Krones AG's (ETR:KRN) Recent Stock Performance Looks Decent- Can Strong Fundamentals Be the Reason?

Krones' (ETR:KRN) stock up by 7.0% over the past three months. Given its impressive performance, we decided to study the company's key financial indicators as a company's long-term fundamentals usually dictate market outcomes. In this article, we decided to focus on Krones' ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for Krones

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Krones is:

13% = €238m ÷ €1.8b (Based on the trailing twelve months to June 2024).

The 'return' is the yearly profit. One way to conceptualize this is that for each €1 of shareholders' capital it has, the company made €0.13 in profit.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Krones' Earnings Growth And 13% ROE

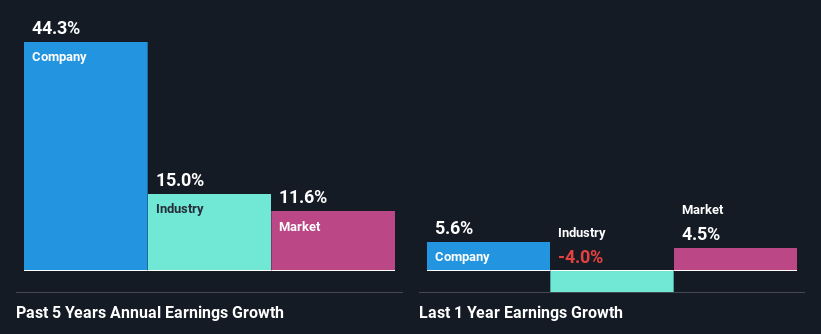

To start with, Krones' ROE looks acceptable. Especially when compared to the industry average of 10% the company's ROE looks pretty impressive. Probably as a result of this, Krones was able to see an impressive net income growth of 44% over the last five years. However, there could also be other causes behind this growth. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

As a next step, we compared Krones' net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 15%.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. Is Krones fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Krones Using Its Retained Earnings Effectively?

Krones' three-year median payout ratio is a pretty moderate 26%, meaning the company retains 74% of its income. This suggests that its dividend is well covered, and given the high growth we discussed above, it looks like Krones is reinvesting its earnings efficiently.

Additionally, Krones has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 25%. Therefore, the company's future ROE is also not expected to change by much with analysts predicting an ROE of 16%.

Summary

On the whole, we feel that Krones' performance has been quite good. Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return. This of course has caused the company to see substantial growth in its earnings. That being so, a study of the latest analyst forecasts show that the company is expected to see a slowdown in its future earnings growth. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

Valuation is complex, but we're here to simplify it.

Discover if Krones might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:KRN

Krones

Engages in the planning, development, and manufacture of machines and lines for the production, filling, and packaging technology in Germany and internationally.

Flawless balance sheet, undervalued and pays a dividend.