Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, KION GROUP AG (ETR:KGX) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

What Is KION GROUP's Debt?

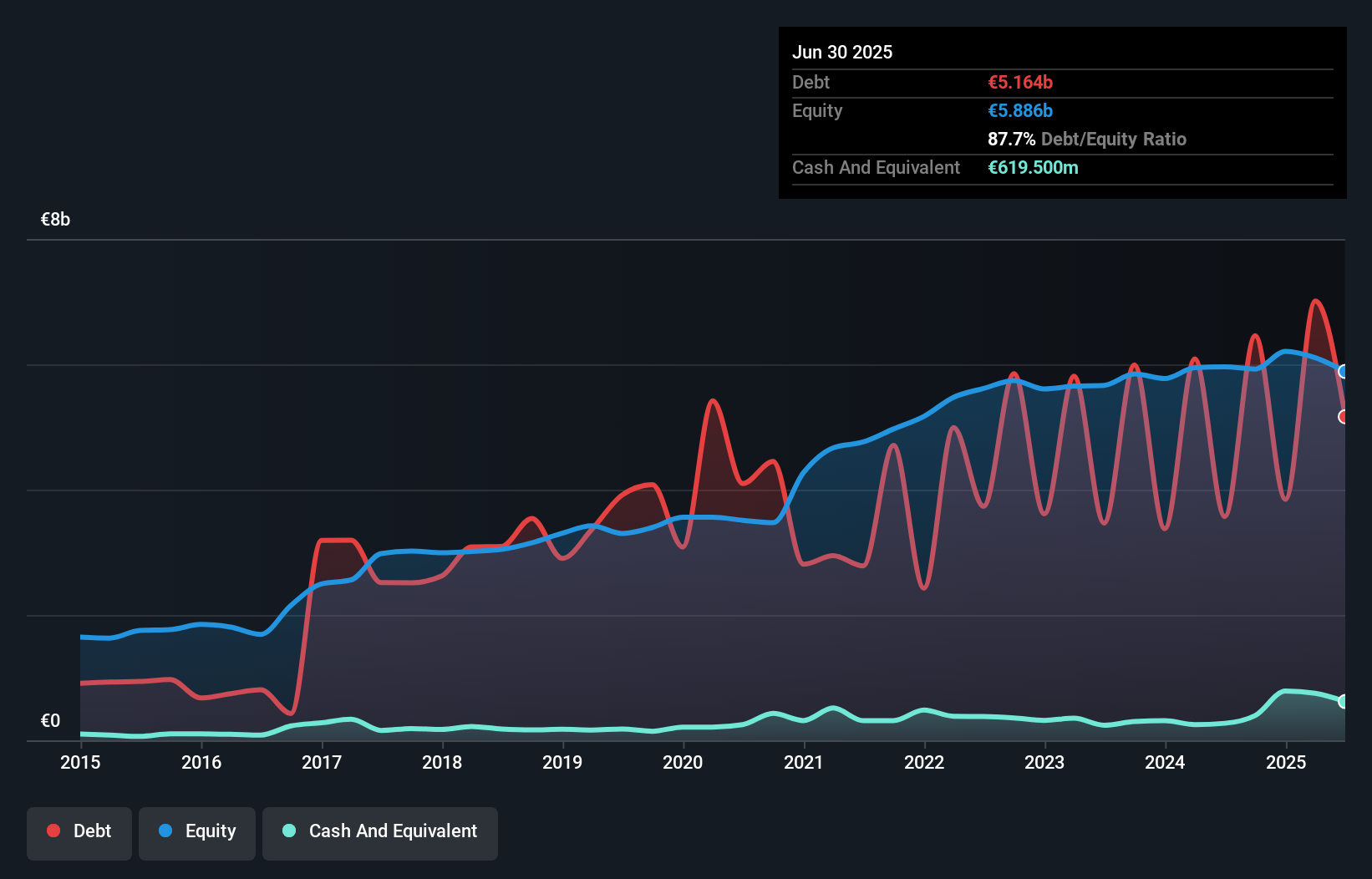

The image below, which you can click on for greater detail, shows that at June 2025 KION GROUP had debt of €5.16b, up from €3.57b in one year. However, because it has a cash reserve of €619.5m, its net debt is less, at about €4.54b.

How Healthy Is KION GROUP's Balance Sheet?

The latest balance sheet data shows that KION GROUP had liabilities of €5.58b due within a year, and liabilities of €6.97b falling due after that. Offsetting this, it had €619.5m in cash and €2.69b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by €9.23b.

When you consider that this deficiency exceeds the company's €7.32b market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

View our latest analysis for KION GROUP

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

KION GROUP's debt is 3.1 times its EBITDA, and its EBIT cover its interest expense 3.4 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Worse, KION GROUP's EBIT was down 33% over the last year. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine KION GROUP's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, KION GROUP actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

We'd go so far as to say KION GROUP's EBIT growth rate was disappointing. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Overall, we think it's fair to say that KION GROUP has enough debt that there are some real risks around the balance sheet. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 2 warning signs for KION GROUP you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if KION GROUP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:KGX

KION GROUP

Provides industrial trucks and supply chain solutions in Western and Eastern Europe, the Middle East, Africa, North America, Central and South America, China, and the rest of the Asia Pacific.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives