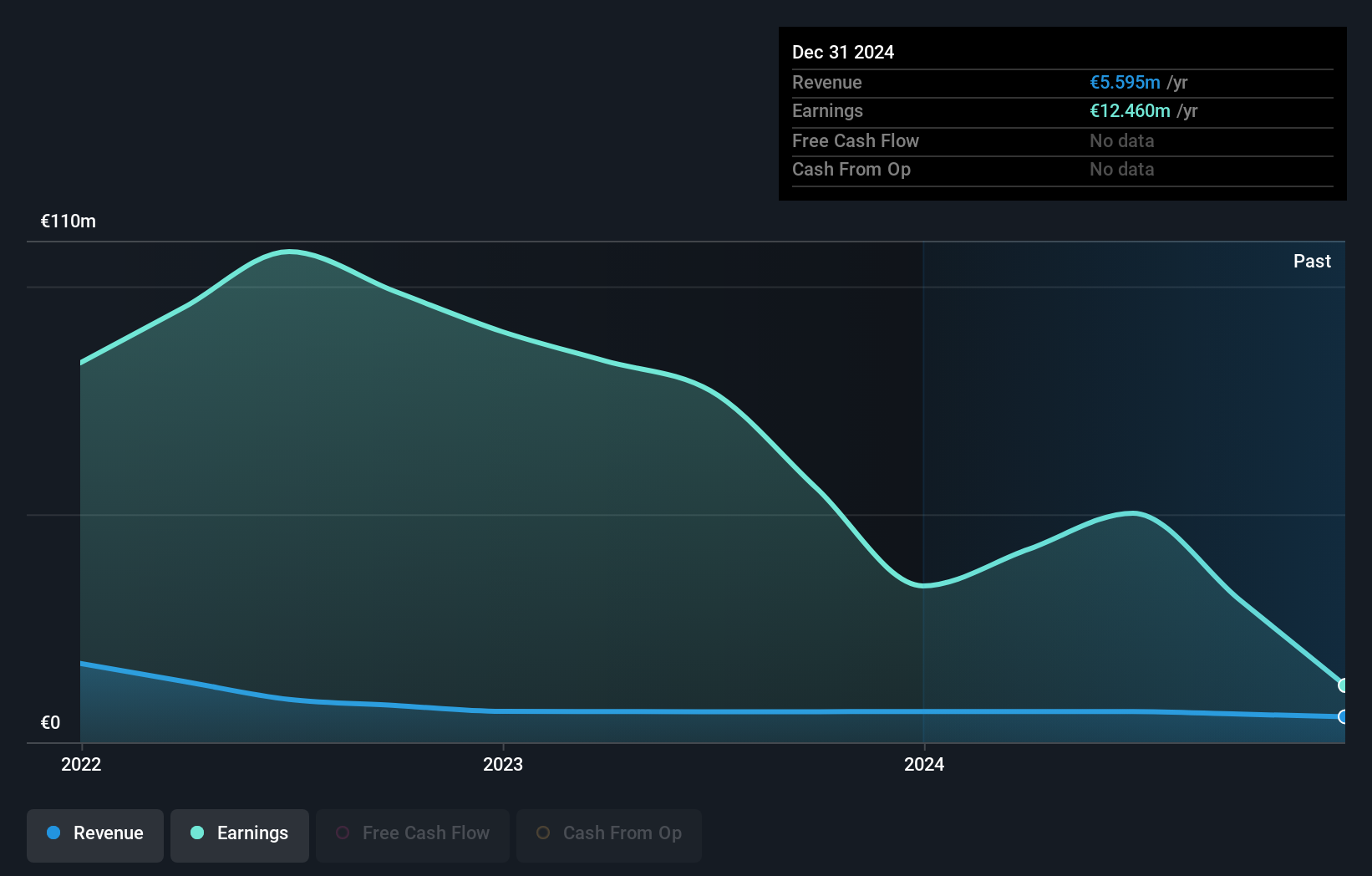

HOMAG Group, a machinery player in Europe, stands out with its attractive price-to-earnings ratio of 8.8x, which is notably lower than the German market's average of 17x. Despite being debt-free for over five years, recent earnings growth has been challenging at -34.8%, lagging behind the industry average of -8.6%. The company's high-quality past earnings offer some reassurance, though profit margins have dipped compared to last year. With a volatile share price observed over the last quarter and no concerns about interest payments due to its debt-free status, HOMAG presents a mixed yet intriguing profile for potential investors.

KSB SE KGaA (XTRA:KSB)

Simply Wall St Value Rating: ★★★★★★

Overview: KSB SE & Co. KGaA is a global manufacturer and supplier of pumps, valves, and related services with a market capitalization of approximately €1.31 billion.

Operations: KSB SE & Co. KGaA generates revenue primarily from its Pumps segment, contributing €1.52 billion, followed by KSB Supremeserv at €978.20 million and Fittings at €370.94 million.

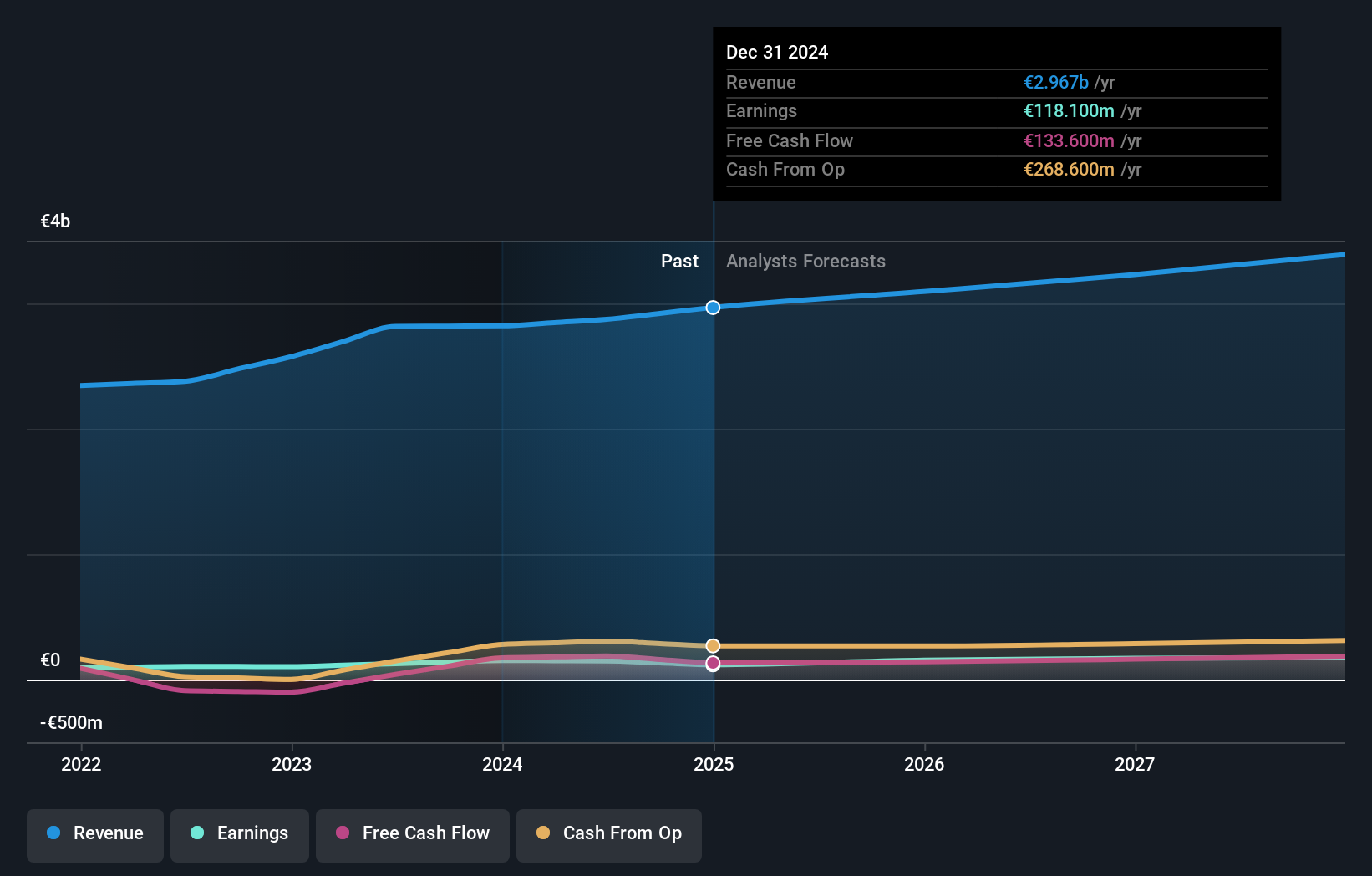

KSB SE KGaA, a notable player in the machinery sector, has demonstrated impressive earnings growth of 16.8% over the past year, outpacing the industry's -8.6%. The company's debt to equity ratio has significantly improved from 9.2% to 0.8% in five years, indicating prudent financial management. Despite a one-off loss of €102 million impacting recent results, KSB remains financially robust with more cash than total debt and free cash flow positivity at €187 million as of June 2024. Trading at approximately 71% below its estimated fair value suggests potential for investors seeking undervalued opportunities in Europe’s market landscape.

- Take a closer look at KSB SE KGaA's potential here in our health report.

Gain insights into KSB SE KGaA's past trends and performance with our Past report.

OHB (XTRA:OHB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: OHB SE is a space and technology company with operations in Germany, the rest of Europe, and internationally, and it has a market capitalization of approximately €1.33 billion.

Operations: OHB SE generates revenue primarily from its Space Systems segment (€818.74 million) and Aerospace segment (€129.26 million), with additional contributions from the Digital segment (€117.41 million).

In recent times, OHB has shown impressive earnings growth of 155.2%, outpacing the Aerospace & Defense industry's 34%. The company's interest payments are well covered by EBIT at 12.6x, indicating a strong ability to manage its debt obligations. However, the net debt to equity ratio stands high at 52.6%, which could be a point of concern for potential investors. A large one-off loss of €37.8M has impacted financial results over the last year, yet the price-to-earnings ratio remains attractive at 19.1x compared to the industry average of 28.9x, suggesting potential value opportunities despite challenges with free cash flow positivity and operating cash coverage for debt.

- Click here to discover the nuances of OHB with our detailed analytical health report.

Review our historical performance report to gain insights into OHB's's past performance.

Key Takeaways

- Click this link to deep-dive into the 367 companies within our European Undiscovered Gems With Strong Fundamentals screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KSB SE KGaA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:KSB

KSB SE KGaA

Manufactures and supplies pumps, valves, and related services worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives