- Germany

- /

- Trade Distributors

- /

- XTRA:BNR

Top European Dividend Stocks To Consider In October 2025

Reviewed by Simply Wall St

As European markets navigate a landscape of steady interest rates and modest economic growth, investors are increasingly focused on the potential of dividend stocks to provide stable returns amidst market uncertainties. In this environment, selecting strong dividend-paying companies can be a prudent strategy for those seeking reliable income and long-term value.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.34% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.75% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.76% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.63% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.98% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.27% | ★★★★★★ |

| d'Amico International Shipping (BIT:DIS) | 11.60% | ★★★★★☆ |

| Credito Emiliano (BIT:CE) | 5.50% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.72% | ★★★★★★ |

| Banca Popolare di Sondrio (BIT:BPSO) | 5.90% | ★★★★★☆ |

Click here to see the full list of 224 stocks from our Top European Dividend Stocks screener.

We'll examine a selection from our screener results.

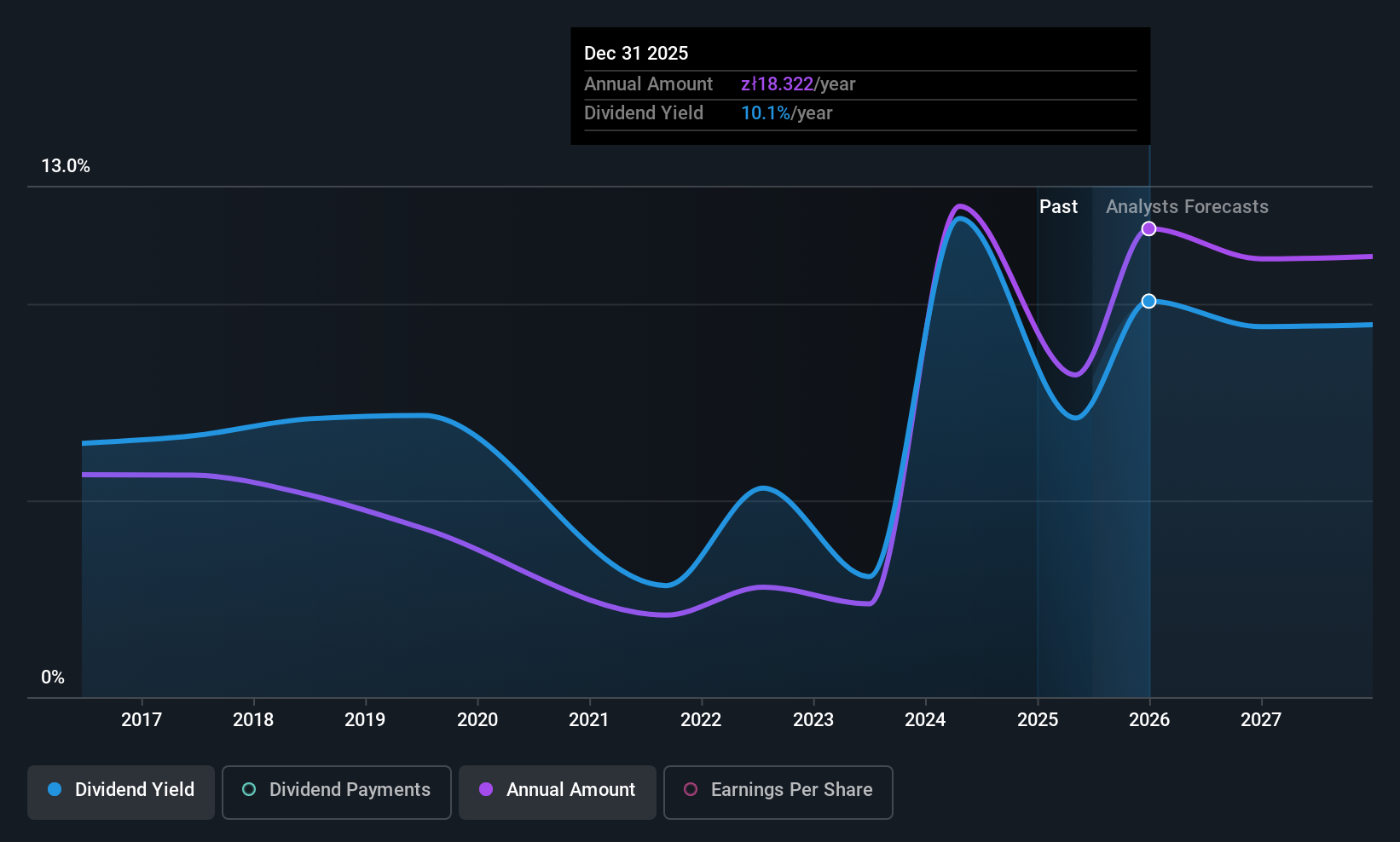

Bank Polska Kasa Opieki (WSE:PEO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank Polska Kasa Opieki S.A. is a commercial bank offering banking products and services to retail and corporate clients in Poland, with a market cap of PLN47.56 billion.

Operations: Bank Polska Kasa Opieki S.A. generates revenue through its Business Banking segment (PLN2.32 billion) and Corporate and Investment Banking segment (PLN3 billion).

Dividend Yield: 7.0%

Bank Polska Kasa Opieki offers a dividend yield of 6.95%, slightly below the top quartile in Poland, with dividends covered by earnings at a 49.2% payout ratio, ensuring sustainability despite past volatility. Earnings are forecast to decline by 1.1% annually over the next three years, potentially impacting future payouts, though dividends are expected to remain covered at a 67% payout ratio. Recent earnings show growth with net income reaching PLN 3.29 billion for H1 2025.

- Get an in-depth perspective on Bank Polska Kasa Opieki's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Bank Polska Kasa Opieki is trading behind its estimated value.

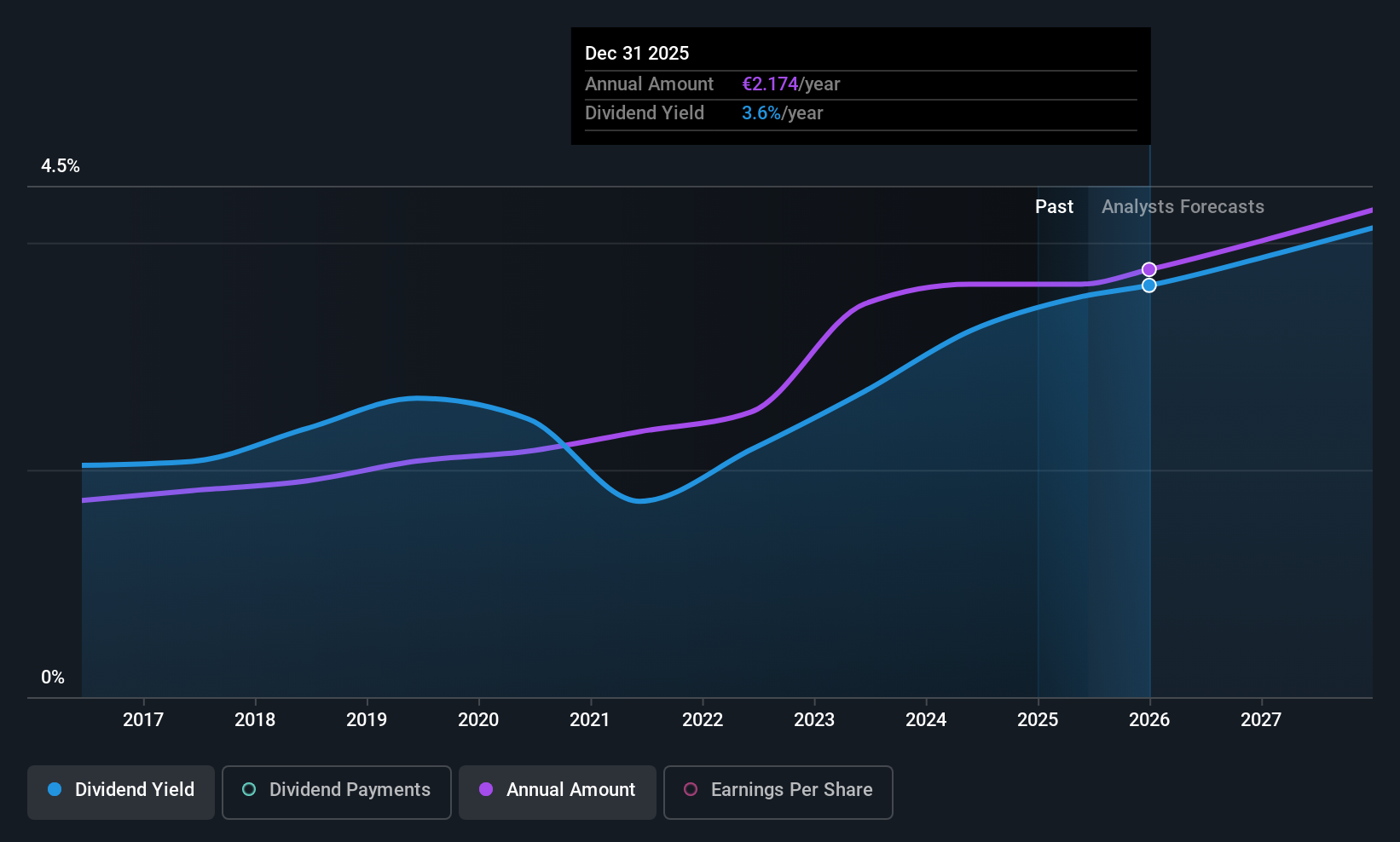

Brenntag (XTRA:BNR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Brenntag SE is involved in the distribution of chemicals and ingredients across various countries including Germany, the United States, and China, with a market cap of €7.63 billion.

Operations: Brenntag SE's revenue is derived from several segments, including Brenntag Essentials in North America (€5.00 billion), EMEA (€3.75 billion), APAC (€994.40 million), Latin America (€882.40 million), and Transregional (€301.40 million); as well as Brenntag Specialties in Life Science (€3.37 billion) and Material Science (€1.65 billion).

Dividend Yield: 4%

Brenntag SE's dividend yield of 3.97% is below the top quartile in Germany, but its dividends are well-covered by earnings and cash flows with payout ratios of 71.7% and 51.7%, respectively, ensuring sustainability. The company has maintained stable and reliable dividends over the past decade, with consistent growth in payouts. Despite a recent decline in earnings for Q2 2025 to €42.9 million from €149.1 million a year ago, dividends remain secure due to prudent financial management.

- Delve into the full analysis dividend report here for a deeper understanding of Brenntag.

- Our valuation report here indicates Brenntag may be undervalued.

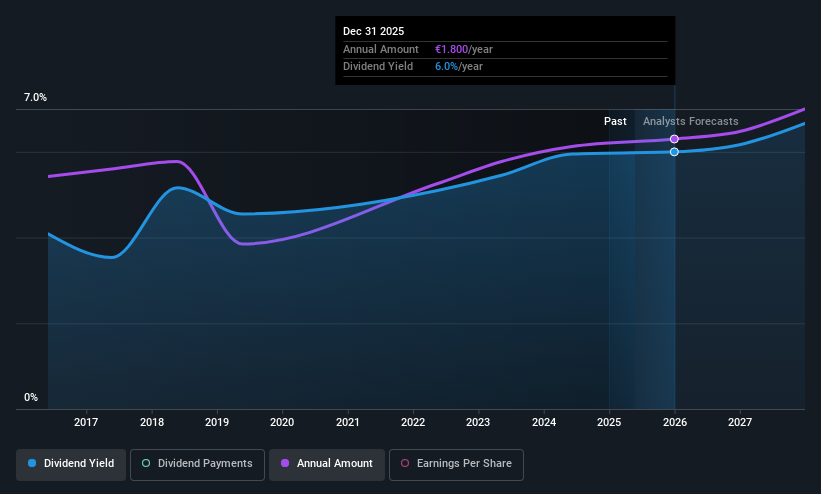

PWO (XTRA:PWO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PWO AG specializes in the development, production, and sale of metal components and systems for the mobility industry across Germany, Czechia, Canada, Mexico, Serbia, and China with a market cap of €92.50 million.

Operations: PWO AG generates revenue primarily from its Auto Parts & Accessories segment, amounting to €540.34 million.

Dividend Yield: 5.9%

PWO's dividend yield of 5.91% ranks in the top 25% of German market payers, with dividends well-covered by earnings and cash flows at payout ratios of 48.9% and 37.9%, respectively. However, its dividend history is unstable, marked by volatility over the past decade despite growth trends. Recent earnings guidance revision reflects a challenging market environment, but strategic expansion in Serbia aims to bolster future capacity and sustainability efforts might enhance long-term prospects for investors focused on climate-friendly operations.

- Click here to discover the nuances of PWO with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of PWO shares in the market.

Where To Now?

- Access the full spectrum of 224 Top European Dividend Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brenntag might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BNR

Brenntag

Engages in the distribution of chemicals and ingredients in Germany, the United States, the United Kingdom, China, Canada, Italy, Poland, France, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.