Is It Too Late to Invest in Commerzbank After a 109% Share Price Surge?

Reviewed by Bailey Pemberton

- Ever looked at Commerzbank and wondered if its surging share price means it's still a bargain, or if you've missed the boat? You're in the right place to find out what its real value might be.

- The stock has taken off this year, up a massive 109.3% year-to-date and delivering an impressive 101.3% gain over the last 12 months. This performance has caught the attention of both growth and value investors.

- Recent headlines have highlighted renewed momentum in Germany’s financial sector. Commerzbank has capitalized on a shift in sentiment as investors respond to interest rate expectations and ongoing consolidation talk among European banks. These developments have added fresh optimism and helped fuel the stock’s latest rally.

- In terms of valuation, Commerzbank currently scores a 2 out of 6 based on our standard checks for undervaluation. We will break down the usual valuation approaches next, so keep reading for a smarter perspective on what determines true value.

Commerzbank scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Commerzbank Excess Returns Analysis

The Excess Returns model estimates a company’s intrinsic value by focusing on how much profit it earns above the required cost of equity on its investments. This method highlights not just current performance but also the ability to consistently generate attractive returns for shareholders over time.

For Commerzbank, the key numbers are as follows:

- Book Value: €30.01 per share

- Stable Earnings Per Share (EPS): €3.04 per share

(Source: Weighted future Return on Equity estimates from 12 analysts.) - Cost of Equity: €1.74 per share

- Excess Return: €1.30 per share

- Average Return on Equity: 10.31%

- Stable Book Value: €29.47 per share

(Source: Weighted future Book Value estimates from 6 analysts.)

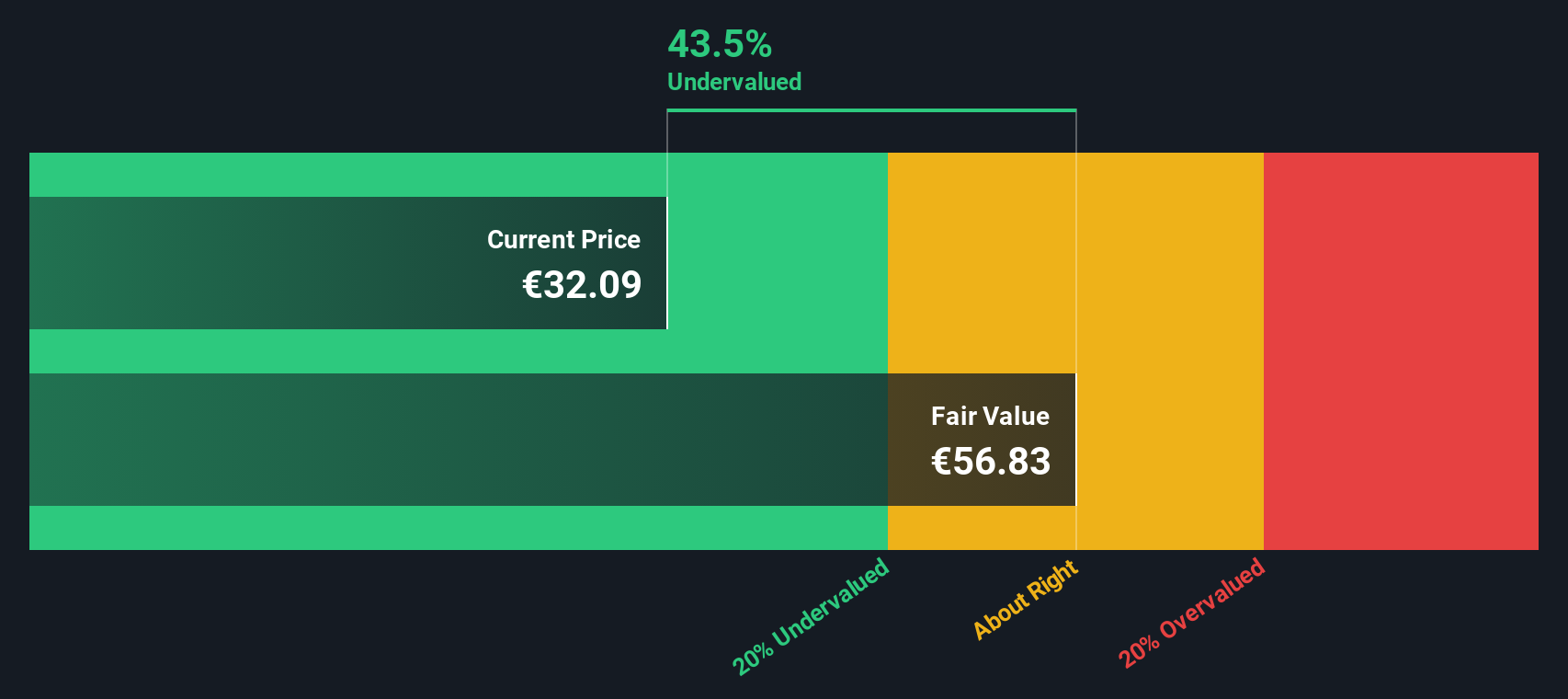

According to this model, Commerzbank’s ability to consistently earn more than its equity cost makes it fundamentally attractive. Factoring in these projections, the model implies that the stock is trading at a 44.1% discount to its estimated intrinsic value. This suggests it is significantly undervalued at the current share price.

Result: UNDERVALUED

Our Excess Returns analysis suggests Commerzbank is undervalued by 44.1%. Track this in your watchlist or portfolio, or discover 842 more undervalued stocks based on cash flows.

Approach 2: Commerzbank Price vs Earnings

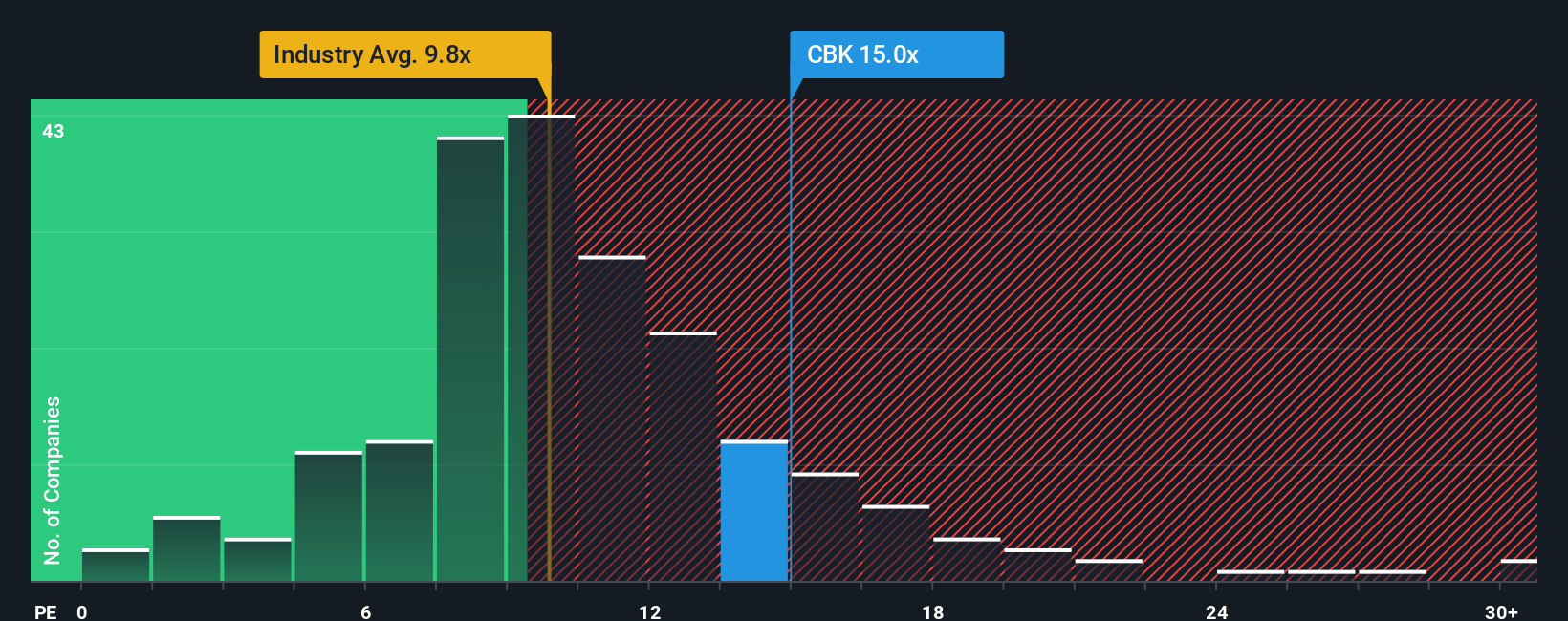

The Price-to-Earnings (PE) ratio is a widely recognized valuation metric, especially when assessing profitable companies like Commerzbank. This ratio measures how much investors are willing to pay for each euro of current earnings, making it a vital tool for gauging whether a stock is valued fairly in relation to its earnings power.

What constitutes a "normal" or "fair" PE ratio often depends on expectations for future growth and the overall risk profile of the company. Businesses with stronger growth prospects or lower risk can typically command higher PE multiples, while those facing uncertainties generally warrant lower ratios.

Currently, Commerzbank trades at a PE ratio of 15.06x. This is notably above the industry average of 10.16x and the peer average of 11.26x. This signals that the market has priced in higher growth or lower risk relative to its peers. However, Simply Wall St's proprietary "Fair Ratio" for Commerzbank stands at 14.21x. This ratio considers not just broad industry trends, but also the company’s own earnings growth, risk levels, profit margins, market capitalization and unique business model.

The Fair Ratio provides a more nuanced view compared to a plain comparison with peers or the industry because it tailors the benchmark to the company’s specific strengths and risks. In Commerzbank’s case, its actual PE is just slightly above this Fair Ratio. That minimal difference suggests the stock is priced about right relative to its fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Commerzbank Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, practical tool that lets you put your own story of Commerzbank—your view of its future revenue, profit margins, and fair value—alongside what you see in the numbers. Rather than just accepting raw figures, Narratives combine a company's business story, your personal assumptions, and a detailed financial forecast to help you estimate what Commerzbank is really worth.

This approach is accessible on Simply Wall St’s Community page, where millions of investors are building, sharing and updating their Narratives. Narratives make it straightforward to track different perspectives, compare your Fair Value against the current share price, and quickly decide if now is the time to buy or sell. Plus, they adjust dynamically when new updates—like financial results or breaking news—are published, helping your view stay current in real time.

For Commerzbank, for example, one Narrative imagines digital innovation and fee-based revenue powering higher earnings, which justifies a fair value of €36.10 per share; another, more cautious view flags slow transformation and economic headwinds, supporting a fair value closer to €21.00. With Narratives, you can instantly see and sense-check these possibilities for yourself.

Do you think there's more to the story for Commerzbank? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:CBK

Commerzbank

Provides banking and capital market products and services to private and small business customers, corporate, financial service providers, and institutional clients in Germany, rest of Europe, the Americas, Asia, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives