Why Mercedes-Benz Group (XTRA:MBG) Is Up 5.8% After New €2 Billion Buyback And 7%+ Yield

Reviewed by Sasha Jovanovic

- Earlier this week, Mercedes-Benz Group AG announced a new €2.00 billion share buyback program while keeping its dividend yield above 7%, reiterating its 2025 financial guidance despite softer earnings.

- The company emphasized its 'Mastering Transformation' plan, highlighting AI-enabled manufacturing, a large upcoming premium model wave, and cost-efficiency efforts as levers to support profitability amid China weakness, tariffs, and the demanding shift to electric vehicles.

- We’ll now examine how the fresh €2.00 billion buyback commitment might influence Mercedes-Benz’s investment narrative and perceived capital strength.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Mercedes-Benz Group Investment Narrative Recap

To own Mercedes-Benz Group, you need to believe it can keep earning solid cash returns from premium combustion and hybrid models while managing an expensive shift to EVs and software. The new €2.00 billion buyback underlines capital return strength, but does not materially change the near term picture where softer earnings and China exposure remain the key swing factor and biggest operational risk.

Among recent moves, the proposed €4.30 per share dividend for 2024, down from €5.30, is highly relevant beside the fresh buyback. Together, they show Mercedes-Benz leaning on a mix of cash dividends and repurchases to reward shareholders while 2025 guidance points to revenue slightly below last year and EBIT significantly lower, keeping execution on cost efficiency and product mix firmly in focus.

Yet while headline yields and buybacks may appeal, investors also need to be aware of the mounting electrification and restructuring spend that...

Read the full narrative on Mercedes-Benz Group (it's free!)

Mercedes-Benz Group's narrative projects €146.0 billion revenue and €8.5 billion earnings by 2028. This requires 1.6% yearly revenue growth and about a €1.7 billion earnings increase from €6.8 billion today.

Uncover how Mercedes-Benz Group's forecasts yield a €61.55 fair value, in line with its current price.

Exploring Other Perspectives

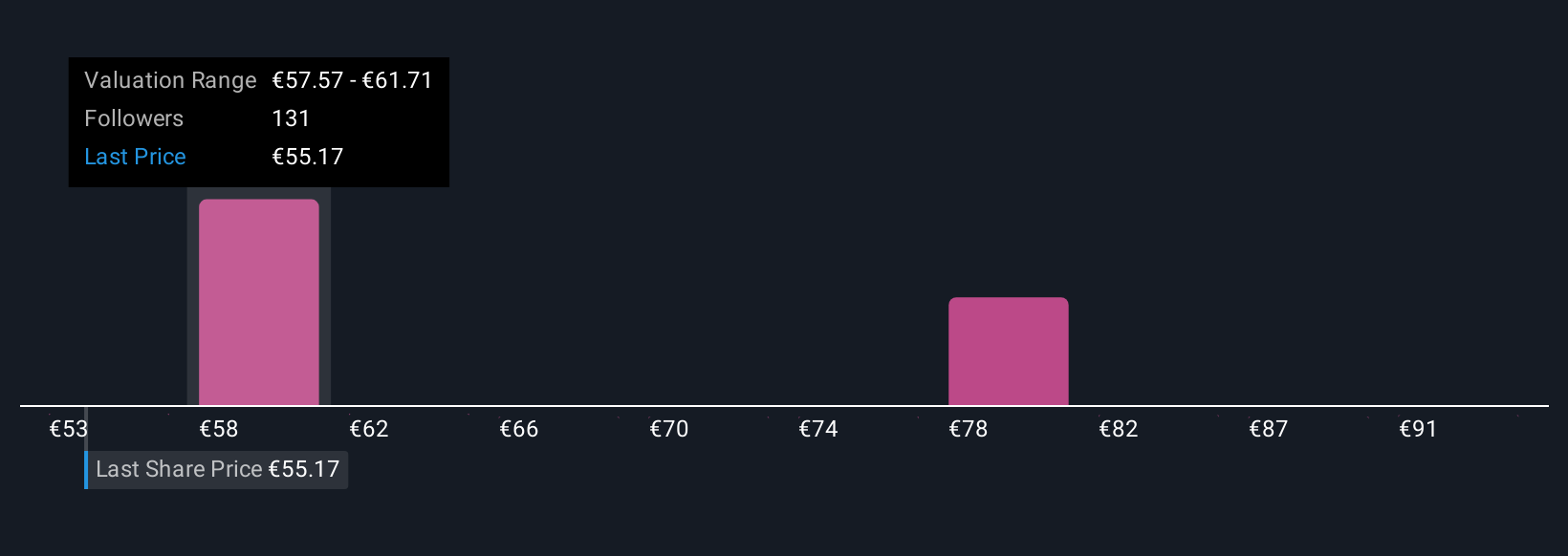

Eight members of the Simply Wall St Community value Mercedes-Benz between €53.42 and €77.74, underscoring how far opinions can differ. As you weigh those views, the pressure from weaker China sales and guided lower 2025 earnings sits front and center for the company’s ability to sustain its current level of capital returns.

Explore 8 other fair value estimates on Mercedes-Benz Group - why the stock might be worth as much as 26% more than the current price!

Build Your Own Mercedes-Benz Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mercedes-Benz Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Mercedes-Benz Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mercedes-Benz Group's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MBG

Mercedes-Benz Group

Operates as an automotive company in Germany and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026