- Germany

- /

- Auto Components

- /

- XTRA:PWO

Should You Think About Buying Progress-Werk Oberkirch AG (ETR:PWO) Now?

Progress-Werk Oberkirch AG (ETR:PWO), is not the largest company out there, but it received a lot of attention from a substantial price increase on the XTRA over the last few months. Less-covered, small caps tend to present more of an opportunity for mispricing due to the lack of information available to the public, which can be a good thing. So, could the stock still be trading at a low price relative to its actual value? Let’s examine Progress-Werk Oberkirch’s valuation and outlook in more detail to determine if there’s still a bargain opportunity.

View our latest analysis for Progress-Werk Oberkirch

What's the opportunity in Progress-Werk Oberkirch?

Good news, investors! Progress-Werk Oberkirch is still a bargain right now. According to my valuation, the intrinsic value for the stock is €31.67, which is above what the market is valuing the company at the moment. This indicates a potential opportunity to buy low. Although, there may be another chance to buy again in the future. This is because Progress-Werk Oberkirch’s beta (a measure of share price volatility) is high, meaning its price movements will be exaggerated relative to the rest of the market. If the market is bearish, the company's shares will likely fall by more than the rest of the market, providing a prime buying opportunity.

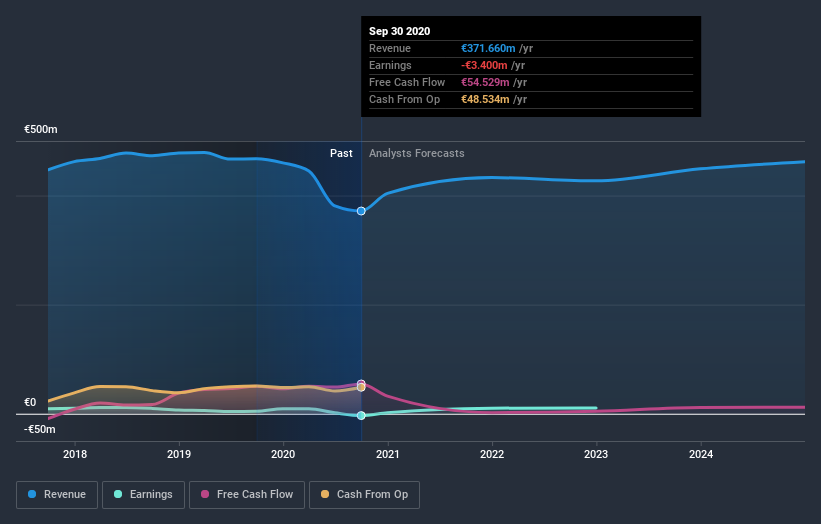

What kind of growth will Progress-Werk Oberkirch generate?

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Buying a great company with a robust outlook at a cheap price is always a good investment, so let’s also take a look at the company's future expectations. Progress-Werk Oberkirch's revenue growth are expected to be in the teens in the upcoming years, indicating a solid future ahead. Unless expenses grow at the same level, or higher, this top-line growth should lead to robust cash flows, feeding into a higher share value.

What this means for you:

Are you a shareholder? Since PWO is currently undervalued, it may be a great time to accumulate more of your holdings in the stock. With a positive outlook on the horizon, it seems like this growth has not yet been fully factored into the share price. However, there are also other factors such as capital structure to consider, which could explain the current undervaluation.

Are you a potential investor? If you’ve been keeping an eye on PWO for a while, now might be the time to enter the stock. Its prosperous future outlook isn’t fully reflected in the current share price yet, which means it’s not too late to buy PWO. But before you make any investment decisions, consider other factors such as the strength of its balance sheet, in order to make a well-informed buy.

So while earnings quality is important, it's equally important to consider the risks facing Progress-Werk Oberkirch at this point in time. For example, we've found that Progress-Werk Oberkirch has 2 warning signs (1 makes us a bit uncomfortable!) that deserve your attention before going any further with your analysis.

If you are no longer interested in Progress-Werk Oberkirch, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

When trading Progress-Werk Oberkirch or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About XTRA:PWO

PWO

Develops, produces, and sells metal components and systems for the mobility industry in Germany, Czechia, Canada, Mexico, Serbia, and China.

Established dividend payer and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion