Why Circus (XTRA:CA1) Is Up 22.6% After Launching AI Chef Robots in REWE Supermarkets

Reviewed by Sasha Jovanovic

- REWE Region West announced the launch of "Fresh & Smart," a new in-store segment featuring Circus SE's CA-1 Series 4 autonomous cooking robot, making it the world’s first supermarket to integrate AI-powered, live meal preparation beginning in Düsseldorf Heerdt, with more locations planned.

- This collaboration not only marks a milestone for automated food service in retail but also highlights Circus SE’s simultaneous expansion into defense applications of autonomous robotics across Europe, reflecting its dual focus on consumer innovation and critical infrastructure.

- We’ll explore how Circus SE’s rapid integration of its AI robotics with a major European grocer signals a shift in its broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Circus' Investment Narrative?

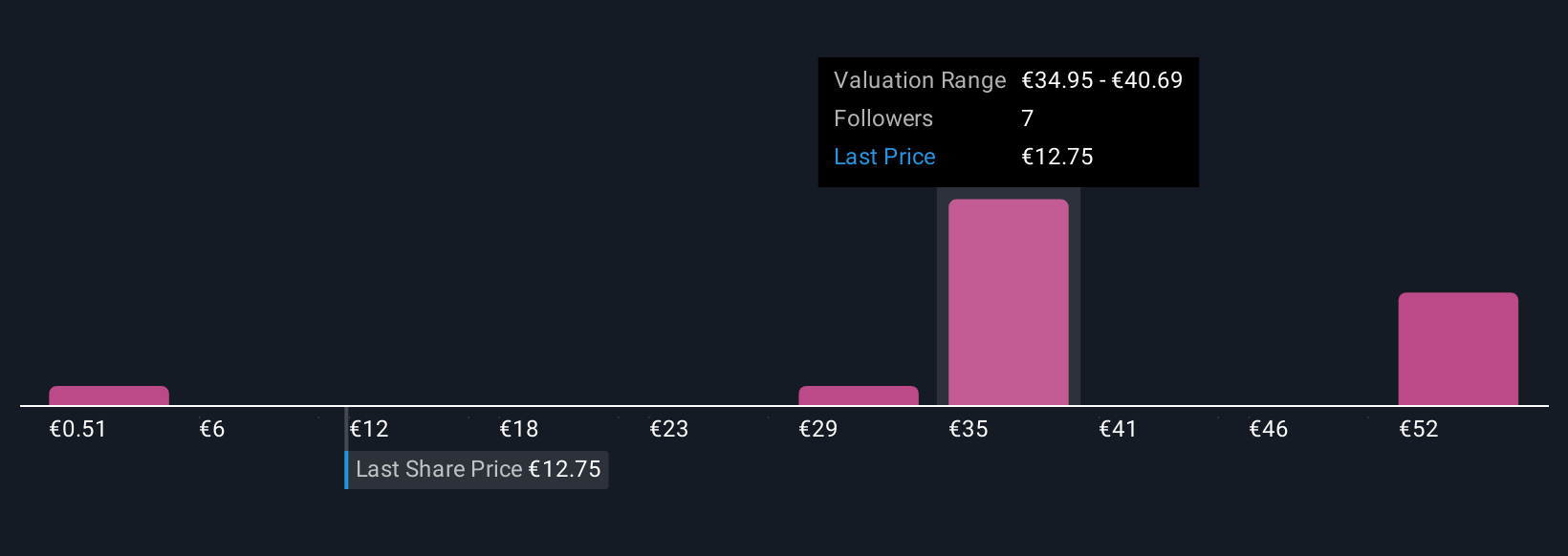

The recent partnership between Circus SE and REWE Region West, launching the world’s first in-store CA-1 Series 4 cooking robot, gives investors a clear marker of Circus’s shift from niche automation to visible, real-world retail application. This move has energized short-term catalysts, most notably by amplifying attention on Circus’s dual trajectory in both commercial food services and defense robotics. With initial rollouts confirmed and expansion underway, market excitement is clear, reflected in sharp price surges ahead of the event. Yet, this shift in focus accelerates key risks: Circus remains early-stage with less than €1 million in annual revenue, high volatility and new management, and still trades at a steep premium to industry peers by book value ratio. The expansion adds promise for revenue growth catalysts but does not reduce the pressure to prove meaningful adoption and profitability, especially given current unprofitability and high execution demands for scaling both retail and defense offerings. New deployments could alter sentiment and risk if they drive substantial uptake or highlight operational bottlenecks, so investor attention is likely to remain high as results trickle in.

But contrast this with the risk that management inexperience and lack of operating history could weigh on execution. Circus' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 5 other fair value estimates on Circus - why the stock might be worth less than half the current price!

Build Your Own Circus Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Circus research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Circus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Circus' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:CA1

Circus

A technology company, develops and delivers autonomous solutions for the food service market.

Exceptional growth potential and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion