Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies DMG MORI AKTIENGESELLSCHAFT (ETR:GIL) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for DMG MORI

What Is DMG MORI's Net Debt?

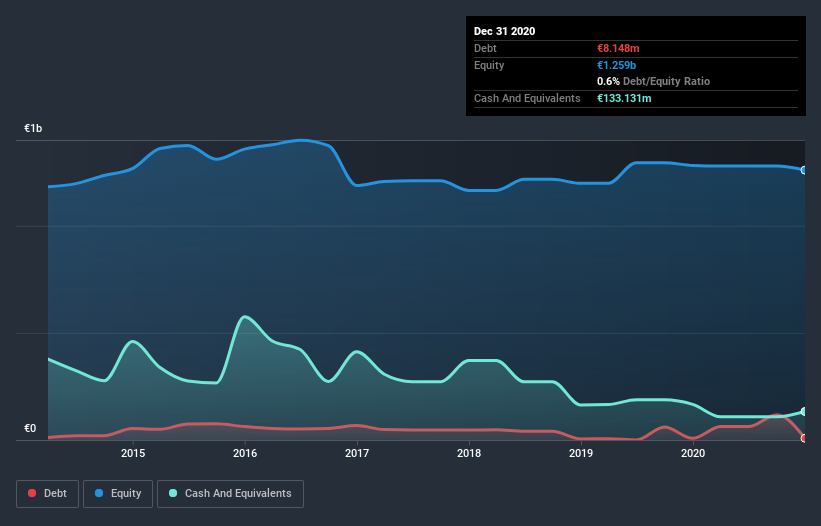

As you can see below, at the end of December 2020, DMG MORI had €8.15m of debt, up from €7.74m a year ago. Click the image for more detail. However, it does have €133.1m in cash offsetting this, leading to net cash of €125.0m.

How Strong Is DMG MORI's Balance Sheet?

According to the last reported balance sheet, DMG MORI had liabilities of €800.9m due within 12 months, and liabilities of €131.1m due beyond 12 months. Offsetting these obligations, it had cash of €133.1m as well as receivables valued at €639.4m due within 12 months. So its liabilities total €159.6m more than the combination of its cash and short-term receivables.

Of course, DMG MORI has a market capitalization of €3.29b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Despite its noteworthy liabilities, DMG MORI boasts net cash, so it's fair to say it does not have a heavy debt load!

The modesty of its debt load may become crucial for DMG MORI if management cannot prevent a repeat of the 68% cut to EBIT over the last year. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since DMG MORI will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While DMG MORI has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, DMG MORI produced sturdy free cash flow equating to 58% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Summing up

We could understand if investors are concerned about DMG MORI's liabilities, but we can be reassured by the fact it has has net cash of €125.0m. So we are not troubled with DMG MORI's debt use. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 2 warning signs for DMG MORI (1 makes us a bit uncomfortable) you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you decide to trade DMG MORI, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:GIL

DMG MORI

Engages in the manufacture and sale of cutting machine tools in Germany, rest of the Europe, the United States, Asia, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives