- Germany

- /

- Electrical

- /

- XTRA:NDX1

Does Nordex’s (XTRA:NDX1) New SSE Wind Contract Signal Growing Value of Service Extensions?

Reviewed by Sasha Jovanovic

- Nordex SE recently announced it secured a new order from SSE to supply and install seven N163 wind turbines across two wind farms in the Aragon region of Spain, totaling 42 MW and accompanied by a 20-year Premium Service contract.

- This move further cements Nordex's longstanding relationship with SSE and reinforces its commitment to European-based manufacturing and extended service offerings for regional clients.

- We will now examine how this substantial contract win and service extension with SSE may influence Nordex’s outlook and investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Nordex Investment Narrative Recap

To be a Nordex shareholder, you have to believe in the ongoing electrification push, strong project pipeline, and the company’s ability to grow recurring service revenues in Europe. The new SSE contract highlights the strength of Nordex’s service business and deep presence in Spain, supporting the service segment’s role as a key short-term catalyst. However, the risk of regional market saturation or policy changes that could slow new orders remains relevant; this contract win does not materially reduce that exposure.

Among recent announcements, the earnings report for the nine months to September 30, 2025, is particularly relevant, as it revealed a return to net profitability (EUR 90.73 million vs. prior year’s net loss). This financial improvement, coupled with ongoing order wins and high-margin service contracts, reinforces confidence in Nordex’s efforts to convert its order backlog into tangible revenue growth, one of the company’s main catalysts right now.

On the other hand, investors should be aware of the risk that, despite healthy order wins, shifts in European energy policy could...

Read the full narrative on Nordex (it's free!)

Nordex's narrative projects €9.0 billion revenue and €353.9 million earnings by 2028. This requires 8.0% yearly revenue growth and a €293.6 million earnings increase from €60.3 million currently.

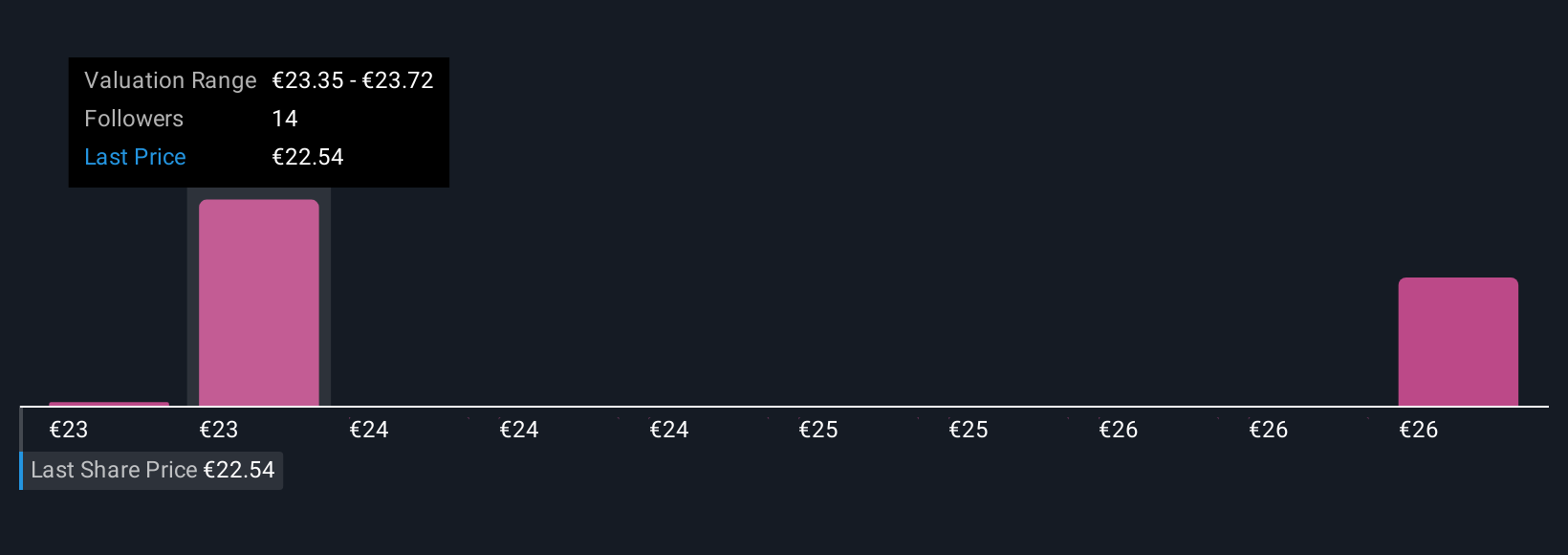

Uncover how Nordex's forecasts yield a €27.29 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate fair value for Nordex between €22.99 and €41.63 across 3 unique perspectives. While service segment growth is a strong catalyst, opinions vary widely so it is worth exploring multiple viewpoints.

Explore 3 other fair value estimates on Nordex - why the stock might be worth as much as 48% more than the current price!

Build Your Own Nordex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nordex research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nordex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nordex's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:NDX1

Nordex

Develops, manufactures, and distributes multi-megawatt onshore wind turbines worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives