Is There Now an Opportunity in Volkswagen Shares After Recent 4% Dip?

Reviewed by Bailey Pemberton

Trying to decide what to do with your Volkswagen stock right now? You’re not alone. After all, it’s a stock that has flashed both opportunity and uncertainty over recent months. Volkswagen’s shares recently closed at 89.36, and results over the last year reflect small but positive growth. The stock is up 2.5% over the past year, and 2.3% since the beginning of 2024. That might not sound spectacular, but it’s far from disastrous for such a complex, globally active company. Meanwhile, Volkswagen’s five-year return sits at 9.3%, a figure that captures some of the company’s swings and signals resilience in the automotive sector.

Aside from the numbers, what’s driving the sentiment? There’s been a handful of notable shifts. Investors are digesting Volkswagen’s ambitious electrification push, regulatory changes around emissions, and evolving partnerships in technology. While these are not the only factors at play, they have certainly reshaped the way the market views both the risks and the upside attached to the stock. The slow dip of -0.6% over the past week and -4.1% in the last month hints that some participants may be re-evaluating growth potential in the short term, even as the company’s longer-term transformation stays in focus.

If you’re here for the bottom line, Volkswagen currently clocks a value score of 5 out of 6 on our valuation checks, marking it as undervalued in all but one metric. But what exactly does that mean, and how do these valuation approaches stack up? Up next, we’ll break down how Volkswagen measures up against classic valuation metrics and then preview a more powerful lens we use to understand stock value beyond the usual checkboxes.

Approach 1: Volkswagen Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a valuation method that estimates the current value of a company by projecting its future cash flows and discounting them back to today’s terms. For Volkswagen, the DCF model uses a 2 Stage Free Cash Flow to Equity approach, taking into account both analyst estimates and longer-term extrapolations.

As of the latest twelve months, Volkswagen’s free cash flow stands at negative €10.5 billion, reflecting recent capital investments and fluctuating operational cash generation. Looking ahead, financial analysts forecast a significant improvement, with free cash flows projected to reach €6.7 billion by 2028. Beyond the standard five-year analyst horizon, further projections are estimated, suggesting upward momentum in Volkswagen’s ability to generate cash.

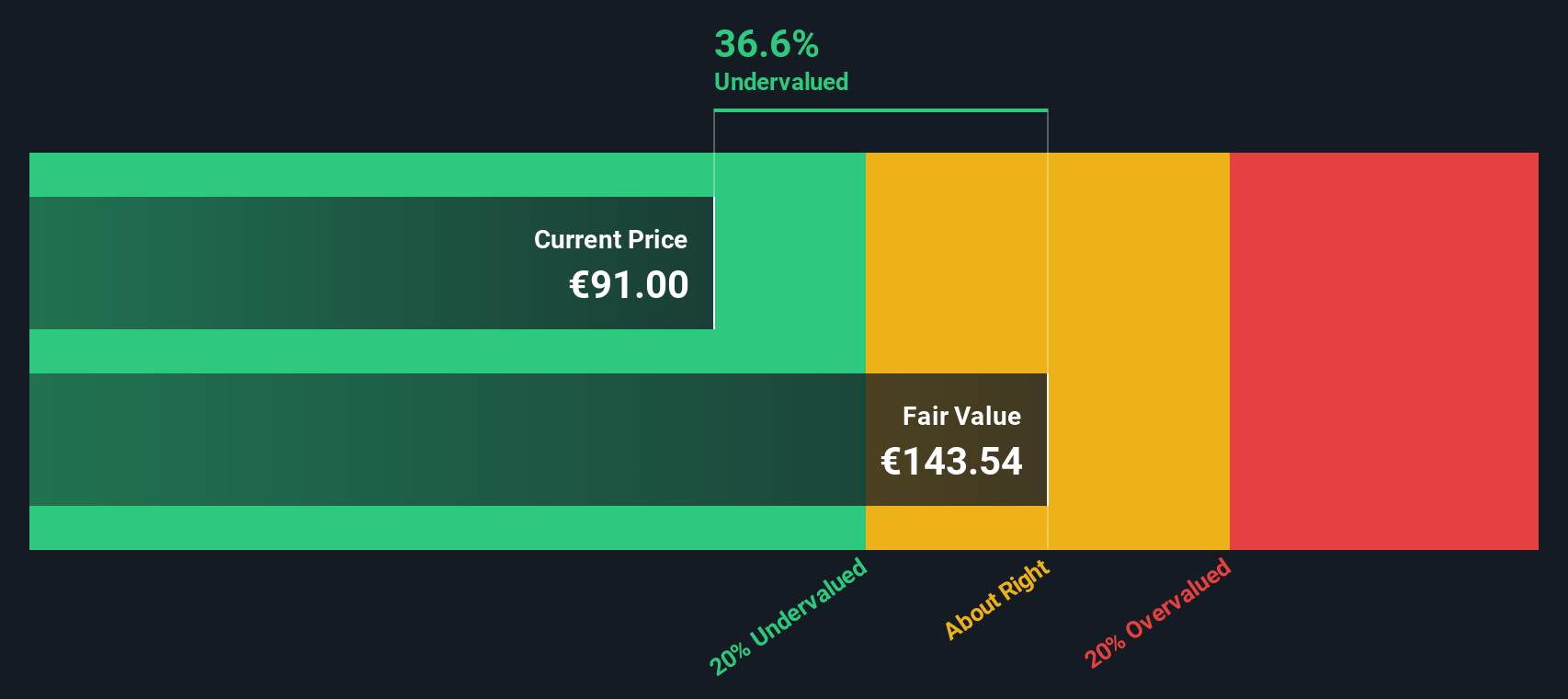

Based on these forecasts and discounting future values appropriately, the DCF model calculates Volkswagen’s intrinsic value at €143.60 per share. With shares currently trading at €89.36, this implies the stock is 37.8% undervalued according to the model’s assumptions.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Volkswagen is undervalued by 37.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Volkswagen Price vs Earnings (PE Ratio)

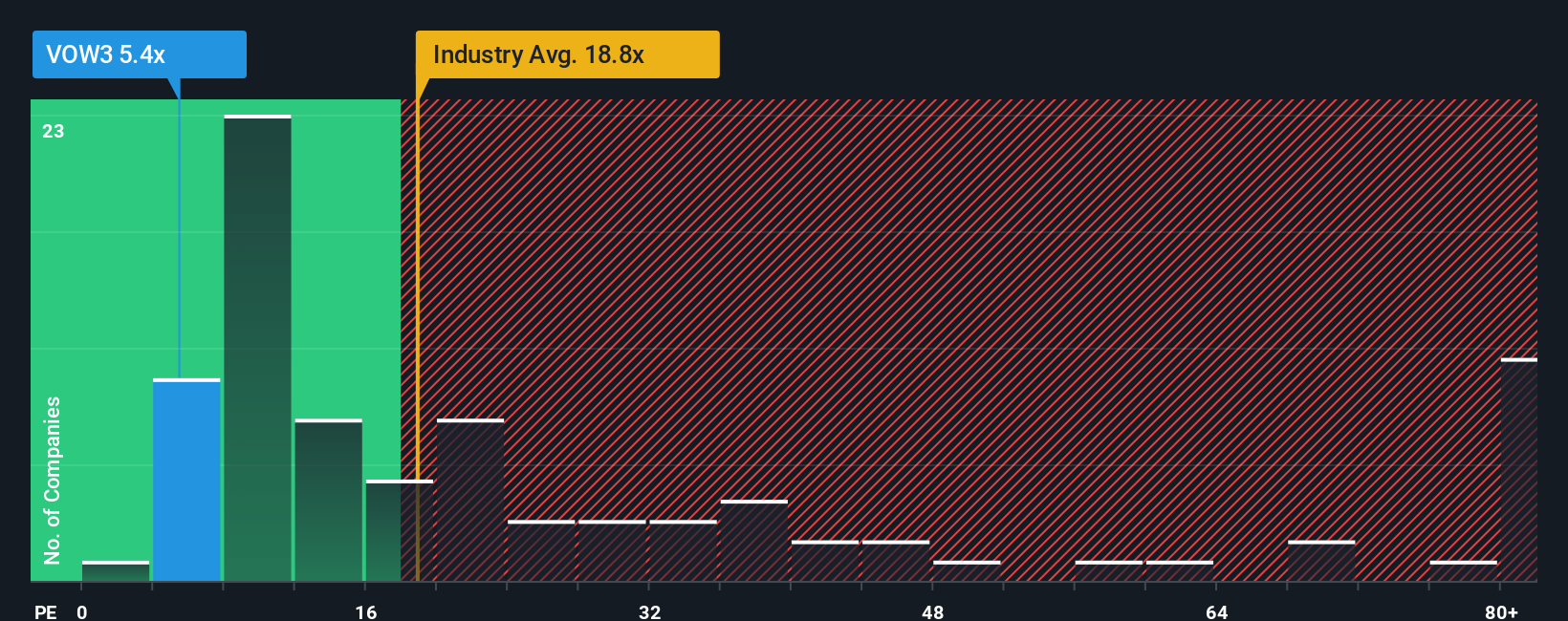

The price-to-earnings (PE) ratio is a widely used valuation metric for established, profitable companies like Volkswagen. It helps investors gauge how much they are paying for each euro of earnings, making it a handy benchmark for comparing valuations across businesses in the same industry.

Typically, growth expectations and risk play an important role in determining what a “normal” or “fair” PE ratio should be. Companies with above-average growth prospects, consistent profitability, and lower business risk often command higher PE multiples. Those facing more uncertainty tend to trade at lower multiples.

Volkswagen currently trades at a PE ratio of 5.3x, which is substantially lower than the auto industry average of 18.3x and also below the peer group average of 11.7x. At face value, this could suggest the stock is undervalued compared to both its industry and similar companies.

However, Simply Wall St’s proprietary “Fair Ratio” goes a step further by estimating what Volkswagen’s PE ratio should reasonably be, based on its specific earnings growth, profit margins, size, risk factors, and industry context. This approach recognizes that not all lower valuations signal a bargain, as some companies trade cheaper for good reason.

For Volkswagen, the Fair Ratio comes in at 14.9x. This is nearly three times higher than the company’s actual PE of 5.3x. This indicates that even after accounting for company-specific risks and growth profiles, Volkswagen appears meaningfully undervalued on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Volkswagen Narrative

Earlier we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a personalized story behind the numbers, where you outline your view of a company’s future by sharing your assumptions about metrics like fair value, expected revenue growth, profit margins, and future price-earnings ratios.

Instead of relying purely on static numbers or one-size-fits-all benchmarks, Narratives let you connect your perspective on Volkswagen’s story, such as their electrification push or responses to global challenges, directly to a financial forecast and fair value estimate. This approach makes valuation relatable and actionable, because it’s rooted in what you believe is likely to happen next.

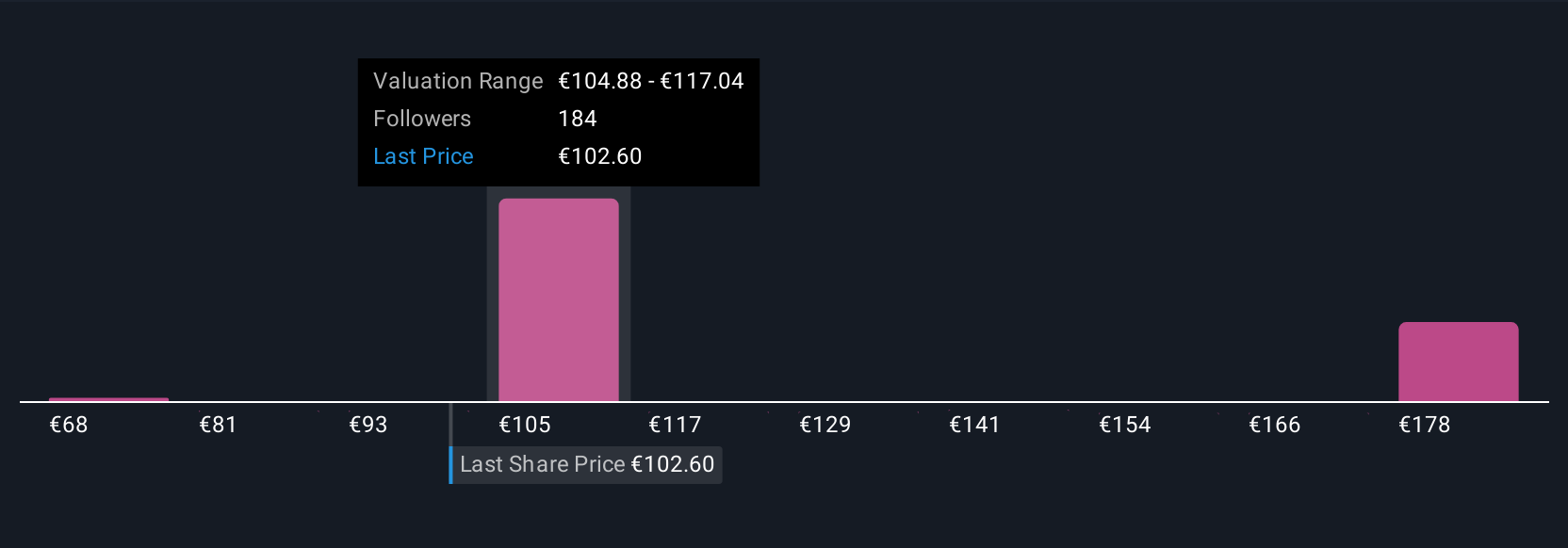

Narratives are simple to create and share on the Simply Wall St Community page, used by millions of investors worldwide. When you craft your Narrative, the platform instantly calculates a fair value based on your assumptions and compares it with the current share price, helping you make smarter buy or sell decisions at a glance.

One of the most powerful features is that Narratives stay up-to-date, automatically reflecting new developments, whether that’s a quarterly earnings report or breaking industry news, so your investment thesis always matches reality. For example, one Narrative for Volkswagen estimates a fair value of just €68.40, reflecting a cautious outlook, while another highlights a bullish scenario with a fair value of €113.55, showing how different investor perspectives drive different decisions.

For Volkswagen, we will make it easy for you with previews of two leading Volkswagen Narratives:

Fair value: €113.55

Undervalued by approximately 21.3%

Forecast annual revenue growth: 2.8%

- Expansion in electrified vehicles, digital services, and local production is expected to drive global growth and strengthen Volkswagen's margin resilience.

- New revenue streams from digital and mobility services, coupled with operational restructuring, are enhancing profitability. However, pressures from BEV competition, luxury brand weakness, and high investment needs persist.

- Consensus analyst forecasts call for revenue, earnings, and margins to improve steadily. This justifies a price target that is 12.8% above the current share price, but these depend on continued cost control, global expansion, and absence of major trade or tariff shocks.

Fair value: €68.40

Overvalued by approximately 30.6%

Forecast annual revenue growth: 1.0%

- Ongoing strategic and management missteps, including heavy dependence on China and delayed responses to industry shifts, have left Volkswagen vulnerable to profit erosion and stagnant international market share.

- Costly past scandals, slow electric vehicle rollout, and a complex, inefficient corporate structure are seen as weighing on margins and future growth potential.

- Recent management guidance downgrades and margin target delays, combined with external risks such as tariffs, further impact the near-term outlook for both earnings and share price.

Do you think there's more to the story for Volkswagen? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:VOW3

Volkswagen

Manufactures and sells automobiles in Germany, other European countries, North America, South America, the Asia-Pacific, and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives