Masterflex SE's (ETR:MZX) CEO Compensation Is Looking A Bit Stretched At The Moment

Key Insights

- Masterflex will host its Annual General Meeting on 12th of June

- CEO Andreas Bastin's total compensation includes salary of €400.0k

- The total compensation is 110% higher than the average for the industry

- Masterflex's EPS grew by 96% over the past three years while total shareholder return over the past three years was 52%

Performance at Masterflex SE (ETR:MZX) has been reasonably good and CEO Andreas Bastin has done a decent job of steering the company in the right direction. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 12th of June. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

See our latest analysis for Masterflex

Comparing Masterflex SE's CEO Compensation With The Industry

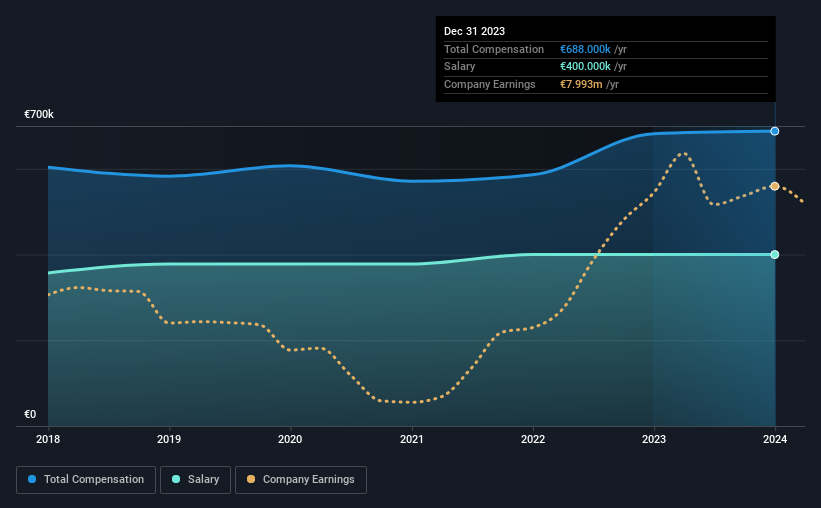

At the time of writing, our data shows that Masterflex SE has a market capitalization of €104m, and reported total annual CEO compensation of €688k for the year to December 2023. That's mostly flat as compared to the prior year's compensation. In particular, the salary of €400.0k, makes up a fairly large portion of the total compensation being paid to the CEO.

For comparison, other companies in the German Machinery industry with market capitalizations below €184m, reported a median total CEO compensation of €328k. This suggests that Andreas Bastin is paid more than the median for the industry.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | €400k | €400k | 58% |

| Other | €288k | €282k | 42% |

| Total Compensation | €688k | €682k | 100% |

Talking in terms of the broader industry, salary and other compensation roughly make up 50% each, of the total compensation. According to our research, Masterflex has allocated a higher percentage of pay to salary in comparison to the wider industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Masterflex SE's Growth

Masterflex SE's earnings per share (EPS) grew 96% per year over the last three years. In the last year, its revenue is down 4.1%.

This demonstrates that the company has been improving recently and is good news for the shareholders. While it would be good to see revenue growth, profits matter more in the end. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Masterflex SE Been A Good Investment?

Most shareholders would probably be pleased with Masterflex SE for providing a total return of 52% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Masterflex that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:MZX

Masterflex

Develops, manufactures, and distributes high-tech hoses and connecting systems for various industrial and manufacturing applications in Germany, Rest of Europe, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026