- Switzerland

- /

- Machinery

- /

- SWX:SUN

3 European Stocks That May Be Undervalued Based On Current Market Estimates

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index remains relatively flat and major stock indexes show mixed returns, investors are keeping a close eye on economic indicators such as eurozone inflation reaching the ECB's target and a steady labor market. In this environment, identifying potentially undervalued stocks can be crucial for investors looking to capitalize on discrepancies between market estimates and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| QPR Software Oyj (HLSE:QPR1V) | €0.82 | €1.62 | 49.5% |

| MilDef Group (OM:MILDEF) | SEK178.40 | SEK352.00 | 49.3% |

| Lectra (ENXTPA:LSS) | €24.75 | €49.37 | 49.9% |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €55.65 | €110.26 | 49.5% |

| Ion Beam Applications (ENXTBR:IBAB) | €11.56 | €22.95 | 49.6% |

| Hybrid Software Group (ENXTBR:HYSG) | €3.50 | €6.96 | 49.7% |

| Green Oleo (BIT:GRN) | €0.795 | €1.56 | 49.2% |

| doValue (BIT:DOV) | €2.472 | €4.88 | 49.3% |

| Almirall (BME:ALM) | €10.62 | €21.21 | 49.9% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.90 | €3.74 | 49.2% |

Underneath we present a selection of stocks filtered out by our screen.

NCAB Group (OM:NCAB)

Overview: NCAB Group AB (publ) manufactures and sells printed circuit boards (PCBs) across Sweden, the Nordic region, Europe, North America, and Asia with a market cap of SEK9.53 billion.

Operations: The company's revenue segments are distributed as follows: East SEK225 million, Europe SEK1.77 billion, Nordic SEK830 million, and North America SEK797 million.

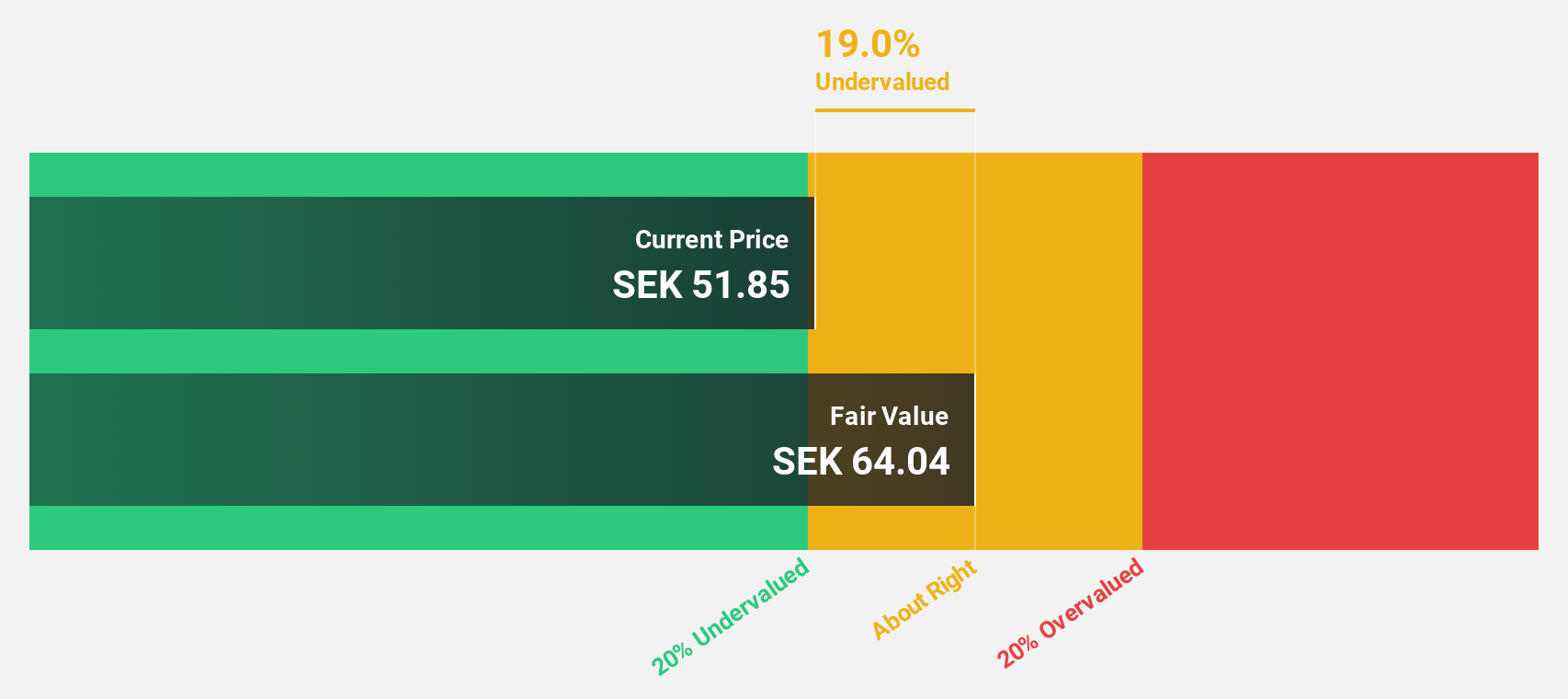

Estimated Discount To Fair Value: 21%

NCAB Group exhibits potential as an undervalued stock based on cash flows, trading over 20% below its estimated fair value of SEK64.46. Despite a volatile share price and lower profit margins, its earnings are forecast to grow significantly at 26.3% annually, outpacing the Swedish market. However, recent dividend suspension and high debt levels may pose concerns for investors assessing its financial health and stability amidst expected revenue growth of 9.7% per year.

- Our comprehensive growth report raises the possibility that NCAB Group is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of NCAB Group.

Sulzer (SWX:SUN)

Overview: Sulzer Ltd specializes in developing and selling products and services for fluid engineering and chemical processing applications globally, with a market cap of CHF4.89 billion.

Operations: Sulzer's revenue is derived from three main segments: Chemtech (CHF837.10 million), Services (CHF1.25 billion), and Flow Equipment (CHF1.44 billion).

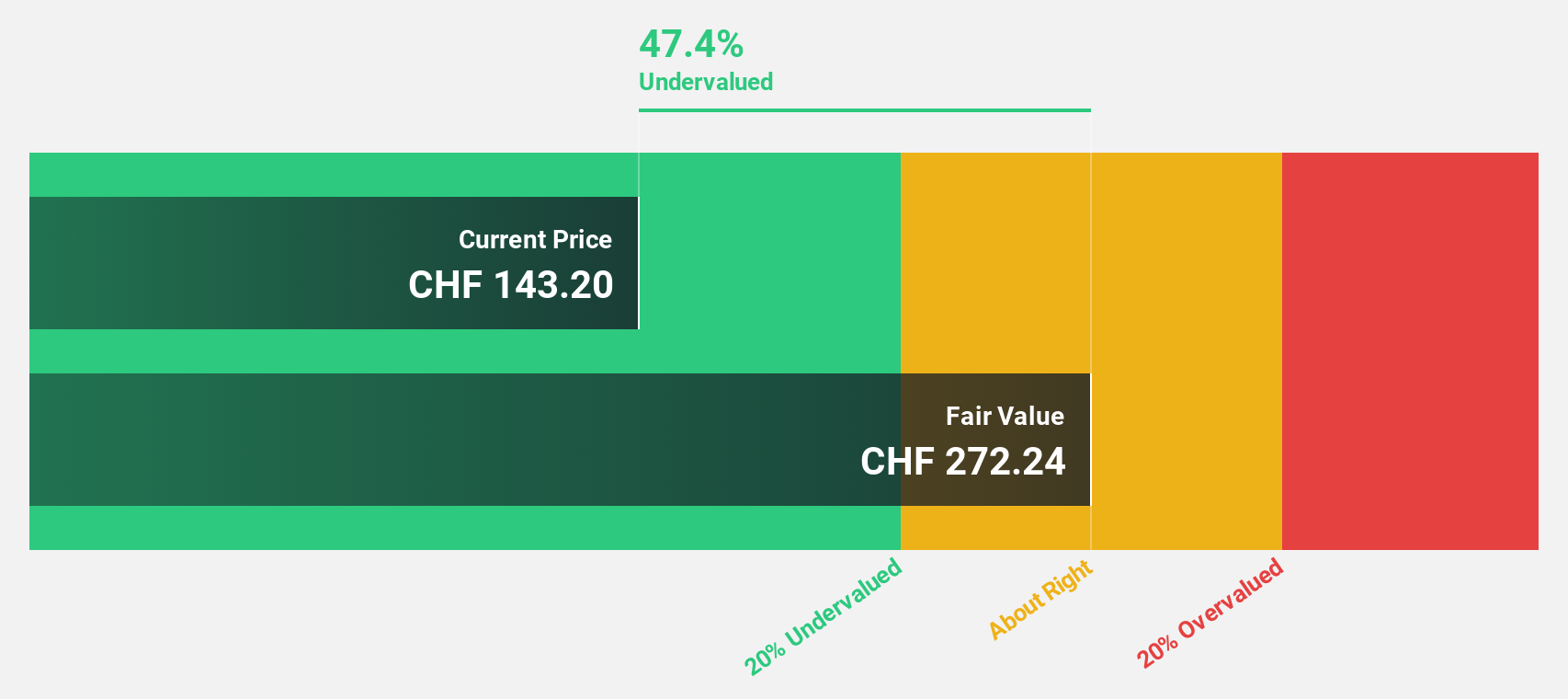

Estimated Discount To Fair Value: 48%

Sulzer appears undervalued based on cash flows, trading at CHF144.8, significantly below the fair value estimate of CHF278.24. Despite moderate earnings growth forecasts of 11.69% annually, which surpass Swiss market expectations, its revenue growth is slower at 4.1%. Recent strategic alliances in renewable fuels enhance its position in sustainable aviation fuel production, potentially bolstering future cash flows and addressing global carbon reduction mandates despite a modest dividend yield of 2.94%.

- Upon reviewing our latest growth report, Sulzer's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Sulzer with our comprehensive financial health report here.

Nordex (XTRA:NDX1)

Overview: Nordex SE, with a market cap of €4.37 billion, develops, manufactures, and distributes multi-megawatt onshore wind turbines globally through its subsidiaries.

Operations: Revenue Segments (in millions of €):

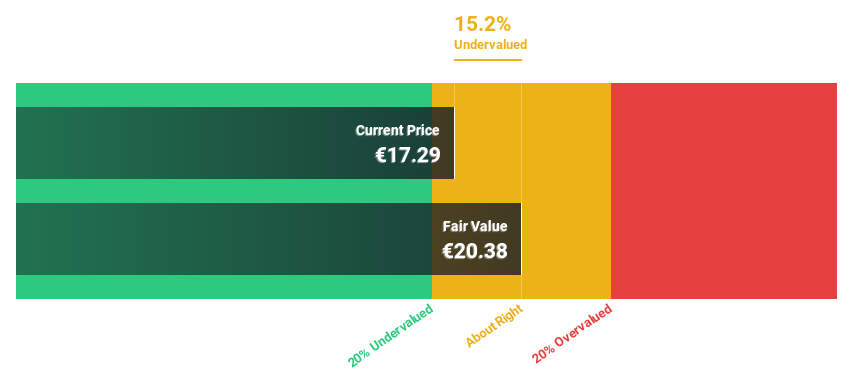

Estimated Discount To Fair Value: 28.8%

Nordex is trading at €18.47, significantly below its estimated fair value of €25.93, highlighting potential undervaluation based on cash flows. The company's earnings are projected to grow substantially at 41.7% annually over the next three years, outpacing the German market's growth rate of 16.5%. Recent large-scale orders in Latvia and Turkiye bolster Nordex's position in renewable energy, potentially enhancing cash flow stability despite slower revenue growth forecasts compared to earnings projections.

- The analysis detailed in our Nordex growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Nordex's balance sheet health report.

Next Steps

- Unlock more gems! Our Undervalued European Stocks Based On Cash Flows screener has unearthed 177 more companies for you to explore.Click here to unveil our expertly curated list of 180 Undervalued European Stocks Based On Cash Flows.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SUN

Sulzer

Develops and sells products and services for fluid engineering and chemical processing applications worldwide.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives