- Germany

- /

- Aerospace & Defense

- /

- XTRA:HAG

Hensoldt (XTRA:HAG): Valuation in Focus as Strong Orders and Growth Strategy Drive Market Momentum

Reviewed by Kshitija Bhandaru

Hensoldt (XTRA:HAG) recently raised its mid-term EBITDA forecast and introduced a new growth strategy following the announcement of strong order intake and growth. Shares have climbed to new all-time highs, reflecting increased market interest.

See our latest analysis for Hensoldt.

Fresh off being added to the FTSE All-World Index and setting all-time highs, Hensoldt’s share price continues to reflect robust investor confidence, with momentum picking up over the past year. While recent gains have built on strong order growth and a strategic outlook, the 1-year total shareholder return of 2.76% suggests the market is still waiting to see how these initiatives translate into longer-term outperformance.

If Hensoldt’s strong run has you curious about what else the defense sector has to offer, it’s a great moment to discover See the full list for free.

With Hensoldt’s shares at record highs and growth prospects bright, the question is whether today’s price still leaves room for upside or if investors are already paying up for future gains in the current valuation.

Most Popular Narrative: 17% Overvalued

Hensoldt’s most widely followed valuation narrative pegs its fair value at €96.77, compared to a last close of €113. With the current share price running ahead of consensus forecasts, investors are left to weigh the company's future fundamentals against expectations for further upside.

The company reports robust order intake growth driven by increased defense spending, particularly in air defense, across Europe. However, future revenue expectations are based on elevated budget levels. These budget levels may not fully materialize, leading to potential overvaluation risk tied to revenue projections.

Want to know the financial assumptions behind this bold valuation? There are specific projections about future revenue and profit growth that shape the story. If you’re curious about what makes this calculation stand out among its industry peers, the full narrative reveals the missing numbers powering this premium price.

Result: Fair Value of €96.77 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong order intake and operational excellence could help Hensoldt outperform expectations, especially if defense spending rises more than currently forecast.

Find out about the key risks to this Hensoldt narrative.

Another View: SWS DCF Model Points to Undervaluation

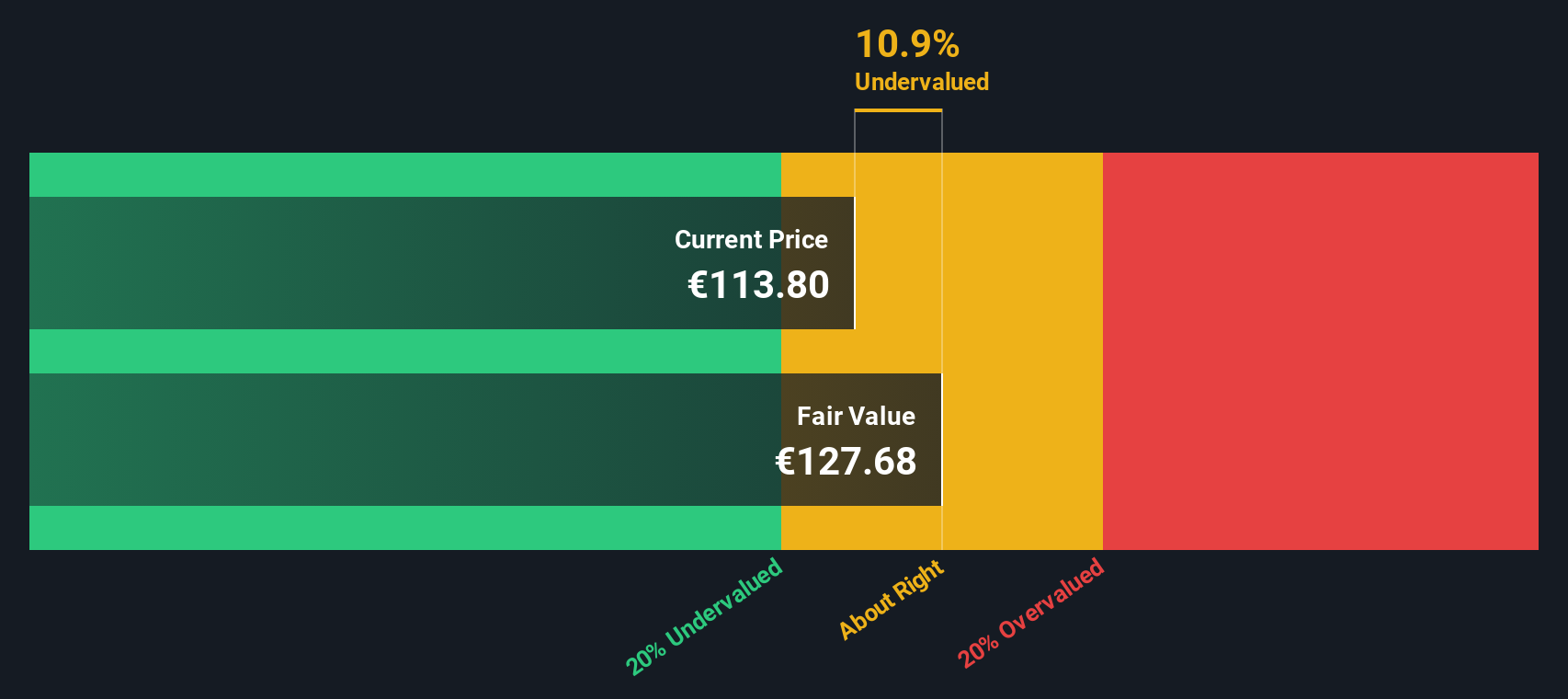

Looking at Hensoldt through the lens of our DCF model tells a different story. In this view, the company appears to be trading around 11.7% below its estimated fair value of €127.93. While market multiples warn of overvaluation, the potential for long-term cash flows could provide more upside than many expect.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hensoldt for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hensoldt Narrative

If you see the numbers differently, or want to dive deeper with your own research, you can analyze the data and develop your own story from scratch in just a few minutes. Do it your way

A great starting point for your Hensoldt research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit themselves to a single opportunity. Now is the perfect time to uncover stocks with remarkable growth, high potential, or reliable income that you might otherwise overlook. Open the door to new possibilities before others do.

- Capture the latest trends in artificial intelligence by checking out these 24 AI penny stocks, which may have the potential to shape tomorrow’s industry leaders.

- Maximize your portfolio’s yield and stability by starting with these 19 dividend stocks with yields > 3%, which offers higher-than-average payouts and a record of proven performance.

- Tap into undervalued gems before they hit the spotlight through these 909 undervalued stocks based on cash flows, evaluated on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hensoldt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HAG

Hensoldt

Provides sensor solutions for defense and security applications worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives