- Germany

- /

- Electrical

- /

- XTRA:F3C

Investors in SFC Energy (ETR:F3C) have unfortunately lost 29% over the last three years

For many investors, the main point of stock picking is to generate higher returns than the overall market. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. Unfortunately, that's been the case for longer term SFC Energy AG (ETR:F3C) shareholders, since the share price is down 29% in the last three years, falling well short of the market return of around 38%. The more recent news is of little comfort, with the share price down 21% in a year. Unfortunately the share price momentum is still quite negative, with prices down 17% in thirty days.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

SFC Energy became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

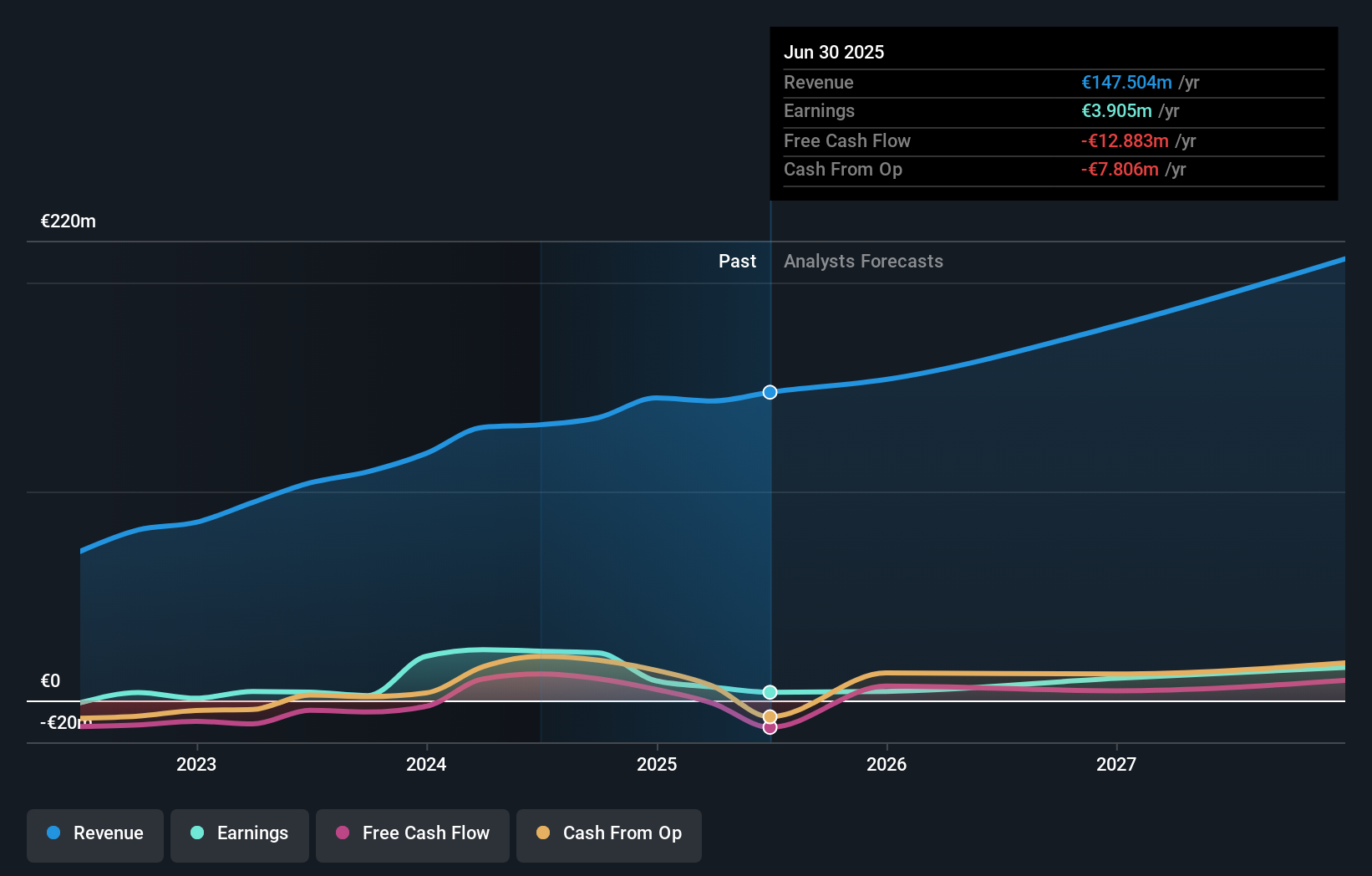

Revenue is actually up 23% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating SFC Energy further; while we may be missing something on this analysis, there might also be an opportunity.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that SFC Energy has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Investors in SFC Energy had a tough year, with a total loss of 21%, against a market gain of about 14%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 0.4% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - SFC Energy has 2 warning signs (and 1 which is concerning) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:F3C

SFC Energy

Develops, produces, and distributes systems and solutions for stationary and mobile off-grid power supply based on hydrogen and direct methanol fuel cells worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives