Porsche (XTRA:PAH3) Valuation After First Quarterly Loss, Cost Cuts, EV Delays and DAX Exit

Reviewed by Simply Wall St

Porsche Automobil Holding (XTRA:PAH3) is back in the spotlight after its operating company shocked investors with a near €1 billion Q3 2025 loss, aggressive cost cuts, delayed EV launches, and a downgrade to slim 0–2% margin guidance.

See our latest analysis for Porsche Automobil Holding.

Despite those setbacks at the operating company level, Porsche Automobil Holding’s own shares have quietly rebounded, with a 14.87% 1 month share price return and 22.37% 1 year total shareholder return. This hints at stabilising sentiment rather than accelerating momentum.

If this kind of volatility has you comparing across the sector, it might be worth scanning auto manufacturers to spot other car makers whose stories and numbers are lining up more convincingly.

With sentiment shaken by Porsche’s operating turmoil, yet the holding company trading at a hefty intrinsic discount, investors now face a key question: is this a mispriced value opportunity, or is the market already baking in the recovery?

Price-to-Book of 0.3x: Is it justified?

On a price-to-book basis, Porsche Automobil Holding looks deeply discounted, with the last close of €40.47 implying a 0.3x multiple versus peers closer to 1x.

The price to book ratio compares the company’s market value to the book value of its net assets, which is particularly relevant for capital intensive auto groups and holding structures like PAH3. A 0.3x reading suggests the market is valuing its equity at a steep discount to the underlying balance sheet, despite expectations that earnings will swing back into positive territory over the next few years.

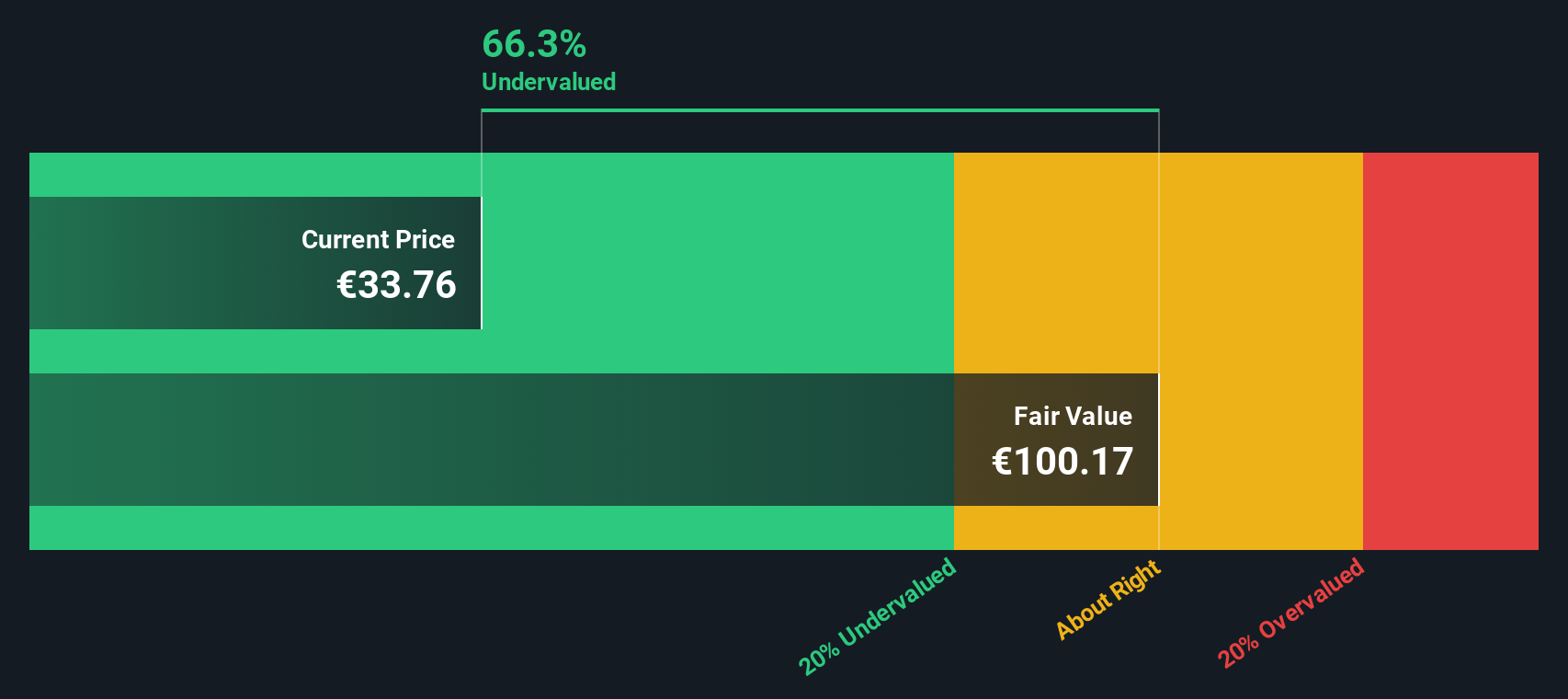

That discount stands out even more when set alongside both the European auto industry average of around 1x and our SWS DCF model, which points to a fair value near €114.47, implying the shares trade roughly 64.6% below intrinsic value. With forecast earnings growth above the broader market and a return to profitability anticipated within three years, the current multiple signals that investors are still heavily discounting the recovery narrative.

In other words, PAH3’s 0.3x price to book multiple sits far below both its immediate peer group at 0.9x and the broader European auto industry at 1x. This underscores how pessimistic current pricing is compared to sector norms.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 0.3x (UNDERVALUED)

However, lingering losses and only modest upside to current analyst targets could signal a value trap if operational recovery at key holdings stalls again.

Find out about the key risks to this Porsche Automobil Holding narrative.

Another View: DCF Still Sees More Upside

While the 0.3x price to book ratio flags deep value versus peers, our DCF model leans in the same direction, suggesting fair value around €114.47, well above today’s €40.47. If both lenses agree on undervaluation, is sentiment the only thing holding the shares back?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Porsche Automobil Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Porsche Automobil Holding Narrative

If you would rather interrogate the numbers yourself and challenge this view, you can quickly build a personalised perspective in just minutes: Do it your way.

A great starting point for your Porsche Automobil Holding research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at one opportunity when the market is offering many more. Use the Simply Wall Street Screener to uncover fresh ideas tailored to your strategy.

- Capture potential mispricings by targeting these 906 undervalued stocks based on cash flows that the market may be overlooking despite strong underlying cash flows.

- Ride powerful technology shifts by focusing on these 26 AI penny stocks positioned to benefit from accelerating demand for intelligent automation.

- Strengthen your income stream by scanning these 15 dividend stocks with yields > 3% that can boost returns while markets remain uncertain.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:PAH3

Porsche Automobil Holding

Through its subsidiaries, operates as an automobile manufacturer worldwide.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026