- Germany

- /

- Life Sciences

- /

- XTRA:GXI

3 German Stocks Estimated To Be Up To 45.2% Below Intrinsic Value

Reviewed by Simply Wall St

As the European Central Bank's recent interest rate cuts have buoyed major stock indexes, Germany's DAX has seen a notable increase of 1.46%, reflecting optimism in the region's economic outlook. In this environment, identifying undervalued stocks becomes crucial for investors seeking opportunities, and this article explores three German stocks currently estimated to be up to 45.2% below their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| technotrans (XTRA:TTR1) | €16.05 | €30.70 | 47.7% |

| init innovation in traffic systems (XTRA:IXX) | €36.50 | €52.13 | 30% |

| 2G Energy (XTRA:2GB) | €22.75 | €41.19 | 44.8% |

| Formycon (XTRA:FYB) | €51.00 | €81.65 | 37.5% |

| CeoTronics (DB:CEK) | €5.45 | €10.06 | 45.8% |

| Schweizer Electronic (XTRA:SCE) | €3.68 | €7.19 | 48.8% |

| Your Family Entertainment (DB:RTV) | €2.50 | €4.32 | 42.1% |

| LPKF Laser & Electronics (XTRA:LPK) | €9.03 | €12.41 | 27.2% |

| Basler (XTRA:BSL) | €6.61 | €12.12 | 45.5% |

| MTU Aero Engines (XTRA:MTX) | €309.50 | €564.44 | 45.2% |

We'll examine a selection from our screener results.

Gerresheimer (XTRA:GXI)

Overview: Gerresheimer AG, with a market cap of €2.93 billion, manufactures and sells medicine packaging, drug delivery devices, and solutions both in Germany and internationally.

Operations: The company's revenue is derived from three main segments: Plastics & Devices (€1.13 billion), Advanced Technologies (€5.83 million), and Primary Packaging Glass (€885.56 million).

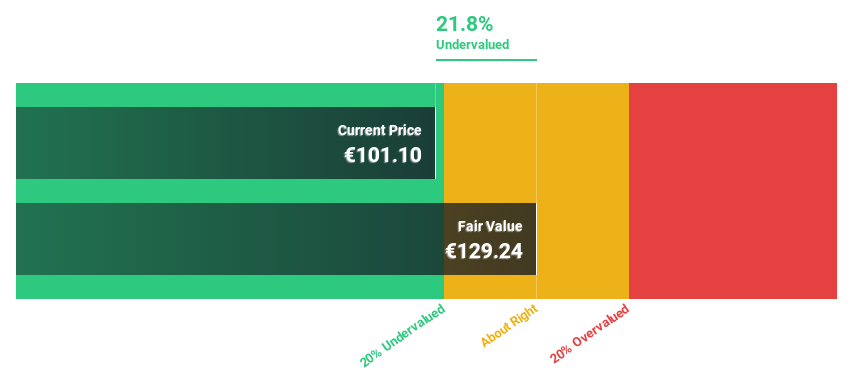

Estimated Discount To Fair Value: 24.3%

Gerresheimer AG is trading at approximately €84.8, below its estimated fair value of €112.07, indicating potential undervaluation based on cash flows. Despite lowering its earnings guidance for 2024 and 2025, the company reported steady revenue growth with Q3 sales reaching €498.5 million. Forecasts suggest significant annual earnings growth of over 20%, although return on equity remains modest at an expected 13.4%. The stock is considered to be in a good financial position despite high debt levels.

- The growth report we've compiled suggests that Gerresheimer's future prospects could be on the up.

- Get an in-depth perspective on Gerresheimer's balance sheet by reading our health report here.

MTU Aero Engines (XTRA:MTX)

Overview: MTU Aero Engines AG develops, manufactures, markets, and maintains commercial and military aircraft engines as well as aero-derivative industrial gas turbines globally, with a market cap of €16.66 billion.

Operations: The company's revenue is primarily derived from the Commercial Maintenance Business (MRO) segment, which accounts for €4.45 billion, and the Commercial and Military Engine Business (OEM) segment, contributing €1.32 billion.

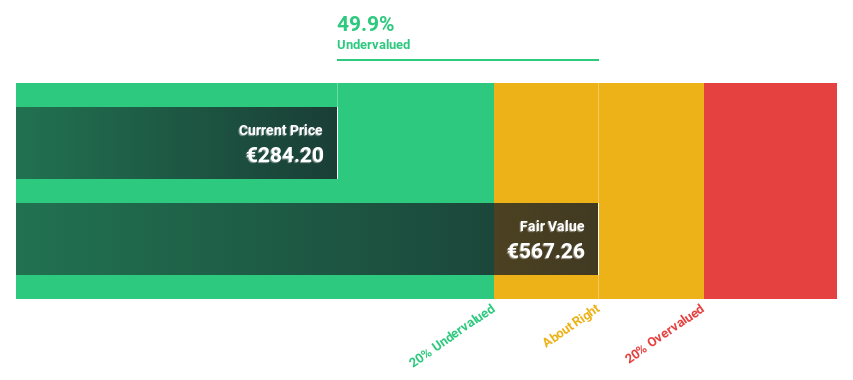

Estimated Discount To Fair Value: 45.2%

MTU Aero Engines, trading at €309.5, is significantly below its estimated fair value of €564.44, reflecting potential undervaluation based on cash flows. The company forecasts robust earnings growth of 34.31% annually and expects to become profitable within three years, outpacing the German market's revenue growth rate at 11.9% per year. Recent financial results show increased sales and net income for the first half of 2024, supported by a successful €745.88 million fixed-income offering in September 2024.

- Our expertly prepared growth report on MTU Aero Engines implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of MTU Aero Engines.

Schaeffler (XTRA:SHA0)

Overview: Schaeffler AG, along with its subsidiaries, develops, manufactures, and sells components and systems for industrial applications across Europe, the Americas, China, and the Asia Pacific; it has a market cap of approximately €4.77 billion.

Operations: The company's revenue is segmented into Automotive Technologies at €9.80 billion, Vehicle Lifetime Solutions at €2.43 billion, and Bearings & Industrial Solutions at €4.10 billion.

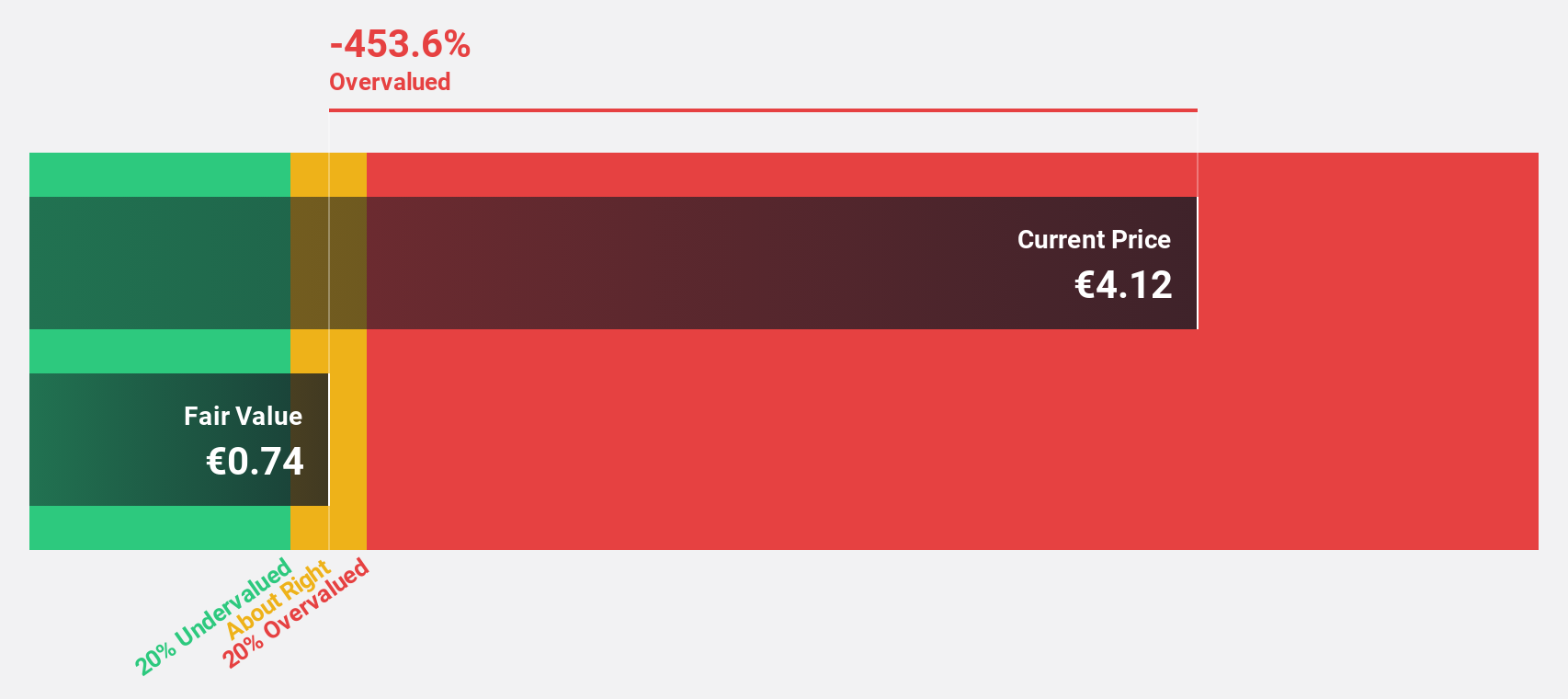

Estimated Discount To Fair Value: 15.9%

Schaeffler, trading at €5.05, is slightly undervalued with a fair value estimate of €6. The company anticipates substantial earnings growth of nearly 38% annually over the next three years, surpassing the German market's average. Despite this potential, recent financials reveal declining net income and lower profit margins compared to last year. Additionally, shares are highly illiquid and interest payments remain inadequately covered by earnings, posing risks to investors focused on cash flow valuation.

- In light of our recent growth report, it seems possible that Schaeffler's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Schaeffler stock in this financial health report.

Summing It All Up

- Click this link to deep-dive into the 20 companies within our Undervalued German Stocks Based On Cash Flows screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:GXI

Gerresheimer

Manufactures and sells medicine packaging, drug delivery devices, and solutions in Germany and internationally.

Good value with reasonable growth potential.