It Looks Like DMG MORI AKTIENGESELLSCHAFT's (ETR:GIL) CEO May Expect Their Salary To Be Put Under The Microscope

The results at DMG MORI AKTIENGESELLSCHAFT (ETR:GIL) have been quite disappointing recently and CEO Christian Thones bears some responsibility for this. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 07 May 2021. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. The data we present below explains why we think CEO compensation is not consistent with recent performance.

Check out our latest analysis for DMG MORI

How Does Total Compensation For Christian Thones Compare With Other Companies In The Industry?

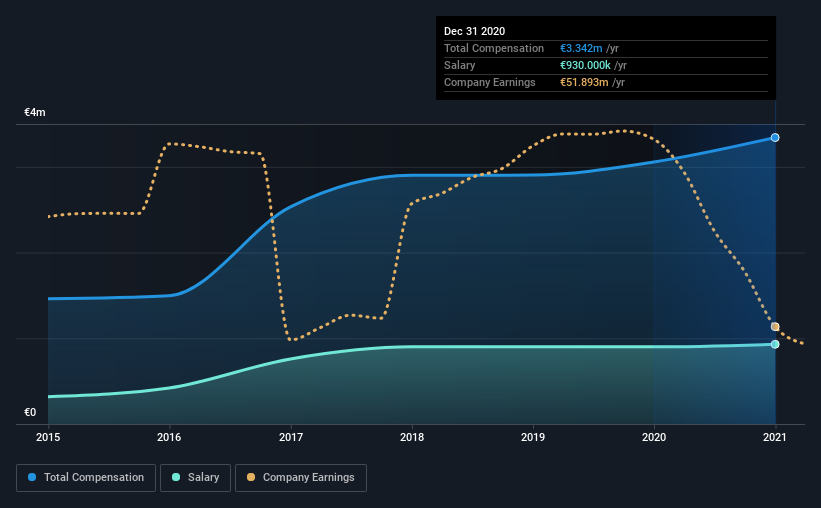

According to our data, DMG MORI AKTIENGESELLSCHAFT has a market capitalization of €3.3b, and paid its CEO total annual compensation worth €3.3m over the year to December 2020. We note that's an increase of 9.4% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at €930k.

On examining similar-sized companies in the industry with market capitalizations between €1.7b and €5.3b, we discovered that the median CEO total compensation of that group was €1.9m. This suggests that Christian Thones is paid more than the median for the industry.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €930k | €900k | 28% |

| Other | €2.4m | €2.2m | 72% |

| Total Compensation | €3.3m | €3.1m | 100% |

Talking in terms of the industry, salary represented approximately 42% of total compensation out of all the companies we analyzed, while other remuneration made up 58% of the pie. It's interesting to note that DMG MORI allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at DMG MORI AKTIENGESELLSCHAFT's Growth Numbers

DMG MORI AKTIENGESELLSCHAFT has reduced its earnings per share by 34% a year over the last three years. Its revenue is down 29% over the previous year.

The decline in EPS is a bit concerning. This is compounded by the fact revenue is actually down on last year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has DMG MORI AKTIENGESELLSCHAFT Been A Good Investment?

With a three year total loss of 6.5% for the shareholders, DMG MORI AKTIENGESELLSCHAFT would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 2 warning signs for DMG MORI (1 shouldn't be ignored!) that you should be aware of before investing here.

Important note: DMG MORI is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade DMG MORI, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:GIL

DMG MORI

Engages in the manufacture and sale of cutting machine tools in Germany, rest of the Europe, the United States, Asia, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives