As global markets respond to China's robust stimulus measures and European indices rebound, the German market has shown notable resilience, with the DAX surging over 4%. Amid this backdrop of renewed optimism and economic adjustments, investors may find opportunities in lesser-known stocks that have strong fundamentals and growth potential. When considering investments in such an environment, it is crucial to identify companies with solid business models, consistent revenue streams, and a clear path for future growth. Energiekontor and two other undiscovered gems in Germany exemplify these qualities.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mineralbrunnen Überkingen-Teinach GmbH KGaA | 19.91% | 0.96% | -5.02% | ★★★★★★ |

| Westag | NA | -1.56% | -21.68% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| EnviTec Biogas | 37.96% | 19.34% | 51.22% | ★★★★★★ |

| Mühlbauer Holding | NA | 10.49% | -12.73% | ★★★★★★ |

| Südwestdeutsche Salzwerke | 0.30% | 4.57% | 25.01% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

| DFV Deutsche Familienversicherung | NA | 19.63% | 62.92% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Energiekontor (XTRA:EKT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Energiekontor AG is a project developer focused on planning, constructing, and operating wind and solar parks in Germany, Portugal, and the United States with a market cap of €790.59 million.

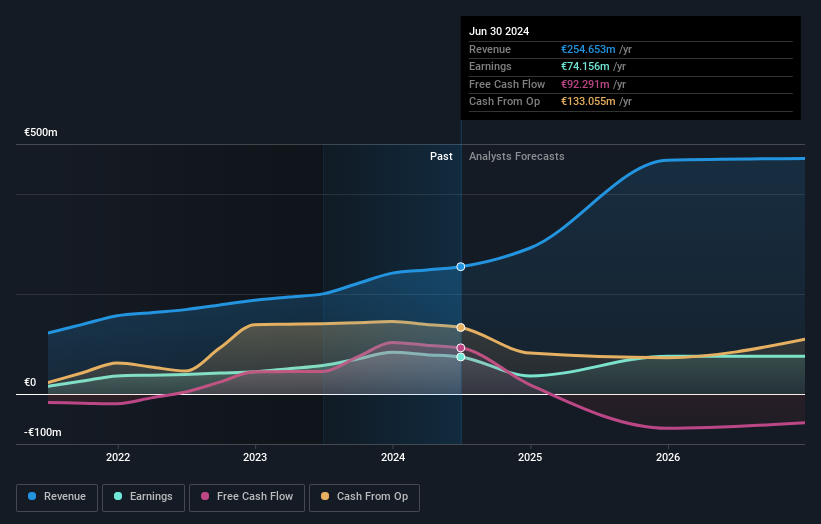

Operations: Energiekontor AG generates revenue primarily from Project Development and Sales (€171.48 million) and Power Generation in Group-Owned Wind and Solar Parks (€78.30 million). The company also incurs costs related to Business Development, Innovation, and other activities totaling €7.72 million.

Energiekontor's recent earnings report showed sales of €78.02M for H1 2024, up from €65.17M last year, although net income dropped to €11.79M from €20.95M. Despite a high net debt to equity ratio of 144%, the company's interest payments are well covered by EBIT at 6x coverage. With a P/E ratio of 10.7x below the German market average, EKT is trading at good value and has seen its debt to equity ratio improve significantly over five years from 373% to 235%.

- Delve into the full analysis health report here for a deeper understanding of Energiekontor.

Understand Energiekontor's track record by examining our Past report.

Eckert & Ziegler (XTRA:EUZ)

Simply Wall St Value Rating: ★★★★★★

Overview: Eckert & Ziegler SE manufactures and sells isotope technology components worldwide, with a market cap of €934.71 million.

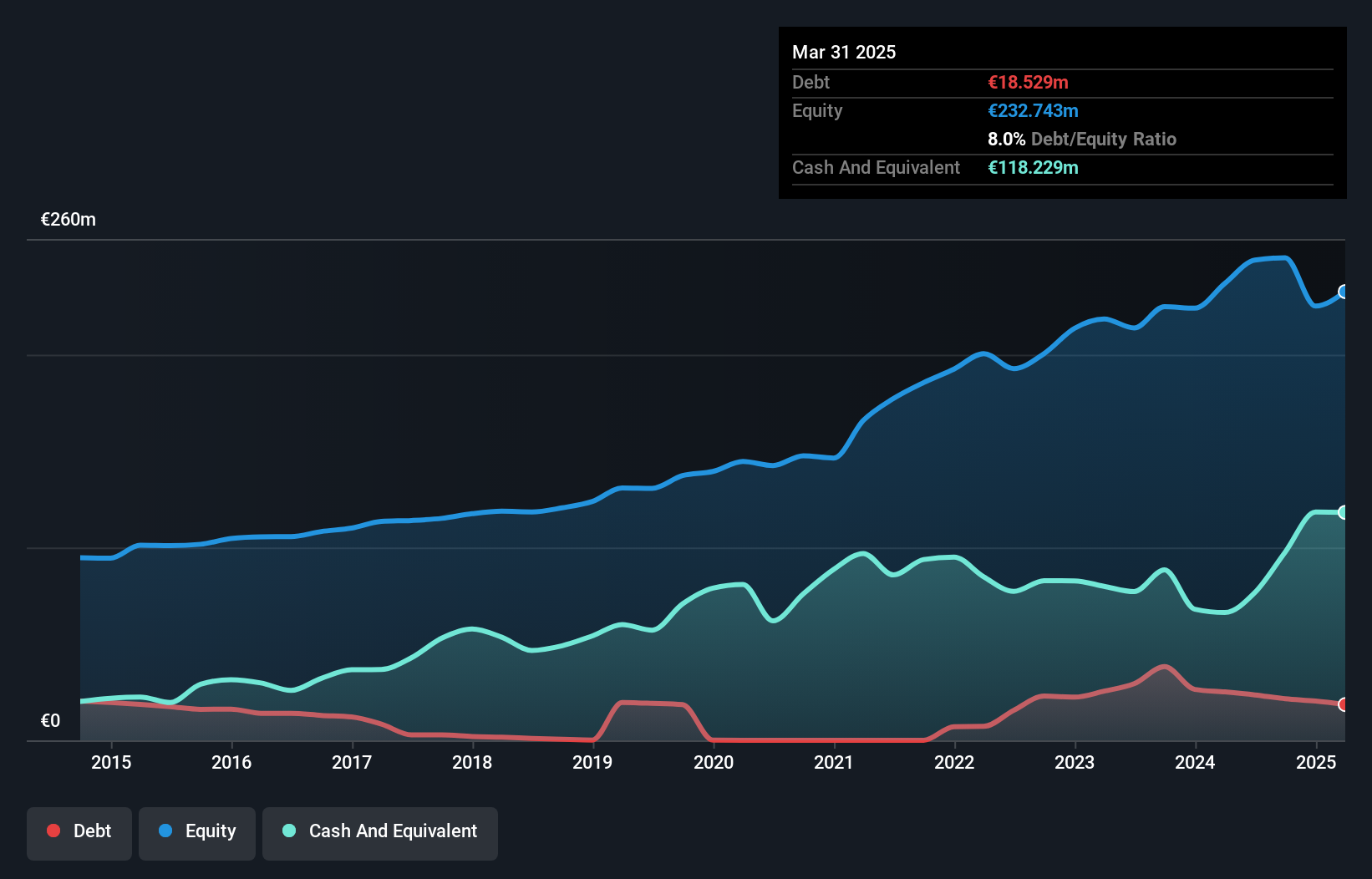

Operations: The company generates revenue primarily from its Medical (€132.80 million) and Isotope Products (€150.97 million) segments, with a total revenue of €283.76 million after adjustments and eliminations.

Eckert & Ziegler, a notable player in the medical equipment sector, has seen its debt to equity ratio improve from 14.7% to 9.5% over five years. The company’s earnings growth of 31.6% in the past year outpaced the industry average of 16.2%. Recent financial results show second-quarter sales at €77.76 million and net income at €9.54 million, up from €60.03 million and €6.17 million respectively a year ago, reflecting robust performance and promising future prospects for investors.

- Click here to discover the nuances of Eckert & Ziegler with our detailed analytical health report.

Gain insights into Eckert & Ziegler's past trends and performance with our Past report.

KSB SE KGaA (XTRA:KSB)

Simply Wall St Value Rating: ★★★★★★

Overview: KSB SE & Co. KGaA, with a market cap of €1.10 billion, manufactures and supplies pumps, valves, and related services worldwide through its subsidiaries.

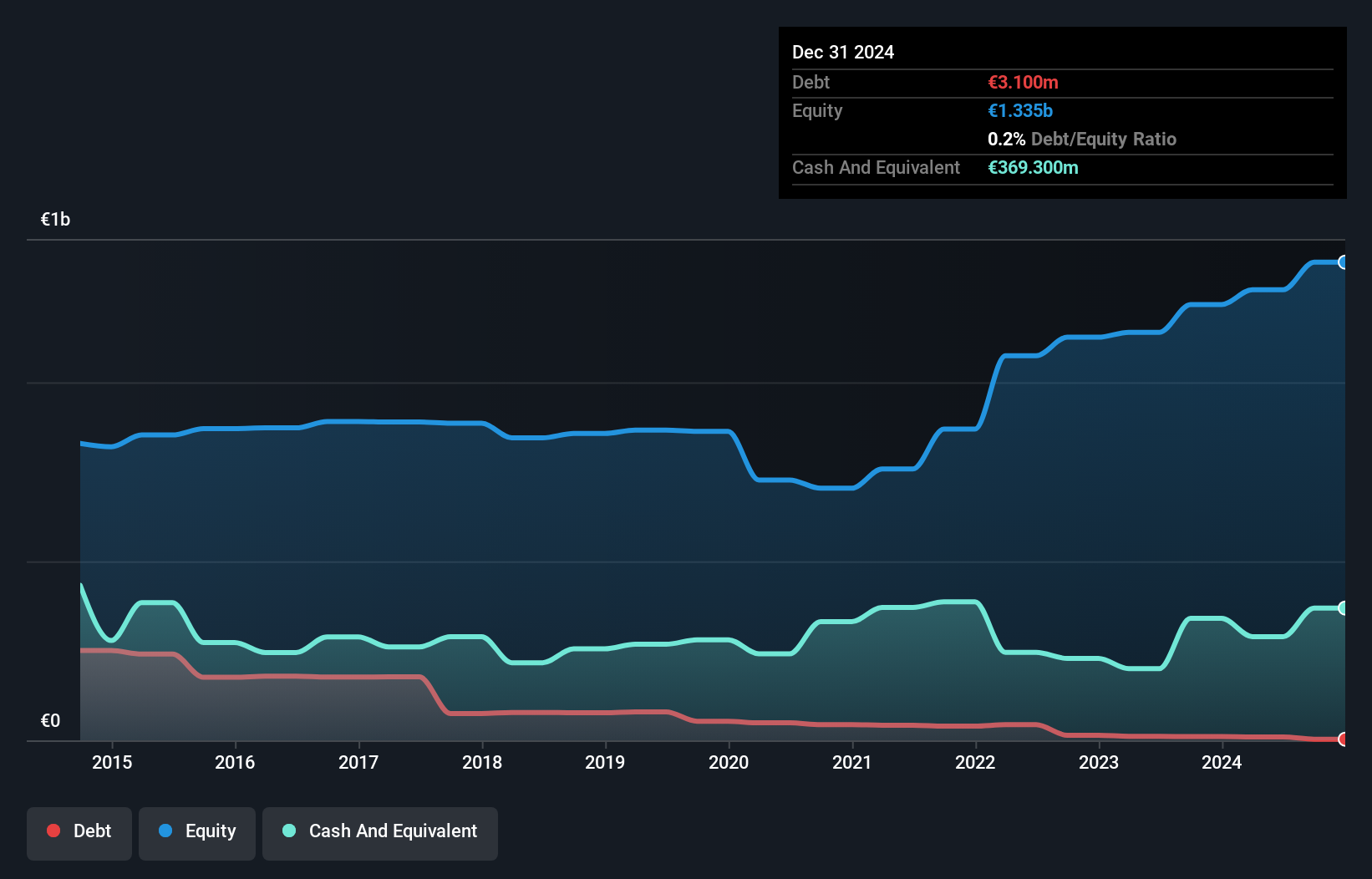

Operations: KSB SE & Co. KGaA generates revenue primarily from three segments: Pumps (€1.52 billion), Fittings (€370.94 million), and KSB Supremeserv (€978.20 million).

KSB SE KGaA has demonstrated robust financial health with earnings growing by 16.8% over the past year, significantly outpacing the Machinery industry's -4%. The company’s debt to equity ratio improved from 9.2% to 0.8% in five years, indicating strong financial management. A notable one-off loss of €102.5M impacted recent results, yet it trades at a compelling value, estimated at 77.5% below fair value and remains profitable with free cash flow positive status.

- Dive into the specifics of KSB SE KGaA here with our thorough health report.

Assess KSB SE KGaA's past performance with our detailed historical performance reports.

Make It Happen

- Gain an insight into the universe of 56 German Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KSB SE KGaA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:KSB

KSB SE KGaA

Manufactures and supplies pumps, valves, and related services worldwide.

Flawless balance sheet, undervalued and pays a dividend.