- Germany

- /

- Medical Equipment

- /

- XTRA:EUZ

Three Undiscovered Gems In Germany To Consider For Your Portfolio

Reviewed by Simply Wall St

Germany's DAX Index has seen a significant surge, reflecting optimism driven by China's new stimulus measures and hopes for interest rate cuts in the eurozone. Despite mixed economic indicators, the German market remains a fertile ground for discovering promising small-cap stocks. In this environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding. Here are three undiscovered gems in Germany that could add value to your portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mineralbrunnen Überkingen-Teinach GmbH KGaA | 19.91% | 0.96% | -5.02% | ★★★★★★ |

| Westag | NA | -1.56% | -21.68% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| EnviTec Biogas | 37.96% | 19.34% | 51.22% | ★★★★★★ |

| Mühlbauer Holding | NA | 10.49% | -12.73% | ★★★★★★ |

| Paul Hartmann | 26.29% | 1.12% | -17.65% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

| DFV Deutsche Familienversicherung | NA | 19.63% | 62.92% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Energiekontor (XTRA:EKT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Energiekontor AG is a project developer involved in the planning, construction, and operation of wind and solar parks in Germany, Portugal, and the United States with a market cap of €787.87 million.

Operations: Energiekontor AG generates revenue primarily from Project Development and Sales (€171.48 million) and Power Generation in Group-Owned Wind and Solar Parks (€78.30 million). The company also engages in Business Development, Innovation, and other activities contributing €7.72 million to its revenue.

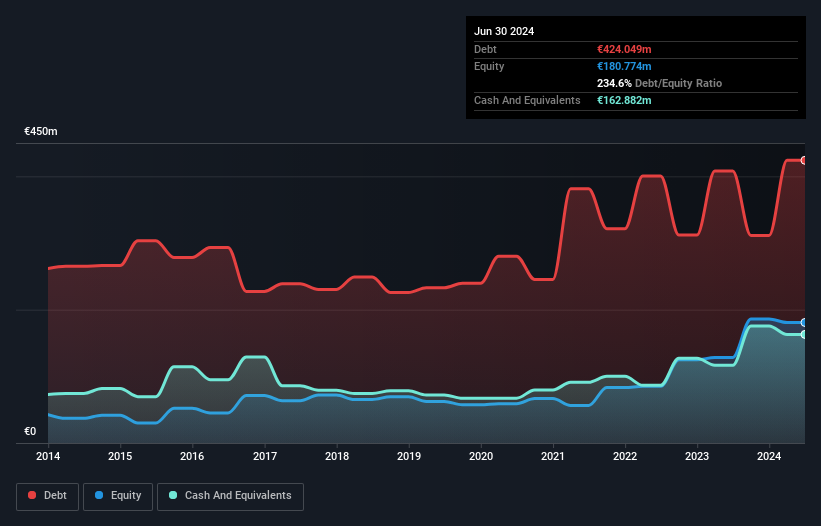

Energiekontor's earnings grew by 30.2% last year, outpacing the Electrical industry’s 0.7%. Its P/E ratio of 10.6x is attractive compared to the German market's 16.7x. Despite a high net debt to equity ratio of 144.5%, interest payments are well covered by EBIT at 6x coverage, and debt has decreased from 373.6% to 234.6% over five years. Recent earnings showed EUR 78 million in sales and EUR 11 million in net income for H1-2024, though revenue fell from EUR114 million last year.

- Get an in-depth perspective on Energiekontor's performance by reading our health report here.

Gain insights into Energiekontor's past trends and performance with our Past report.

Eckert & Ziegler (XTRA:EUZ)

Simply Wall St Value Rating: ★★★★★★

Overview: Eckert & Ziegler SE manufactures and sells isotope technology components worldwide, with a market cap of €933.04 million.

Operations: Eckert & Ziegler SE generates revenue primarily from its Medical (€132.80 million) and Isotopes Products (€150.97 million) segments, with a total revenue of €283.76 million after accounting for eliminations and adjustments.

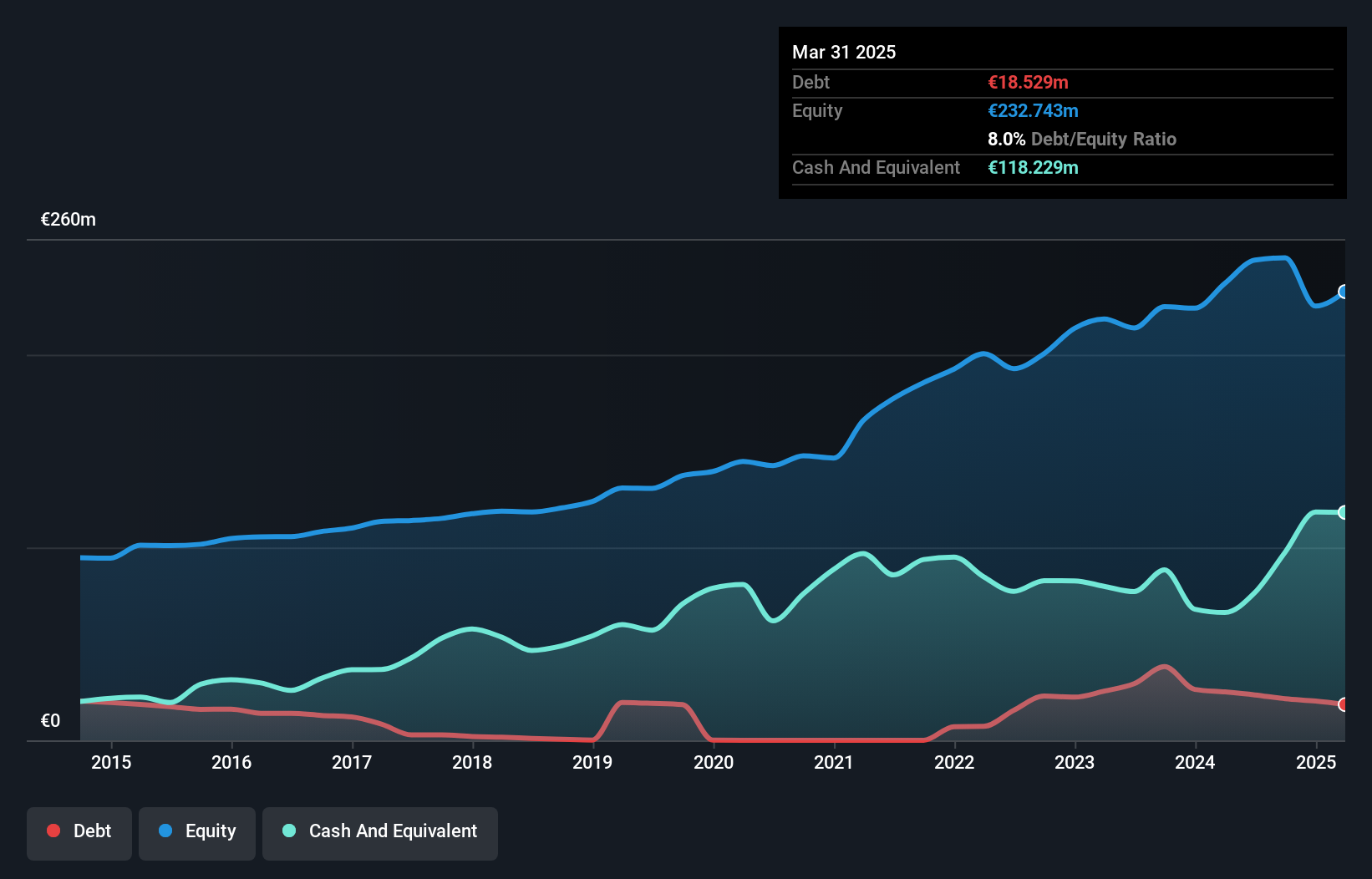

Earnings for Eckert & Ziegler grew by 31.6% over the past year, outpacing the Medical Equipment industry’s 16.2% growth rate. The company reported Q2 sales of €77.76M, up from €60.03M last year, with net income rising to €9.54M from €6.17M previously. Trading at 82% below its estimated fair value and having reduced its debt-to-equity ratio from 14.7% to 9.5% over five years, EUZ appears undervalued and financially robust with high-quality earnings and strong EBIT coverage of interest payments (20x).

- Click here to discover the nuances of Eckert & Ziegler with our detailed analytical health report.

Explore historical data to track Eckert & Ziegler's performance over time in our Past section.

KSB SE KGaA (XTRA:KSB)

Simply Wall St Value Rating: ★★★★★★

Overview: KSB SE & Co. KGaA, with a market cap of €1.08 billion, manufactures and supplies pumps, valves, and related services globally through its subsidiaries.

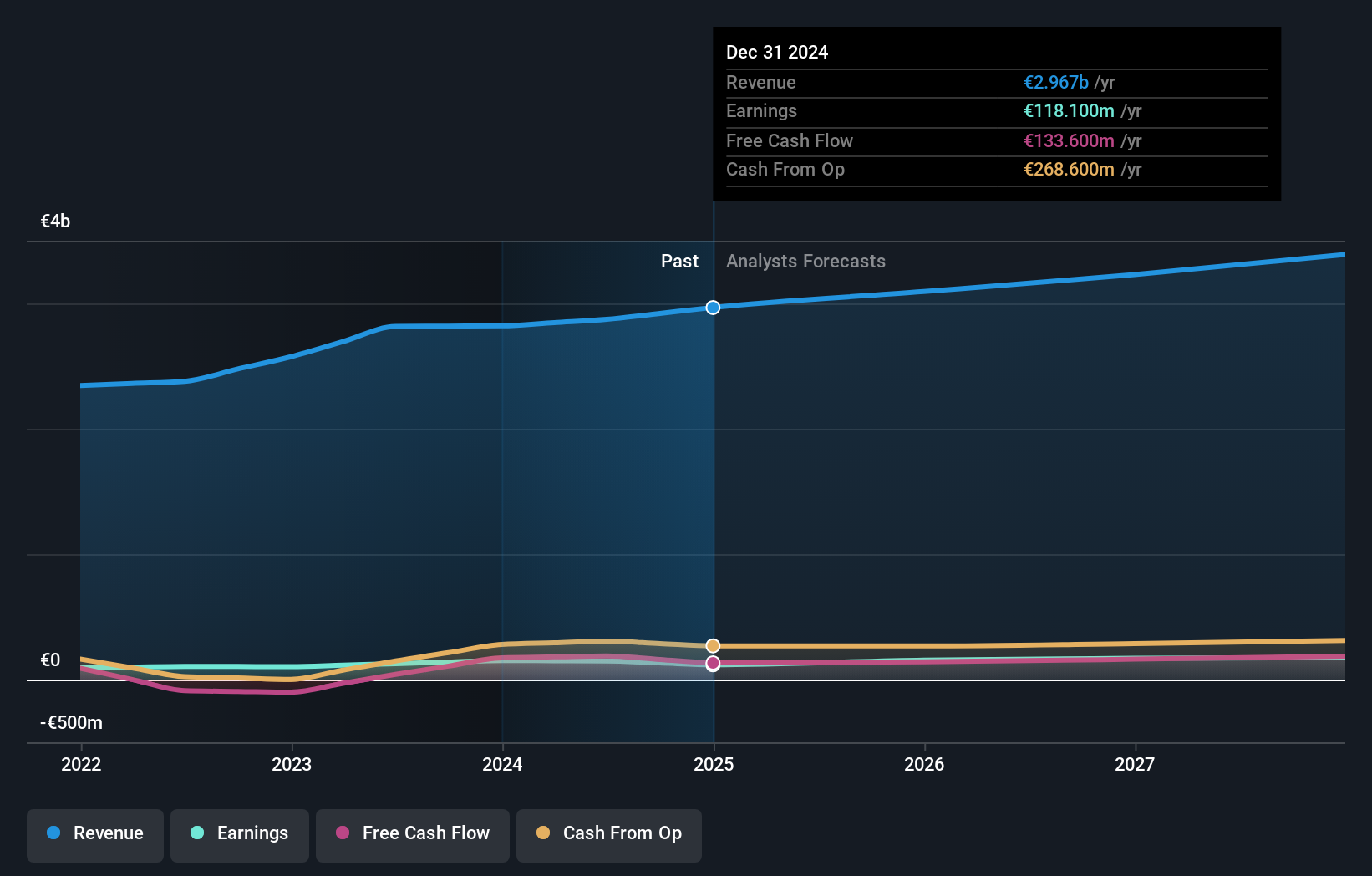

Operations: KSB SE & Co. KGaA generates revenue primarily from three segments: Pumps (€1.52 billion), Fittings (€370.94 million), and KSB Supremeserv (€978.20 million). The company's net profit margin is 3.5%.

KSB SE KGaA, a notable player in the machinery industry, has shown resilience despite a €102.5M one-off loss impacting its financials as of June 2024. Trading at 78.2% below its estimated fair value and with earnings growth of 16.8% last year, it outpaced the broader machinery sector's -4%. The company’s debt to equity ratio impressively dropped from 9.2% to 0.8% over five years, reflecting robust financial management and strategic positioning for future growth.

- Navigate through the intricacies of KSB SE KGaA with our comprehensive health report here.

Evaluate KSB SE KGaA's historical performance by accessing our past performance report.

Summing It All Up

- Take a closer look at our German Undiscovered Gems With Strong Fundamentals list of 56 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eckert & Ziegler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:EUZ

Eckert & Ziegler

Manufactures and sells isotope technology components worldwide.

Flawless balance sheet with proven track record.