- France

- /

- Gas Utilities

- /

- ENXTPA:RUI

European Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

Amidst concerns over the independence of the U.S. Federal Reserve and geopolitical tensions, European markets have faced headwinds, with the pan-European STOXX Europe 600 Index ending 1.99% lower recently. In such a climate, dividend stocks can offer stability and income potential, making them an attractive option for investors looking to enhance their portfolios in uncertain times.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.38% | ★★★★★★ |

| Swiss Re (SWX:SREN) | 4.21% | ★★★★★☆ |

| Rubis (ENXTPA:RUI) | 7.08% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.76% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.12% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.06% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.69% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.74% | ★★★★★☆ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.68% | ★★★★★☆ |

| Afry (OM:AFRY) | 4.10% | ★★★★★☆ |

Click here to see the full list of 219 stocks from our Top European Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

ABN AMRO Bank (ENXTAM:ABN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ABN AMRO Bank N.V. offers a range of banking products and financial services to retail, private, and business clients across the Netherlands, Europe, the United States, Asia, and globally with a market cap of €20.84 billion.

Operations: ABN AMRO Bank's revenue is primarily derived from Personal & Business Banking (€4.01 billion), Corporate Banking (€3.16 billion), and Wealth Management (€1.55 billion).

Dividend Yield: 5.4%

ABN AMRO Bank's dividend payments are currently covered by earnings with a payout ratio of 50.2%, and this is expected to remain stable in three years at 50%. However, its dividend history has been volatile over the past decade, despite an overall increase. The bank recently announced a share repurchase program worth €250 million to reduce share capital. Earnings have declined slightly, impacting net interest income and net income compared to last year.

- Click here and access our complete dividend analysis report to understand the dynamics of ABN AMRO Bank.

- Our expertly prepared valuation report ABN AMRO Bank implies its share price may be lower than expected.

Rubis (ENXTPA:RUI)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Rubis operates bulk liquid storage facilities for commercial and industrial customers across Europe, Africa, and the Caribbean, with a market cap of €2.95 billion.

Operations: Rubis generates its revenue primarily from Energy Distribution (€6.59 billion) and Renewable Electricity Production (€49.15 million).

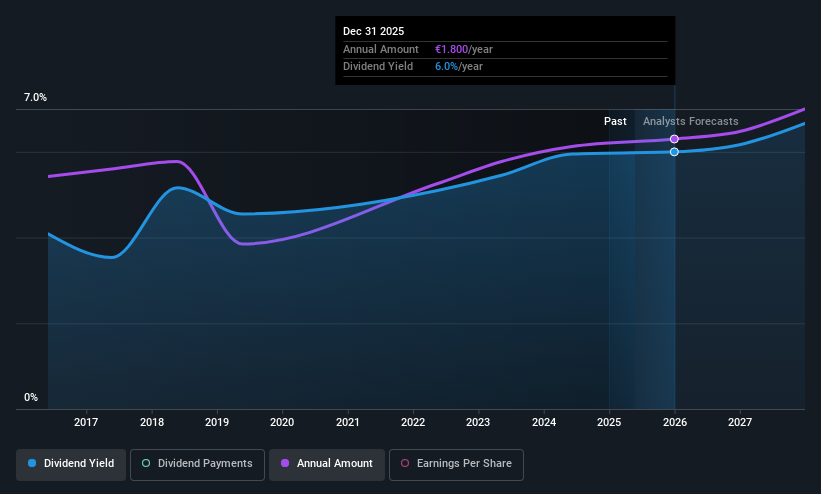

Dividend Yield: 7.1%

Rubis offers an attractive dividend yield of 7.08%, placing it among the top 25% in the French market. Its dividends have been stable and growing over the past decade, supported by a payout ratio of 61.4% and a cash payout ratio of 50%, indicating sustainability from both earnings and cash flows. While trading at a significant discount to its estimated fair value, concerns exist due to its high debt levels, which could impact financial flexibility.

- Get an in-depth perspective on Rubis' performance by reading our dividend report here.

- The analysis detailed in our Rubis valuation report hints at an deflated share price compared to its estimated value.

PWO (XTRA:PWO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PWO AG is engaged in the development, production, and sale of metal components and systems for the mobility industry across Germany, Czechia, Canada, Mexico, Serbia, and China with a market cap of €88.13 million.

Operations: PWO AG generates its revenue primarily from the Auto Parts & Accessories segment, which accounts for €540.34 million.

Dividend Yield: 6.2%

PWO's dividend yield of 6.21% ranks in the top 25% of German dividend payers, supported by a payout ratio of 48.9% and a cash payout ratio of 37.9%, suggesting strong coverage from earnings and cash flows. However, its dividends have been volatile over the past decade, raising sustainability concerns despite recent growth in earnings per share to €1.17 for Q2 2025. The company's strategic expansion in Serbia aims to bolster production capabilities amidst revised lower revenue guidance for fiscal year 2025.

- Unlock comprehensive insights into our analysis of PWO stock in this dividend report.

- Upon reviewing our latest valuation report, PWO's share price might be too pessimistic.

Make It Happen

- Gain an insight into the universe of 219 Top European Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:RUI

Rubis

Engages in the operation of bulk liquid storage facilities for commercial and industrial customers in Europe, Africa, and the Caribbean.

6 star dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives