How GEA Group's (XTRA:G1A) Leadership Extension and Reaffirmed Guidance Have Shaped Its Investment Outlook

Reviewed by Sasha Jovanovic

- Earlier this week, GEA Group AG confirmed its earnings guidance for the full year 2025, projecting organic sales growth between 2% and 4%, and announced that CEO Stefan Klebert's contract has been extended to the end of 2028 along with a major executive reorganization starting in 2026.

- This combination of leadership continuity and streamlined organizational structure, paired with a reaffirmed outlook, highlights the company’s ongoing focus on operational efficiency and long-term stability.

- We’ll now assess how the extension of CEO leadership and confirmed guidance could influence GEA Group’s investment narrative and future outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

GEA Group Investment Narrative Recap

To invest confidently in GEA Group, you need to believe in the company's ability to deliver reliable organic growth and stable earnings, despite its exposure to volatile large industrial projects and soft demand in some segments. The recent confirmation of 2025 sales growth guidance and executive changes does not meaningfully shift the biggest short-term catalyst: large project order intake, particularly the ramp-up and execution of contracts like Baladna. However, risks remain from potential project delays and divisional headwinds, and the latest news does not eliminate this revenue visibility challenge.

Of all recent announcements, GEA’s addition to the Germany DAX Index in September 2025 stands out. This inclusion has the potential to boost the stock’s trading volume and attract a wider base of institutional investors, which could amplify the impact of both near-term catalysts like the Algerian project and ongoing risks such as order lumpiness, although these fundamental issues still anchor the investment case.

But while management stability and index inclusion capture the headlines, investors should pay close attention if project ramp-up issues begin to impact revenue recognition and ...

Read the full narrative on GEA Group (it's free!)

GEA Group's outlook anticipates €6.2 billion in revenue and €581.4 million in earnings by 2028. This scenario requires annual revenue growth of 4.4% and an earnings increase of €173.7 million from the current €407.7 million.

Uncover how GEA Group's forecasts yield a €60.29 fair value, a 4% downside to its current price.

Exploring Other Perspectives

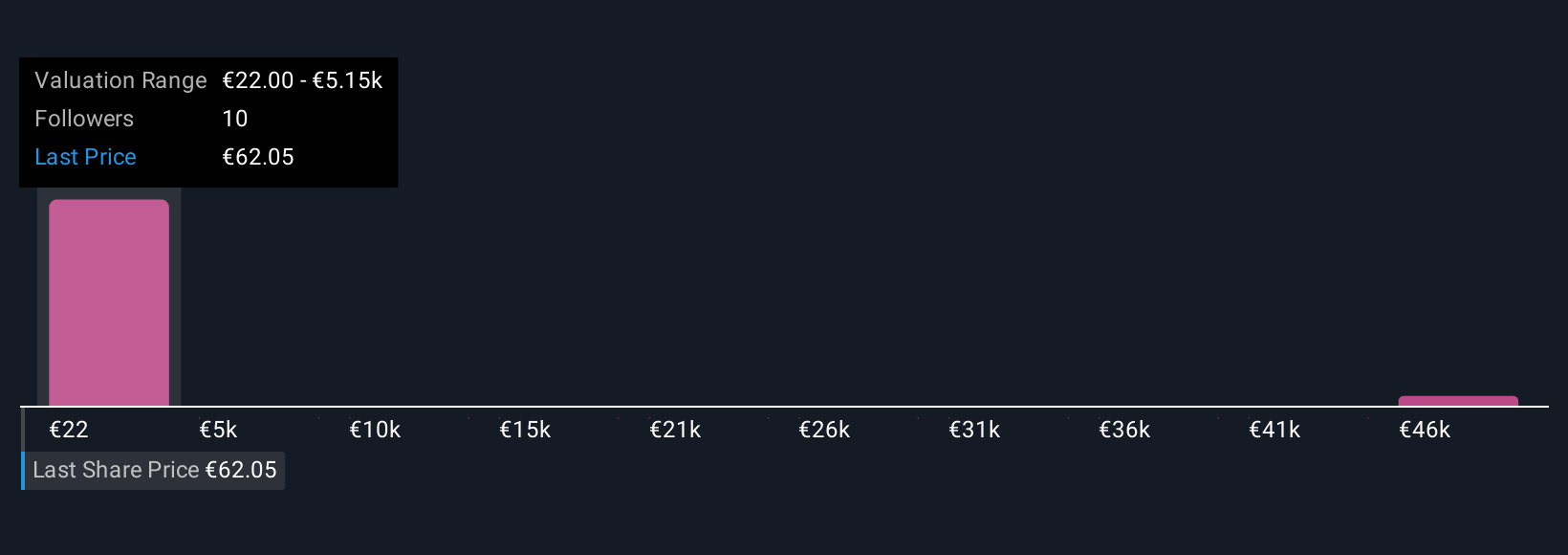

Simply Wall St Community members have published five fair value estimates for GEA shares, ranging from €22 to €51,256.93. While analysts see robust order growth as a key driver, your peers show that expectations for GEA’s true worth can vary enormously, so consider several perspectives before deciding how these catalysts could affect returns.

Explore 5 other fair value estimates on GEA Group - why the stock might be worth less than half the current price!

Build Your Own GEA Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GEA Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free GEA Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GEA Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:G1A

GEA Group

Produces and supplies systems and components to the food, beverage, and pharmaceutical industries worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.