Leadership Talks at Porsche Might Change the Case for Investing in Volkswagen (XTRA:VOW3)

Reviewed by Sasha Jovanovic

- In recent days, Volkswagen AG has faced heightened speculation as Porsche, its luxury automobile subsidiary, initiated talks to potentially replace CEO Oliver Blume with former McLaren chief Michael Leiters amid operational challenges and management criticism. This consideration follows mounting pressure due to weak demand, increased competition, and Volkswagen’s difficult shift toward electric vehicles, spotlighting the company’s complex leadership structure and industry headwinds.

- The uncertainty surrounding executive leadership signals significant change at both Porsche and Volkswagen, as leadership transitions often impact corporate direction, employee morale, and investor confidence, particularly during periods of major industry transformation and rising competitive pressures.

- We’ll explore how this potential leadership change at Porsche could influence Volkswagen’s investment outlook given the company’s ongoing operational and electrification challenges.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Volkswagen Investment Narrative Recap

For investors, the core belief underlying Volkswagen’s investment case is its ability to execute on an ambitious electrification strategy and deliver margin recovery despite global headwinds. The latest speculation over Porsche’s CEO succession does raise questions over operational stability, but it does not materially alter the key catalyst: Volkswagen’s push to expand electric vehicle offerings and strengthen its position in key growth markets. However, risks around brand-specific demand in China and margin pressure from BEVs remain acute.

Recent news that Markus Haupt has been formally appointed CEO of Seat and Cupra, both Volkswagen Group brands, is particularly relevant as it highlights efforts to reinforce leadership stability across subsidiaries. While the attention is on Porsche's executive search, these groupwide management changes may offer some reassurance around Volkswagen’s capacity to manage leadership transitions and maintain momentum in restructuring, critical to supporting the company’s long-term electrification and cost efficiency targets.

Yet, investors should keep in mind that at the same time, persistent weakness in Porsche and Audi demand in China poses a risk to group revenue and...

Read the full narrative on Volkswagen (it's free!)

Volkswagen's outlook suggests €352.0 billion in revenue and €15.8 billion in earnings by 2028. This projection is based on a 2.8% annual revenue growth rate and a €7.4 billion increase in earnings from the current €8.4 billion.

Uncover how Volkswagen's forecasts yield a €113.55 fair value, a 25% upside to its current price.

Exploring Other Perspectives

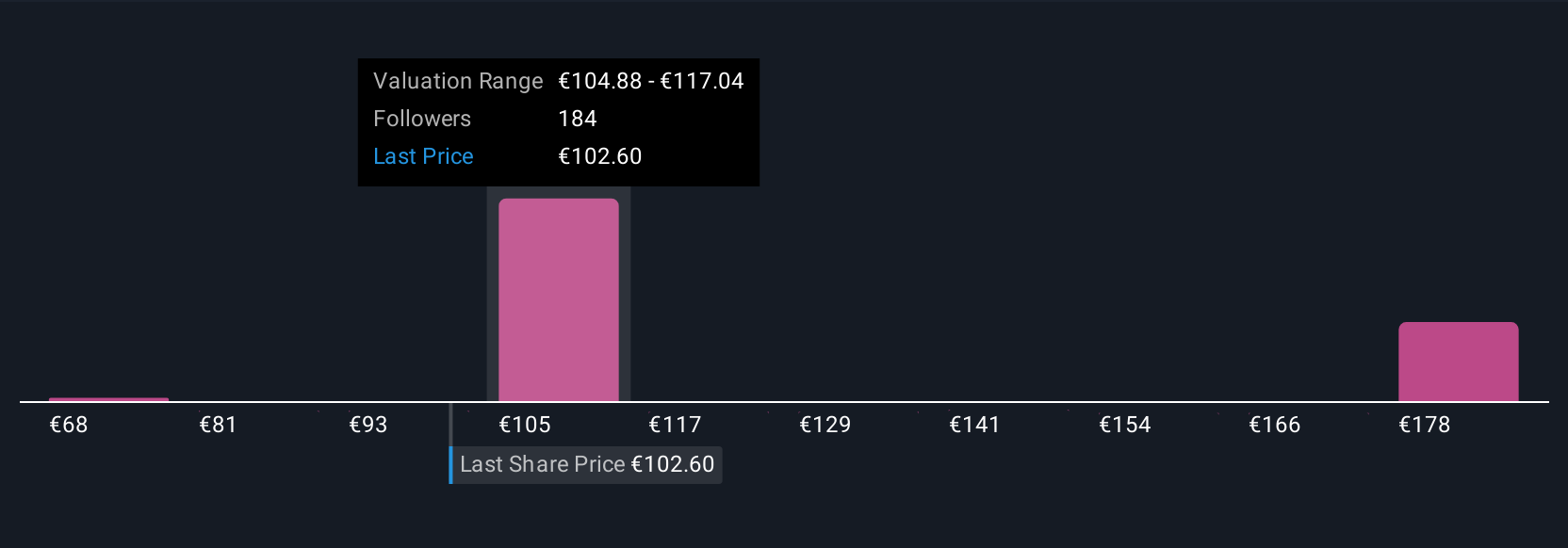

Twelve estimates from the Simply Wall St Community place Volkswagen’s fair value between €68.40 and €144.45, spanning a broad spectrum of outlooks. With competition in the BEV market putting pressure on margins, it is worth considering how widely investor opinions can differ when assessing the company’s trajectory.

Explore 12 other fair value estimates on Volkswagen - why the stock might be worth as much as 58% more than the current price!

Build Your Own Volkswagen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Volkswagen research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Volkswagen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Volkswagen's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:VOW3

Volkswagen

Manufactures and sells automobiles in Germany, other European countries, North America, South America, the Asia-Pacific, and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives