How Investors Are Reacting To Traton (XTRA:8TRA) as US Tariff Exemptions Ease Regulatory Concerns

Reviewed by Sasha Jovanovic

- Earlier this month, Traton SE reported that its sales for the third quarter of 2025 totaled 71,400 vehicles, down from 85,300 in the same period last year, and later took part in the Automotive Circle’s EuroCarBody 2025 Conference in Bad Nauheim, Germany.

- A catalyst for industry discussion emerged as the White House confirmed expected exemptions for European truck makers from proposed U.S. import taxes, alleviating concerns about potential regulatory disruptions for companies like Traton.

- We’ll explore how relief from U.S. tariff uncertainty could shift Traton’s investment narrative and support its long-term industry outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Traton Investment Narrative Recap

To be a Traton shareholder, you need to believe in the company's ability to recover from current market pressures and benefit from long-term global transport demand, despite recent declines in vehicle sales. The White House’s confirmed tariff exemptions for European truck makers eases a key regulatory risk for Traton in the US, but doesn’t materially offset the immediate catalyst of weak transportation demand and volume declines, especially in Europe and Brazil, which remain the most important short-term concerns.

Of the most recent updates, Traton’s Q3 2025 sales results, showing a year-on-year decline from 85,300 to 71,400 vehicles, are highly relevant, reinforcing the need for near-term demand recovery to unlock any benefit from a more stable regulatory outlook. Persistent volume pressure, rather than tariff policy, is still at the core of the company’s risk-reward balance.

Yet, even with tariff concerns easing, investors should also be mindful that recovery could be challenged by...

Read the full narrative on Traton (it's free!)

Traton's outlook projects €48.9 billion in revenue and €3.3 billion in earnings by 2028. This requires 2.0% annual revenue growth and a €1.1 billion increase in earnings from the current €2.2 billion level.

Uncover how Traton's forecasts yield a €33.05 fair value, a 26% upside to its current price.

Exploring Other Perspectives

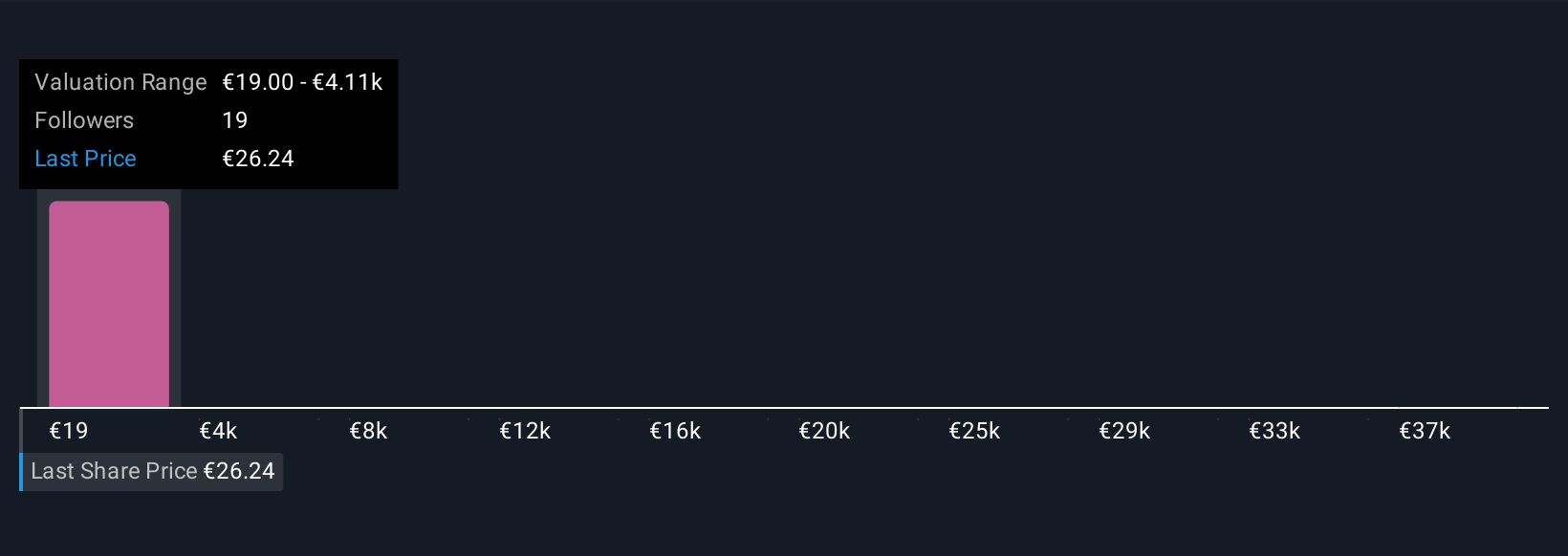

Eight individual fair value estimates from the Simply Wall St Community span from €19 to over €40,000, showing immense variation in expectations. While opinions are broad, ongoing volume declines underscore why many are still cautious about near-term performance.

Explore 8 other fair value estimates on Traton - why the stock might be a potential multi-bagger!

Build Your Own Traton Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Traton research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Traton research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Traton's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Traton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:8TRA

Traton

Manufactures and sells commercial vehicles in Germany, rest of Europe, the United States of America, rest of North America, Brazil, rest of South America, and internationally.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives