Why ProCredit Holding (XTRA:PCZ) Cut Its 2025 ROE Guidance and What This Means for Its Risk Appetite

Reviewed by Sasha Jovanovic

- In October 2025, ProCredit Holding AG’s Management Board revised the group’s 2025 return on equity guidance down to 7-8% from about 10%, citing increased loss allowances for the upcoming year.

- This development highlights the firm’s more cautious view on loan performance, even as guidance for loan portfolio growth and capital strength remains steady.

- We'll now explore how this lowered profit expectation, and its link to higher projected loss allowances, may shift ProCredit Holding's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

ProCredit Holding Investment Narrative Recap

To be a shareholder in ProCredit Holding, an investor needs to trust in the long-term value of a digitally-focused, expansion-driven bank serving underpenetrated markets, while accepting the realities of lower near-term returns. The October 2025 reduction in return on equity guidance, due to increased loss allowances, doesn’t change the fact that margin pressure from policy rate trends remains the key short-term catalyst, while the biggest immediate risk is ongoing weakness and structural pressures in Ecuador, which have a direct impact on group-wide profitability.

Among recent announcements, the earnings report from August 2025 stands out, showing declining net interest and net income year-over-year. These figures reinforce how sensitive near-term earnings are to both asset quality and the persistent headline risks that the group faces, especially as higher loss allowances feed through to reported results and weigh on key profitability metrics.

On the other hand, investors should keep in mind the ongoing challenges in Ecuador and how these conditions could worsen if...

Read the full narrative on ProCredit Holding (it's free!)

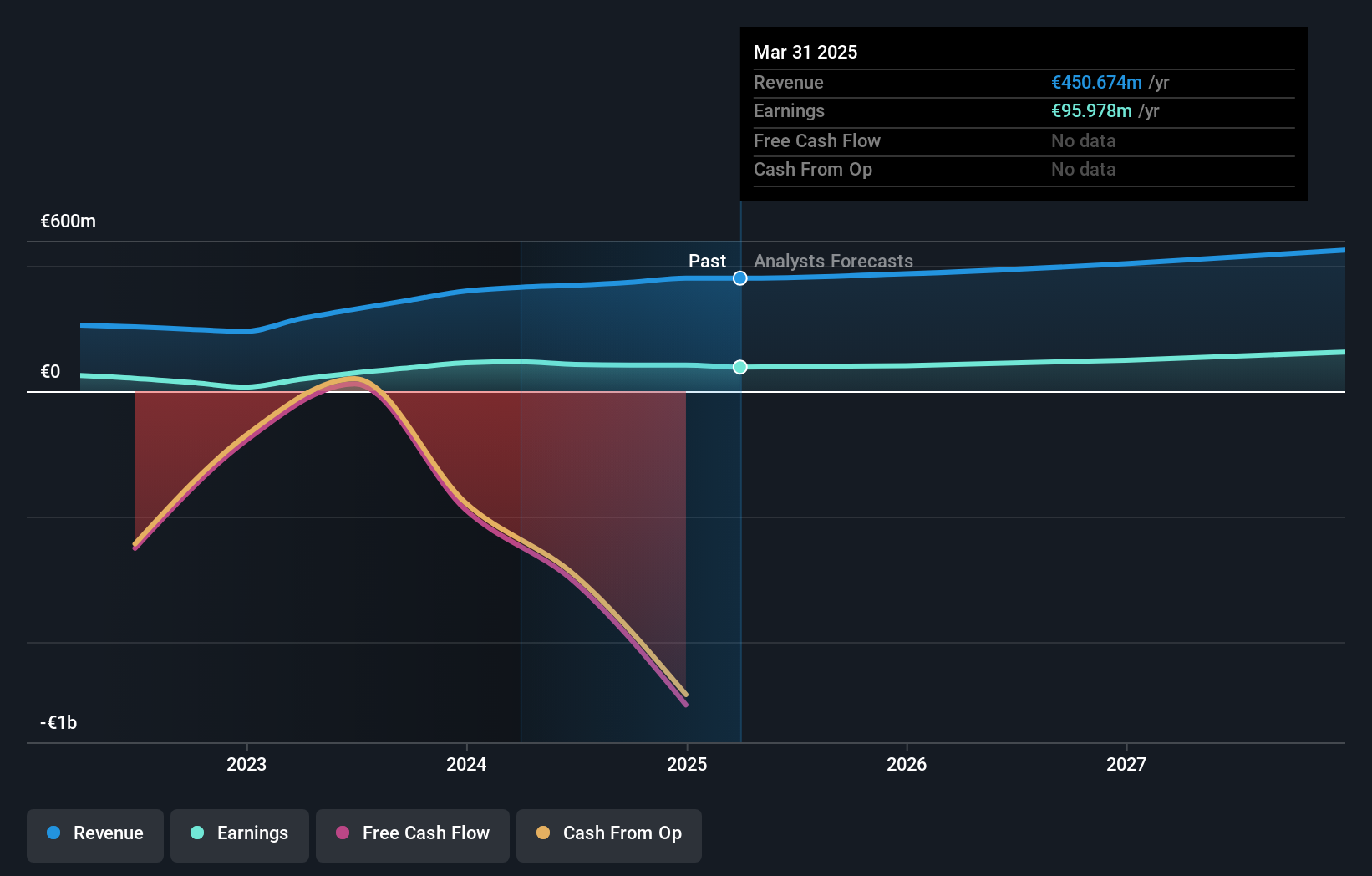

ProCredit Holding's outlook anticipates €569.6 million in revenue and €163.7 million in earnings by 2028. This is based on 8.2% annual revenue growth and an increase in earnings of €70.0 million from the current €93.7 million.

Uncover how ProCredit Holding's forecasts yield a €16.00 fair value, a 112% upside to its current price.

Exploring Other Perspectives

Six private investors in the Simply Wall St Community estimate ProCredit’s fair value between €9.58 and €24,882.06. With policy rates and margin pressure in focus, such a wide range of views highlights how investor conclusions can diverge, compare several opinions before taking a stance.

Explore 6 other fair value estimates on ProCredit Holding - why the stock might be a potential multi-bagger!

Build Your Own ProCredit Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ProCredit Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ProCredit Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ProCredit Holding's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:PCZ

ProCredit Holding

Provides commercial banking products and services for small and medium enterprises and private customers in Europe, South America, and Germany.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives