- China

- /

- Semiconductors

- /

- SHSE:688209

Undiscovered Gems with Potential for December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by record highs in major indices and mixed performances across sectors, small-cap stocks represented by the Russell 2000 Index have faced recent declines after periods of outperformance. Amid these dynamics, investors are increasingly focused on identifying opportunities within underexplored segments that may offer growth potential despite broader market volatility. In this context, discovering stocks with strong fundamentals and unique market positions becomes crucial for those seeking to capitalize on emerging trends and economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Société Multinationale de Bitumes Société Anonyme | 54.45% | 24.68% | 23.10% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Shenzhen Injoinic TechnologyLtd (SHSE:688209)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Injoinic Technology Co., Ltd. is an integrated circuit design company that specializes in the design, development, manufacturing, and sale of digital-analog hybrid chips, with a market capitalization of CN¥8.08 billion.

Operations: Shenzhen Injoinic Technology Co., Ltd. generates revenue primarily from its integrated circuit segment, totaling CN¥1.40 billion. The company's financial performance is characterized by a focus on digital-analog hybrid chips within the IC design industry, contributing to its market presence and valuation.

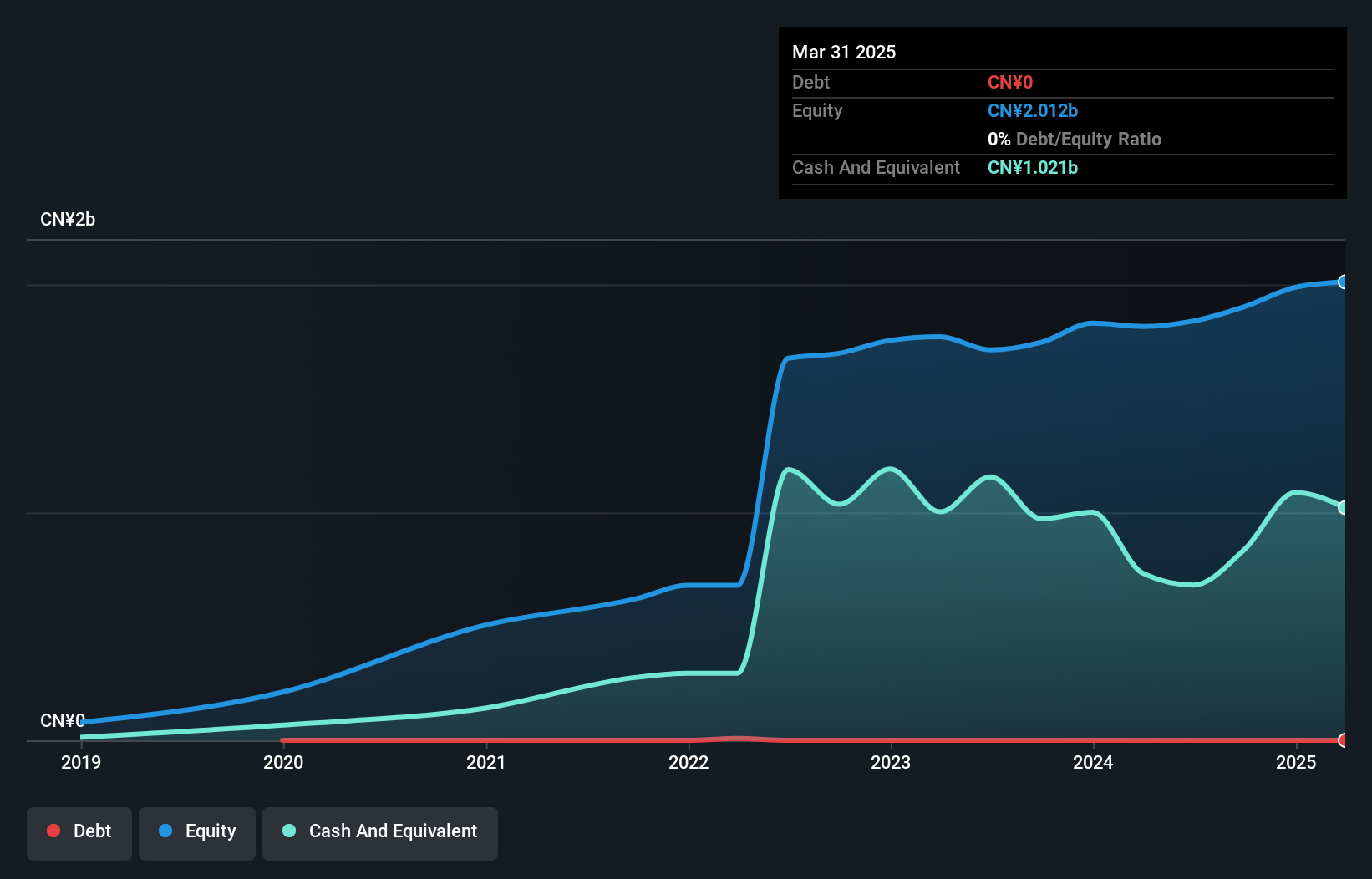

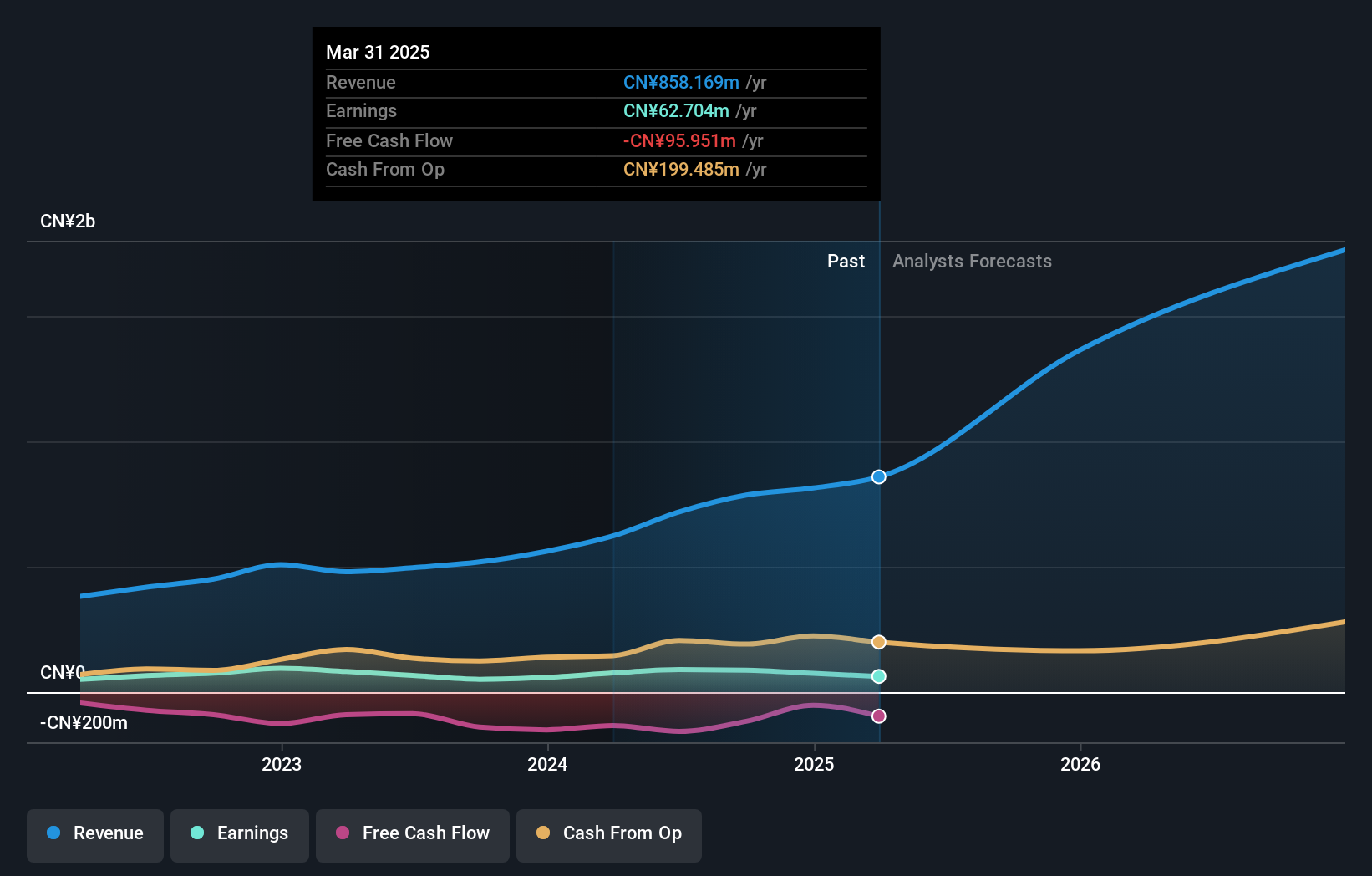

Injoinic, a small cap player in the semiconductor industry, has shown impressive earnings growth of 88.2% over the past year, outpacing the industry's 12.1%. Despite a volatile share price recently, its high-quality earnings and debt-free status provide stability. For nine months ending September 2024, sales reached CNY 1.02 billion (up from CNY 842.92 million), with net income jumping to CNY 89.04 million from CNY 15.74 million last year. Earnings per share rose to CNY 0.21 from CNY 0.04, reflecting strong operational performance amidst industry challenges and opportunities for future expansion.

Shenzhen Pacific Union Precision Manufacturing (SHSE:688210)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Pacific Union Precision Manufacturing Co., Ltd. operates in the precision manufacturing industry and has a market cap of CN¥3.36 billion.

Operations: Shenzhen Pacific Union Precision Manufacturing generates revenue primarily from its precision manufacturing operations. The company has a market cap of CN¥3.36 billion.

Shenzhen Pacific Union Precision Manufacturing, a nimble player in the electronics sector, has shown impressive earnings growth of 71.1% over the past year, outpacing the industry average of 1.9%. The company's net income for the first nine months of 2024 reached CNY 52.06 million, up from CNY 23.21 million in the same period last year, reflecting its high-quality earnings and robust financial health with EBIT covering interest payments by a staggering 103.7 times. Additionally, a share repurchase program worth up to CNY 100 million indicates confidence in its future prospects and commitment to enhancing shareholder value.

KSB SE KGaA (XTRA:KSB)

Simply Wall St Value Rating: ★★★★★★

Overview: KSB SE & Co. KGaA, along with its subsidiaries, is a global manufacturer and supplier of pumps, valves, and related services with a market capitalization of approximately €1.12 billion.

Operations: KSB SE & Co. KGaA generates revenue primarily from three segments: Pumps (€1.52 billion), Fittings (€370.94 million), and KSB Supremeserv (€978.20 million).

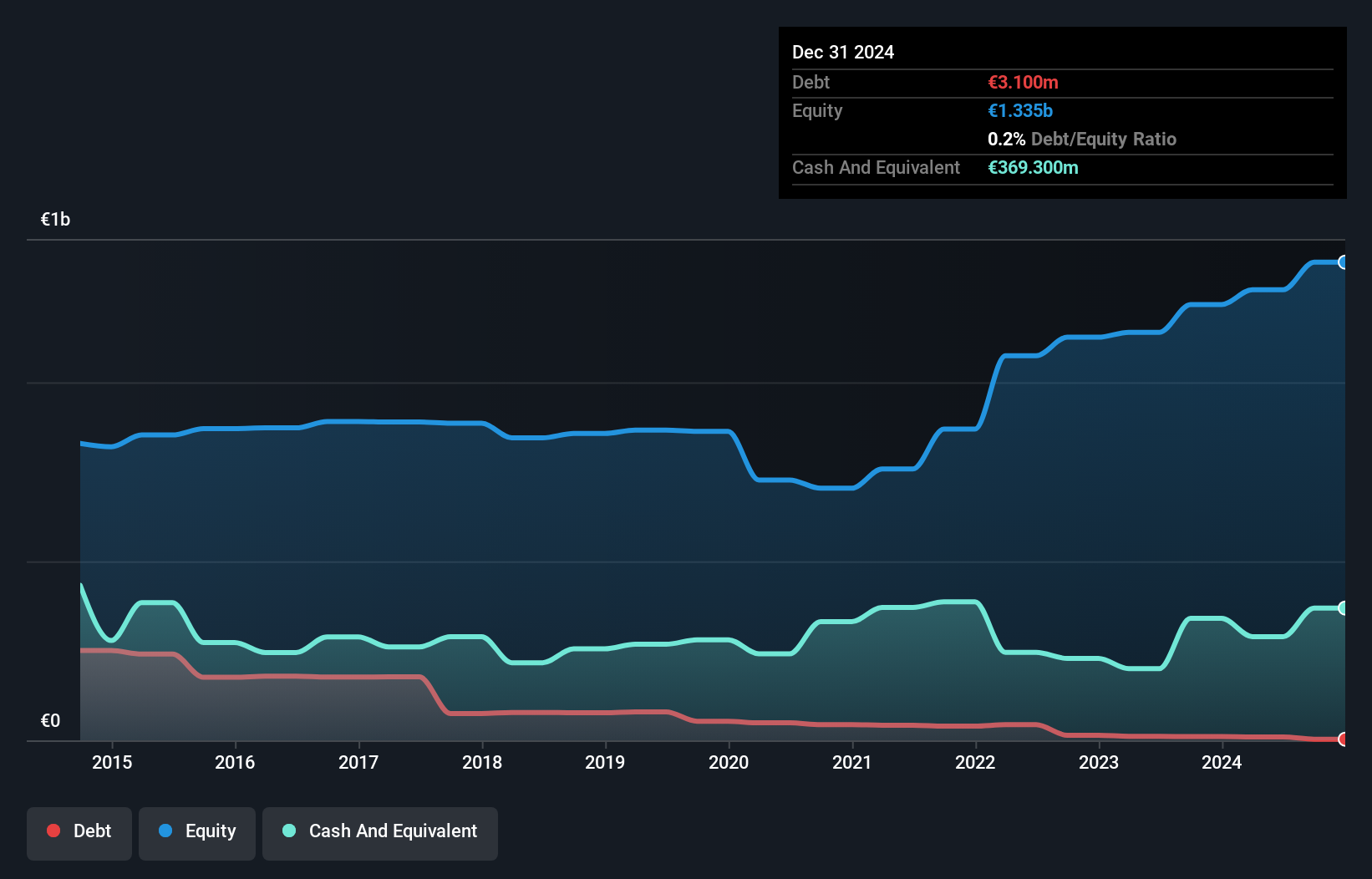

KSB SE KGaA, a notable player in the machinery sector, stands out with its strong financial footing and promising growth trajectory. Over the past five years, its debt to equity ratio impressively decreased from 9.2% to 0.8%, indicating effective debt management. Despite a significant one-off loss of €102M impacting recent results, KSB's earnings surged by 16.8% last year, surpassing industry averages that saw an -8.6%. Trading at a substantial discount of 76% below estimated fair value enhances its appeal as a potential investment opportunity while future earnings are projected to grow annually by about 7.68%.

- Get an in-depth perspective on KSB SE KGaA's performance by reading our health report here.

Evaluate KSB SE KGaA's historical performance by accessing our past performance report.

Key Takeaways

- Get an in-depth perspective on all 4632 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688209

Shenzhen Injoinic TechnologyLtd

An IC design company, designs, develops, manufactures, and sells digital-analog hybrid chips.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives