Does Traton’s Share Price Rally Signal Room for Growth in 2025?

Reviewed by Bailey Pemberton

Trying to figure out what to do with Traton stock? You are not alone. Whether you are wondering if it is time to buy more, hold tight, or maybe look elsewhere, recent moves in Traton’s share price have definitely caught investors’ eyes. Over just the last week, shares nudged up by 2.0%, after a somewhat bumpy ride: down 6.1% in the last month, but only slightly negative for the year to date. Longer-term, things look even more interesting. Traton is up 4.1% over the past year and has soared an impressive 153.4% in three years. If you invested five years ago, you are sitting on a 93.1% gain.

These numbers do not always tell the whole story, but they do hint at both growth potential and shifting perceptions of risk. Some recent price moves may reflect broader market optimism about the commercial vehicle sector and investor bets that Traton is well-positioned to capitalize on industry trends. For anyone serious about weighing up the next move, it is worth noting that Traton earns a value score of 5 out of 6 based on standard valuation checks, meaning the company looks undervalued in nearly every way analysts assess it.

Of course, not all valuation methods are created equal, and some investors rely too much on familiar measures. Up next, we will walk through the main approaches for figuring out if Traton offers real value, before revealing a crucial perspective that many investors overlook.

Why Traton is lagging behind its peers

Approach 1: Traton Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to their present value in today's euros. For Traton, analysts and model extrapolations provide an insight into these future cash flows, grounding the valuation on expected company performance rather than just past results.

Traton's latest reported Free Cash Flow (FCF) stands at €51.1 million as of the last twelve months. Looking ahead, analysts expect significant growth, with FCF projected to reach €2.54 billion by 2028. Only the next five years are based on direct analyst estimates, while projections for subsequent years are modeled by Simply Wall St and continue this strong upward trend. These estimates are central to the DCF approach, as they shape the calculation of Traton's total intrinsic worth.

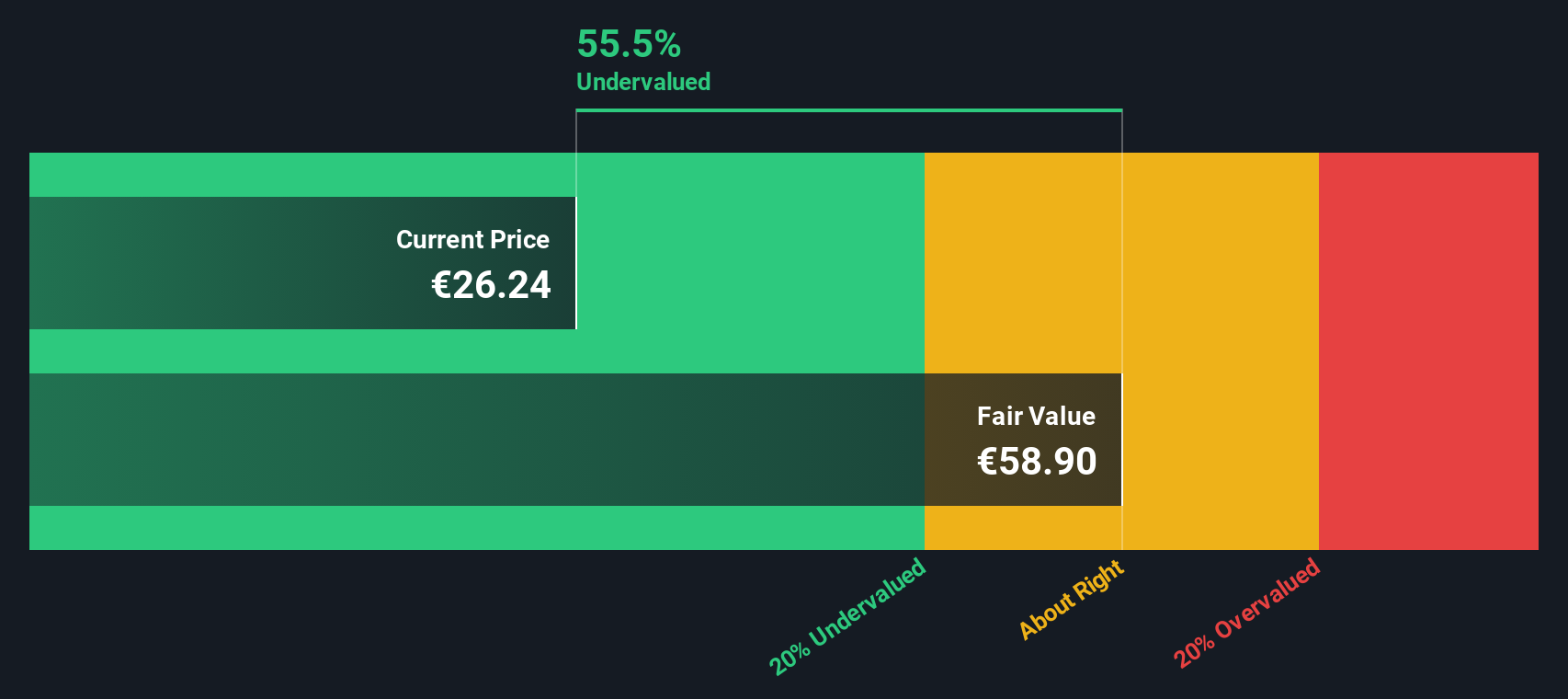

Bringing all these cash flows back to today's value, the DCF analysis assigns Traton a fair value of €52.22 per share. Compared to the current market price, this represents a 46.2% discount, signaling the stock is significantly undervalued according to this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Traton is undervalued by 46.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Traton Price vs Earnings

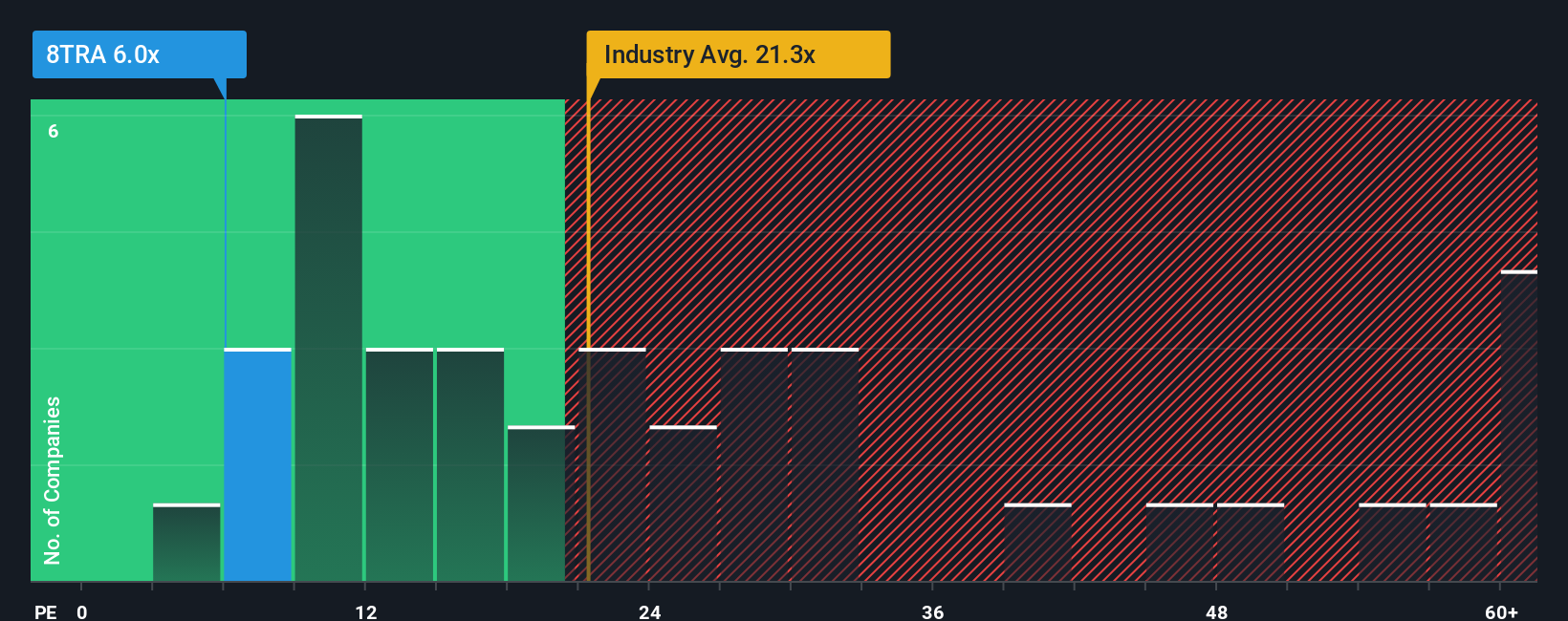

For companies that are profitable and generating steady earnings, the Price-to-Earnings (PE) ratio is one of the most commonly used ways to judge valuation. It offers a quick snapshot of how much investors are willing to pay today for each euro of a company's earnings, making it especially relevant for mature and stable businesses like Traton.

The "right" PE ratio depends on several factors, most notably a company's prospects for growth and the risks it faces. Higher expected growth typically justifies a higher PE, while greater risk or business volatility tends to push the "fair" PE down. For context, Traton's current PE is just 6.4x, which stands in stark contrast to the machinery industry average of 21.1x and a peer average of 47.8x. This low number could mean the market is cautious, or it might signal a potential bargain.

Rather than relying solely on peer or industry averages, Simply Wall St uses a "Fair Ratio" approach. In this case, a proprietary fair PE ratio of 25.7x is set for Traton. This metric is tailored for the company by weighing its earnings growth, industry position, profit margins, market cap and risks. Because it accounts for company-specific strengths and headwinds, the Fair Ratio provides a more precise benchmark than broad sector comparisons.

With Traton trading at 6.4x and a Fair Ratio of 25.7x, there is a substantial gap indicating the shares appear strongly undervalued based on this method.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Traton Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story about Traton, connecting its business outlook, financial forecasts, and your belief about its fair value into one dynamic, actionable framework.

Unlike traditional valuation methods, Narratives empower you to link your own perspective on Traton’s future revenues, margins, and risks directly to a forward-looking valuation. This approach puts context behind the numbers, helping you make sense of where the stock’s price is headed and why. Narratives are easy to use and accessible to all investors on the Simply Wall St Community page, where millions of investors regularly share and update their views.

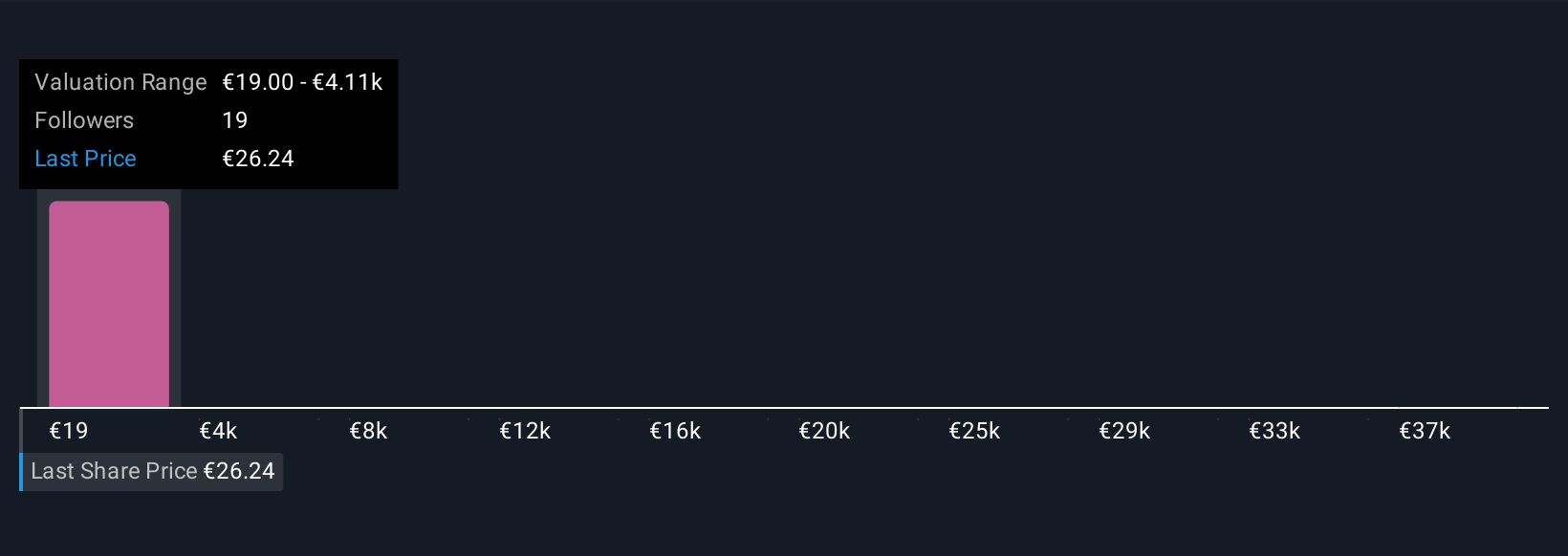

By comparing a Narrative’s calculated fair value with Traton’s latest share price, you can quickly assess whether it is time to buy, sell, or hold. Your story adjusts dynamically as new announcements, earnings, or global events occur. For example, Traton Narratives in the community currently range from a bullish €50.0 to a cautious €23.0 fair value, showing just how different assumptions and stories can shape each investor’s view.

Do you think there's more to the story for Traton? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Traton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:8TRA

Traton

Manufactures and sells commercial vehicles in Germany, rest of Europe, the United States of America, rest of North America, Brazil, rest of South America, and internationally.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026