- Germany

- /

- Electrical

- /

- XTRA:ENR

Why Siemens Energy (XTRA:ENR) Is Up 8.5% After Upgraded 2028 Outlook and Dividend Resumption

Reviewed by Sasha Jovanovic

- Earlier this week, Siemens Energy AG announced it raised its mid-term guidance for 2028, projecting at least 10% annual sales growth, higher profit margins, and the return to dividend payments after four years, following robust full-year earnings results with sales of €39.08 billion and net income of €1.41 billion.

- The company cited rising global demand for electricity, data centers, and power grid upgrades as key drivers behind the heightened outlook and renewed shareholder returns.

- We'll now examine how Siemens Energy's improved growth and margin targets could influence its investment narrative and long-term appeal.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Siemens Energy Investment Narrative Recap

To own shares in Siemens Energy, you need to believe that the global push for electrification, the expansion of renewables, and rising energy demand, especially from data centers, will result in sustained, profitable growth for the company. This week’s raised mid-term guidance boosts hopes for higher sales and wider margins but does not materially reduce near-term uncertainty around how quickly the wind division can return to breakeven, which remains the main watchpoint. Short-term performance continues to hinge on execution risks within the wind business.

Among several company updates, Siemens Energy’s contract win to deliver 1.1 GW of generation equipment to Fermi America is particularly relevant. Large-scale project wins like this underpin the strong order backlog supporting management’s new growth targets, but also reinforce that capital-intensive, complex contracts can amplify both opportunities and delivery risks when order momentum is high. However, investors should remain attentive to...

Read the full narrative on Siemens Energy (it's free!)

Siemens Energy's outlook anticipates €48.7 billion in revenue and €3.6 billion in earnings by 2028. This scenario is built on an assumed annual revenue growth rate of 9.1% and a dramatic increase in earnings of about €3.4 billion from the current €198.0 million.

Uncover how Siemens Energy's forecasts yield a €101.33 fair value, a 8% downside to its current price.

Exploring Other Perspectives

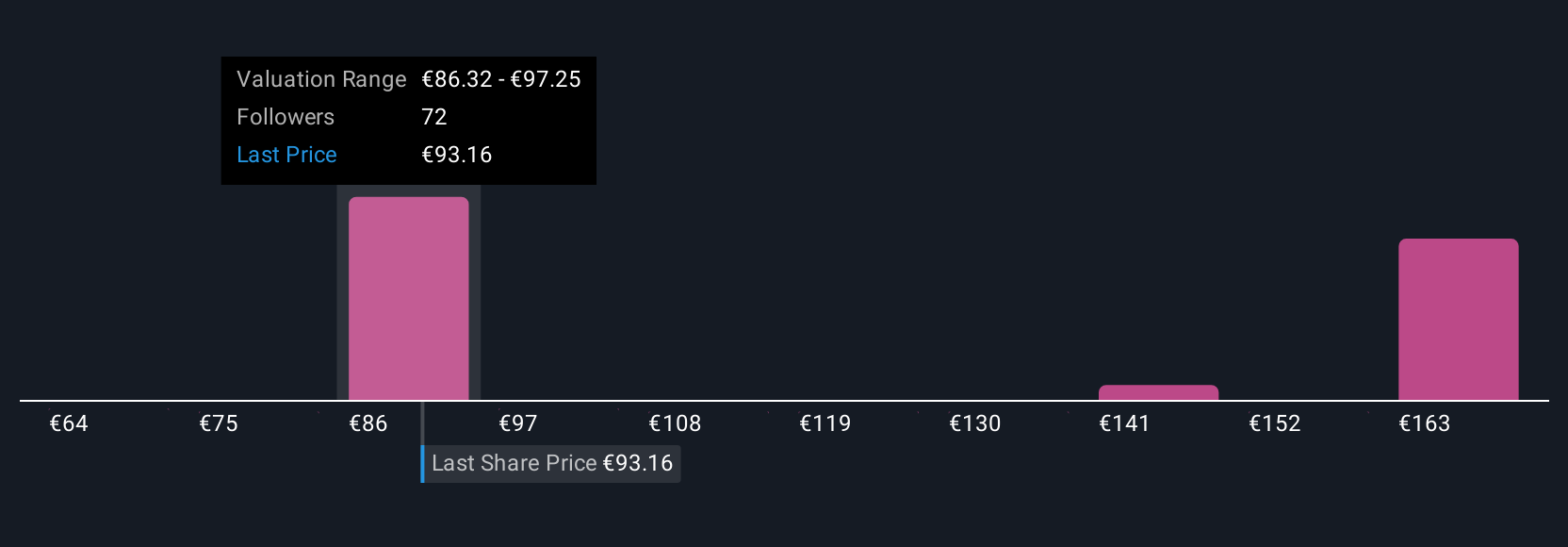

Simply Wall St Community members have published eight fair value estimates for Siemens Energy, spanning from €87.17 to €149.05 per share. While optimism runs high after the company upgraded its growth outlook, expectations for faster margin improvements remain a key source of debate about future performance.

Explore 8 other fair value estimates on Siemens Energy - why the stock might be worth 21% less than the current price!

Build Your Own Siemens Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Siemens Energy research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Siemens Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Siemens Energy's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ENR

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives