Is Mercedes-Benz Group Fairly Priced After Recent Gains and EV Strategy Headlines in 2025?

Reviewed by Bailey Pemberton

If you’re standing at the crossroads, trying to decide what to do with Mercedes-Benz Group stock, you're not alone. Over the past few years, this iconic automaker has revved up some impressive long-term gains while teasing investors with its recent price moves. Just this month, shares have edged up by 1.1%, accelerating to 4.3% over the past 30 days. While the one-year performance sits flat at 0.0%, those who’ve been in the driver’s seat for the past five years are sitting on a remarkable 99.0% gain.

So, what’s behind these numbers? Recent optimism in the European auto market and Mercedes-Benz’s focus on high-end electric vehicles have been in the headlines. The company’s strategy to double down on luxury EVs, alongside positive sentiment about future emissions targets, has nudged risk perception and growth potential in interesting directions. These headlines have certainly played a role in shaping investor mindset, fueling speculation about where the stock might go next.

Valuation-wise, Mercedes-Benz Group currently boasts a value score of 5 out of 6, indicating it checks the box for undervaluation in nearly every major metric we look at. But how meaningful is that score, really, and what does it say about the investment case moving forward?

Let’s dive into the main valuation approaches investors rely on to size up this stock. Stay tuned, because at the end, I’ll share a perspective that could help you see the company’s valuation in an entirely new light.

Approach 1: Mercedes-Benz Group Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting them back to today's value, capturing what those future earnings are really worth right now. For Mercedes-Benz Group, the DCF uses a “2 Stage Free Cash Flow to Equity” framework to consider both analyst forecasts and longer-term model estimates.

Currently, Mercedes-Benz is generating €13.26 billion of Free Cash Flow (FCF). Looking ahead, analysts project FCF to be €6.34 billion by 2029, with annual figures moving from €4.51 billion in 2026 up to €8.07 billion by 2035. Estimates for the years beyond the initial five-year range are extrapolated, but this long-term view helps anchor the company’s value to its core cash-generating ability.

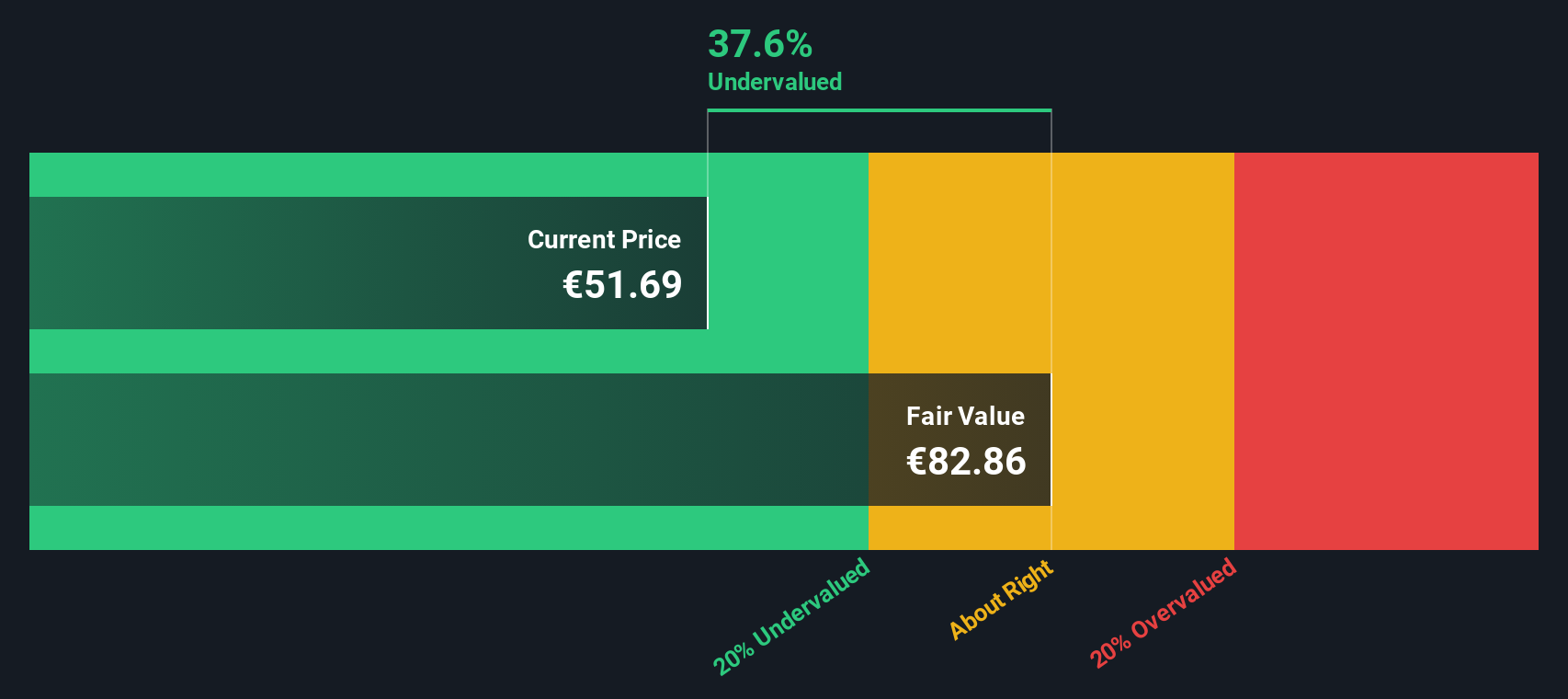

Using these projections, the DCF model arrives at an intrinsic fair value of €81.19 per share. Compared to the market price, this suggests the stock is 34.8% undervalued. This could indicate a possible margin of safety for investors considering entry at current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Mercedes-Benz Group is undervalued by 34.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Mercedes-Benz Group Price vs Earnings

The Price-to-Earnings (PE) ratio is a time-tested tool for valuing established, profitable companies such as Mercedes-Benz Group. It reflects how much investors are willing to pay for each euro of current earnings, which makes it especially relevant when the business generates steady profits and has a transparent growth outlook.

A fair or “normal” PE ratio is not fixed; it shifts based on expectations for future growth or potential risks. Companies seen as having strong growth prospects or more stable cash flows generally command higher PE ratios, while those with greater risk or sluggish outlooks tend to trade at lower multiples.

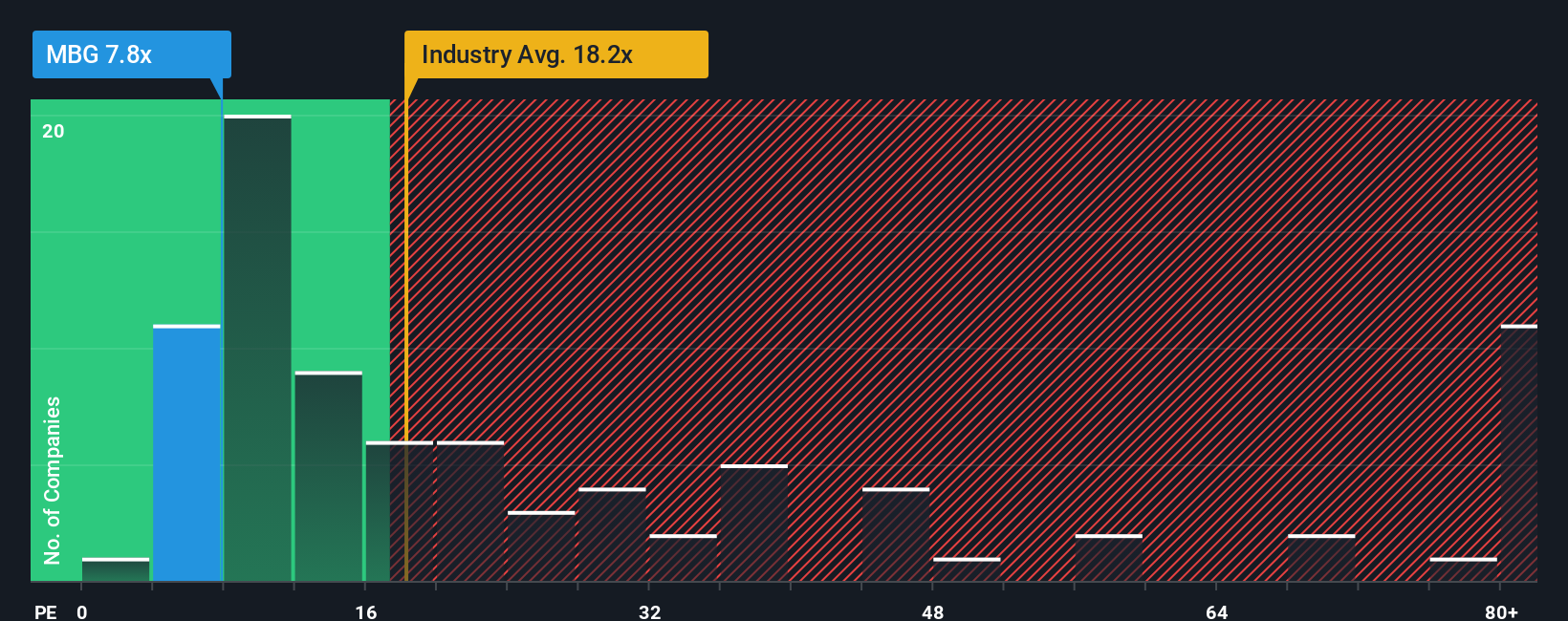

Mercedes-Benz Group currently trades at a PE ratio of 7.5x. For context, the industry average PE in the Auto sector is much higher at 18.3x, while listed peers average around 11.0x. At first glance, this suggests Mercedes-Benz may be undervalued compared to its competitors.

However, Simply Wall St’s “Fair Ratio” adds a deeper layer to the story. This proprietary benchmark blends in growth expectations, earnings quality, company size, profit margins, and sector-specific risk. Its aim is to estimate what a reasonable valuation should be for this specific business, rather than relying solely on a generic industry figure. This holistic approach often provides a more accurate picture than broad industry comparisons or peer averages.

In this case, Mercedes-Benz Group’s fair PE ratio is calculated at 10.5x, just slightly above where its shares are currently trading. That small gap signals that, based on all the relevant fundamentals, Mercedes-Benz Group stock appears about right from a PE perspective.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Mercedes-Benz Group Narrative

Earlier, we mentioned that there’s an even better way to understand valuation, so let's introduce you to Narratives. A Narrative combines your story or perspective on a company, what you believe about its future, with your assumptions for key numbers like future revenue, earnings, and margins. With Narratives, you’re not just looking at historical data or static ratios, but connecting the company’s journey to your own financial forecast and fair value.

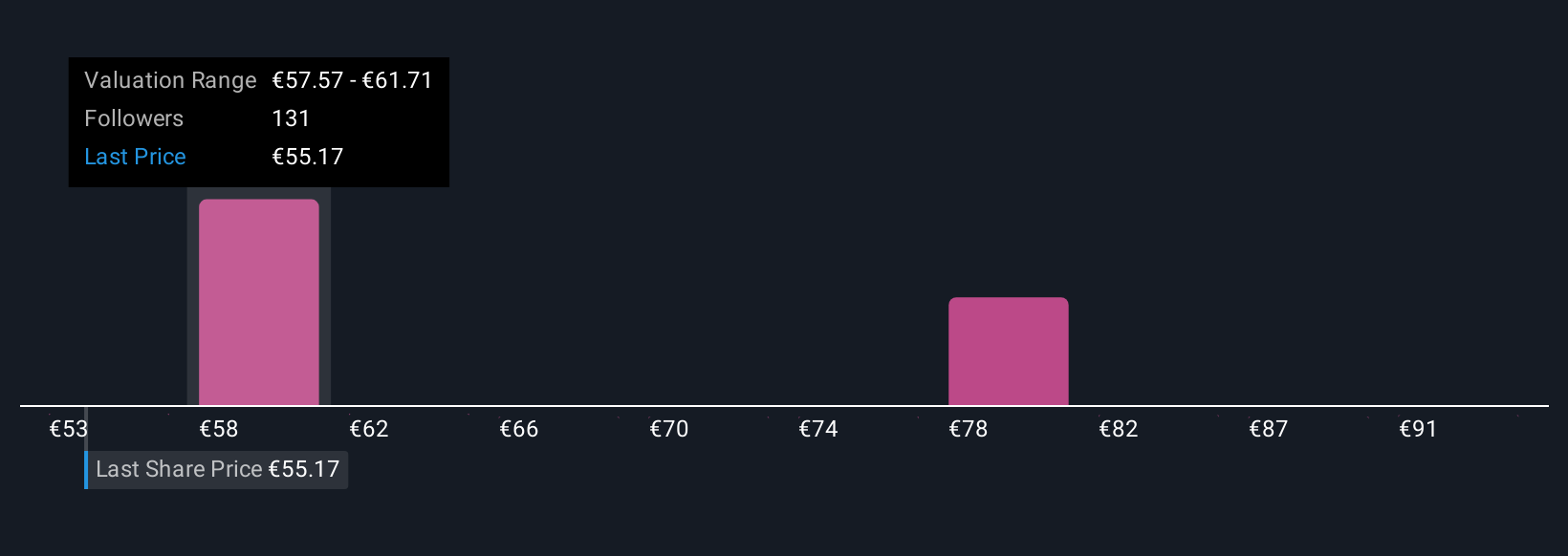

Using Simply Wall St’s Narratives on the Community page, millions of investors can build or explore these dynamic forecasts for Mercedes-Benz Group, making investing more accessible and personalized than ever. Narratives help you decide when to buy or sell by showing if your estimated Fair Value is above or below the current share price, and they refresh automatically when new news or earnings arrive.

For example, among current Mercedes-Benz Group Narratives, one investor may be bullish, focusing on growth from electrification and digital platforms, arriving at a fair value of €83.0 per share, while another could be more cautious about China demand and industry headwinds, targeting just €40.0. Narratives put you in control, allowing you to invest with a story that matches your own convictions.

Do you think there's more to the story for Mercedes-Benz Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MBG

Mercedes-Benz Group

Operates as an automotive company in Germany and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives