Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that paragon GmbH & Co. KGaA (ETR:PGN) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

Check out the opportunities and risks within the DE Auto Components industry.

What Is paragon GmbH KGaA's Net Debt?

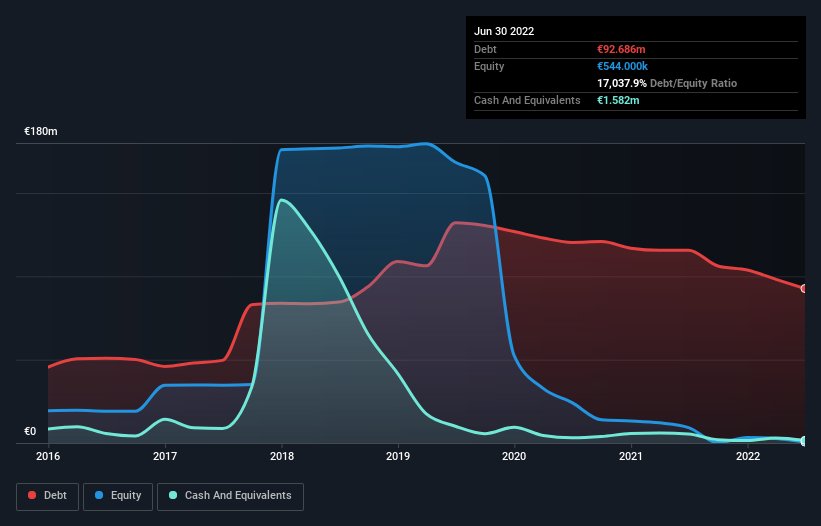

The image below, which you can click on for greater detail, shows that paragon GmbH KGaA had debt of €92.7m at the end of June 2022, a reduction from €115.7m over a year. And it doesn't have much cash, so its net debt is about the same.

How Healthy Is paragon GmbH KGaA's Balance Sheet?

According to the last reported balance sheet, paragon GmbH KGaA had liabilities of €87.1m due within 12 months, and liabilities of €72.6m due beyond 12 months. Offsetting these obligations, it had cash of €1.58m as well as receivables valued at €12.6m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by €145.5m.

This deficit casts a shadow over the €23.5m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, paragon GmbH KGaA would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

paragon GmbH KGaA shareholders face the double whammy of a high net debt to EBITDA ratio (24.4), and fairly weak interest coverage, since EBIT is just 1.6 times the interest expense. The debt burden here is substantial. Even worse, paragon GmbH KGaA saw its EBIT tank 22% over the last 12 months. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since paragon GmbH KGaA will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Looking at the most recent two years, paragon GmbH KGaA recorded free cash flow of 34% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

To be frank both paragon GmbH KGaA's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. Having said that, its ability to convert EBIT to free cash flow isn't such a worry. Considering all the factors previously mentioned, we think that paragon GmbH KGaA really is carrying too much debt. To us, that makes the stock rather risky, like walking through a dog park with your eyes closed. But some investors may feel differently. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example paragon GmbH KGaA has 3 warning signs (and 2 which are a bit unpleasant) we think you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:PGN

paragon GmbH KGaA

Develops, produces, and distributes automotive electronics, body kinematics, and e-mobility solutions for the automotive industry in Germany, European Union, and internationally.

Good value with imperfect balance sheet.

Market Insights

Community Narratives