- Germany

- /

- Auto Components

- /

- DB:HGEA

hGears AG Just Missed Earnings - But Analysts Have Updated Their Models

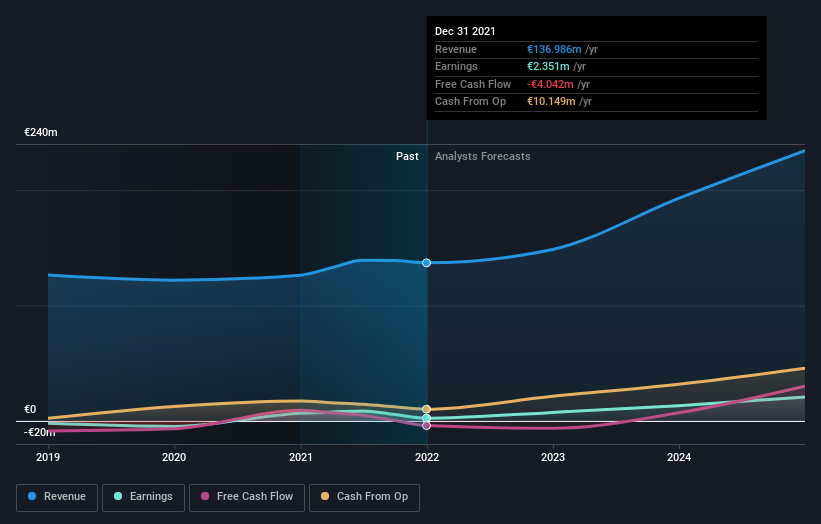

There's been a notable change in appetite for hGears AG (FRA:HGEA) shares in the week since its annual report, with the stock down 11% to €18.50. It looks like a pretty bad result, all things considered. Although revenues of €137m were in line with analyst predictions, statutory earnings fell badly short, missing estimates by 50% to hit €0.33 per share. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

See our latest analysis for hGears

Taking into account the latest results, the consensus forecast from hGears' twin analysts is for revenues of €148.6m in 2022, which would reflect a decent 8.5% improvement in sales compared to the last 12 months. Per-share earnings are expected to soar 219% to €0.72. Yet prior to the latest earnings, the analysts had been anticipated revenues of €154.6m and earnings per share (EPS) of €0.97 in 2022. The analysts seem less optimistic after the recent results, reducing their sales forecasts and making a pretty serious reduction to earnings per share numbers.

Despite the cuts to forecast earnings, there was no real change to the €31.50 price target, showing that the analysts don't think the changes have a meaningful impact on its intrinsic value.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the hGears' past performance and to peers in the same industry. It's clear from the latest estimates that hGears' rate of growth is expected to accelerate meaningfully, with the forecast 8.5% annualised revenue growth to the end of 2022 noticeably faster than its historical growth of 3.9% p.a. over the past three years. Other similar companies in the industry (with analyst coverage) are also forecast to grow their revenue at 7.4% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that hGears is expected to grow at about the same rate as the wider industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. They also downgraded their revenue estimates, although as we saw earlier, forecast growth is only expected to be about the same as the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At least one analyst has provided forecasts out to 2024, which can be seen for free on our platform here.

We don't want to rain on the parade too much, but we did also find 2 warning signs for hGears that you need to be mindful of.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:HGEA

hGears

Develops, manufactures, distributes, and supplies precision components and subsystems, and system solutions in European Union, the United States, China, and rest of the world.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion