If You Had Bought SLM Solutions Group (ETR:AM3D) Shares A Year Ago You'd Have Earned 137% Returns

SLM Solutions Group AG (ETR:AM3D) shareholders have seen the share price descend 29% over the month. But that doesn't detract from the splendid returns of the last year. Indeed, the share price is up an impressive 137% in that time. So it may be that the share price is simply cooling off after a strong rise. The real question is whether the business is trending in the right direction.

View our latest analysis for SLM Solutions Group

SLM Solutions Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

SLM Solutions Group grew its revenue by 7.9% last year. That's not great considering the company is losing money. In contrast, the share price took off during the year, gaining 137%. We're happy that investors have made money, though we wonder if the increase will be sustained. It's quite likely that the market is considering other factors, not just revenue growth.

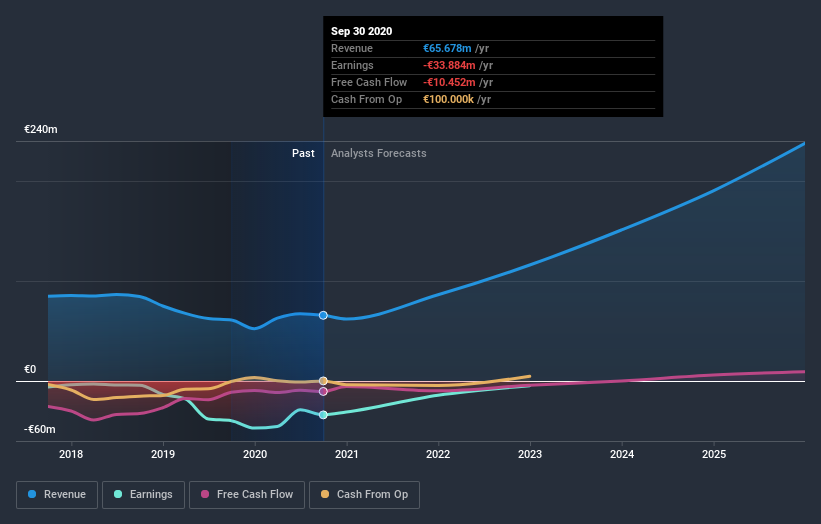

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling SLM Solutions Group stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's good to see that SLM Solutions Group has rewarded shareholders with a total shareholder return of 137% in the last twelve months. That certainly beats the loss of about 3% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with SLM Solutions Group .

Of course SLM Solutions Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

When trading SLM Solutions Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Nikon SLM Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:AM3D

Nikon SLM Solutions

Nikon SLM Solutions AG provides metal-based additive manufacturing technology solutions worldwide.

Mediocre balance sheet with weak fundamentals.

Similar Companies

Market Insights

Community Narratives