- Germany

- /

- Electrical

- /

- XTRA:ENR

Siemens Energy AG's (ETR:ENR) 29% Jump Shows Its Popularity With Investors

Siemens Energy AG (ETR:ENR) shareholders have had their patience rewarded with a 29% share price jump in the last month. The last month tops off a massive increase of 267% in the last year.

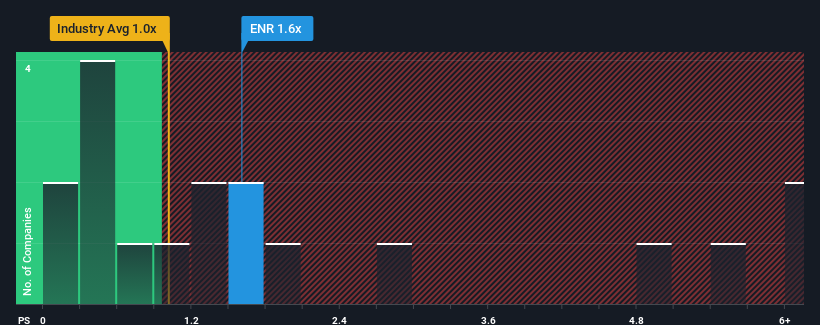

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Siemens Energy's P/S ratio of 1.6x, since the median price-to-sales (or "P/S") ratio for the Electrical industry in Germany is also close to 1.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Our free stock report includes 1 warning sign investors should be aware of before investing in Siemens Energy. Read for free now.Check out our latest analysis for Siemens Energy

What Does Siemens Energy's Recent Performance Look Like?

Recent revenue growth for Siemens Energy has been in line with the industry. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Siemens Energy.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Siemens Energy would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 13% last year. Revenue has also lifted 28% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 9.1% each year over the next three years. With the industry predicted to deliver 9.8% growth per year, the company is positioned for a comparable revenue result.

With this in mind, it makes sense that Siemens Energy's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Siemens Energy appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at Siemens Energy's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Before you settle on your opinion, we've discovered 1 warning sign for Siemens Energy that you should be aware of.

If you're unsure about the strength of Siemens Energy's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:ENR

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives