- Germany

- /

- Trade Distributors

- /

- XTRA:HMU

HMS Bergbau's (ETR:HMU) Shareholders Will Receive A Bigger Dividend Than Last Year

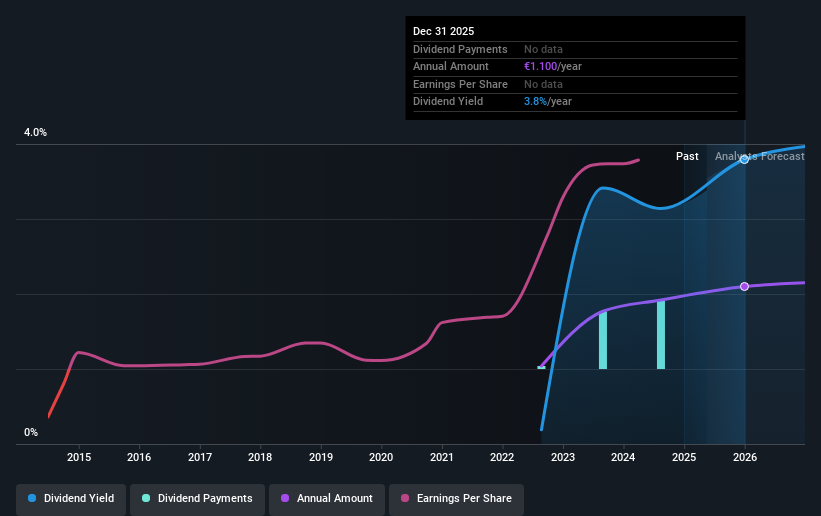

The board of HMS Bergbau AG (ETR:HMU) has announced that the dividend on 19th of August will be increased to €1.05, which will be 14% higher than last year's payment of €0.92 which covered the same period. This makes the dividend yield about the same as the industry average at 3.2%.

Our free stock report includes 1 warning sign investors should be aware of before investing in HMS Bergbau. Read for free now.HMS Bergbau's Payment Could Potentially Have Solid Earnings Coverage

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. Before making this announcement, HMS Bergbau was easily earning enough to cover the dividend. This means that most of its earnings are being retained to grow the business.

Looking forward, earnings per share is forecast to rise by 25.7% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 34%, which is in the range that makes us comfortable with the sustainability of the dividend.

See our latest analysis for HMS Bergbau

HMS Bergbau Is Still Building Its Track Record

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. The annual payment during the last 3 years was €0.04 in 2022, and the most recent fiscal year payment was €0.92. This implies that the company grew its distributions at a yearly rate of about 184% over that duration. It is always nice to see strong dividend growth, but with such a short payment history we wouldn't be inclined to rely on it until a longer track record can be developed.

HMS Bergbau May Find It Hard To Grow The Dividend

Investors could be attracted to the stock based on the quality of its payment history. Earnings growth is slow, but on the plus side, the dividend payout ratio is low and dividends could grow faster than earnings, if the company decides to increase its payout ratio.

In Summary

Overall, it's great to see the dividend being raised and that it is still in a sustainable range. The payout ratio looks good, but unfortunately the company's dividend track record isn't stellar. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've picked out 1 warning sign for HMS Bergbau that investors should know about before committing capital to this stock. Is HMS Bergbau not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if HMS Bergbau might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:HMU

HMS Bergbau

Engages in trading and distributing coal and other energy raw materials to energy producers, cement manufacturers, and industrial consumers worldwide.

Undervalued with high growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026