- Switzerland

- /

- Consumer Durables

- /

- SWX:VZUG

Discovering January 2025's Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As we step into 2025, global markets are navigating a complex landscape marked by mixed performances in major stock indices and fluctuating economic indicators. Despite the recent downturns in manufacturing activity and revised GDP forecasts, the U.S. equity market has shown resilience with significant gains over the past two years, while European and Asian markets face their own sets of challenges and opportunities. In this dynamic environment, identifying promising stocks requires a keen eye for companies that can leverage current market conditions—such as those with strong fundamentals or innovative strategies—to potentially thrive amidst economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Suraj | 37.84% | 15.84% | 63.29% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Philip Morris CR (SEP:TABAK)

Simply Wall St Value Rating: ★★★★★★

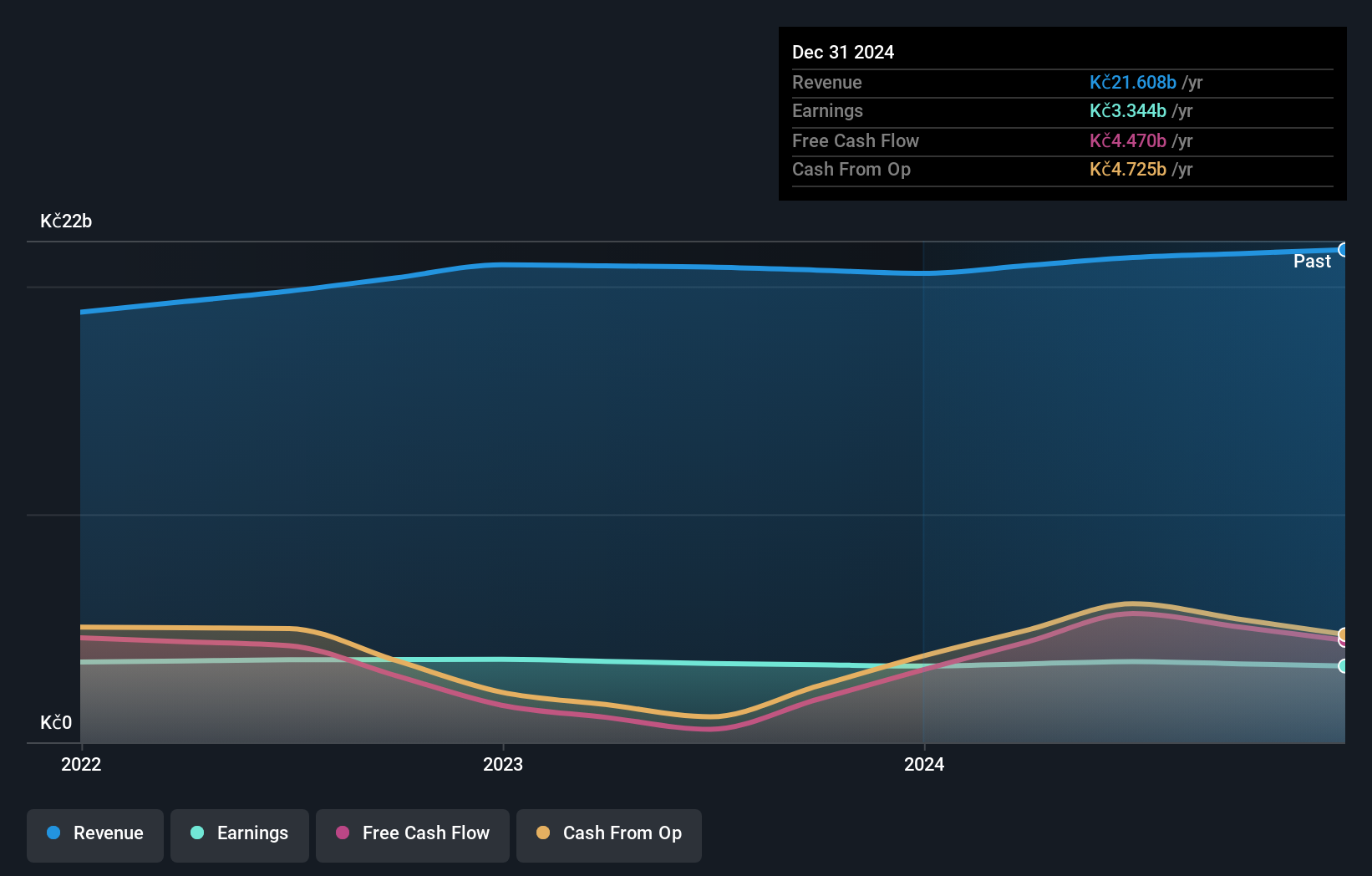

Overview: Philip Morris CR a.s., with a market cap of CZK46.18 billion, operates through its subsidiary Philip Morris Slovakia s.r.o. to manufacture and market tobacco products under brands such as Marlboro, L&M, Chesterfield, Petra Klasik, and Sparta in the Czech Republic and Slovak Republic.

Operations: The company generates revenue primarily from the distribution of tobacco products, with CZK14.69 billion from the Czech Republic and CZK6.16 billion from the Slovak Republic. It also earns CZK2.78 billion through manufacturing services.

Philip Morris CR, a tobacco company, seems undervalued as it trades at 73.7% below its estimated fair value. Despite earnings growing by 2.4% over the past year, they lag behind the broader tobacco industry growth of 7.3%. Over the last five years, earnings have decreased by about 3% annually. On a positive note, Philip Morris CR has no debt now compared to a minimal debt-to-equity ratio of 0.01% five years ago and maintains positive free cash flow with high-quality past earnings. These factors suggest potential for value realization if industry conditions improve or management strategies shift favorably.

- Unlock comprehensive insights into our analysis of Philip Morris CR stock in this health report.

Evaluate Philip Morris CR's historical performance by accessing our past performance report.

Innovita Biological Technology (SHSE:688253)

Simply Wall St Value Rating: ★★★★★★

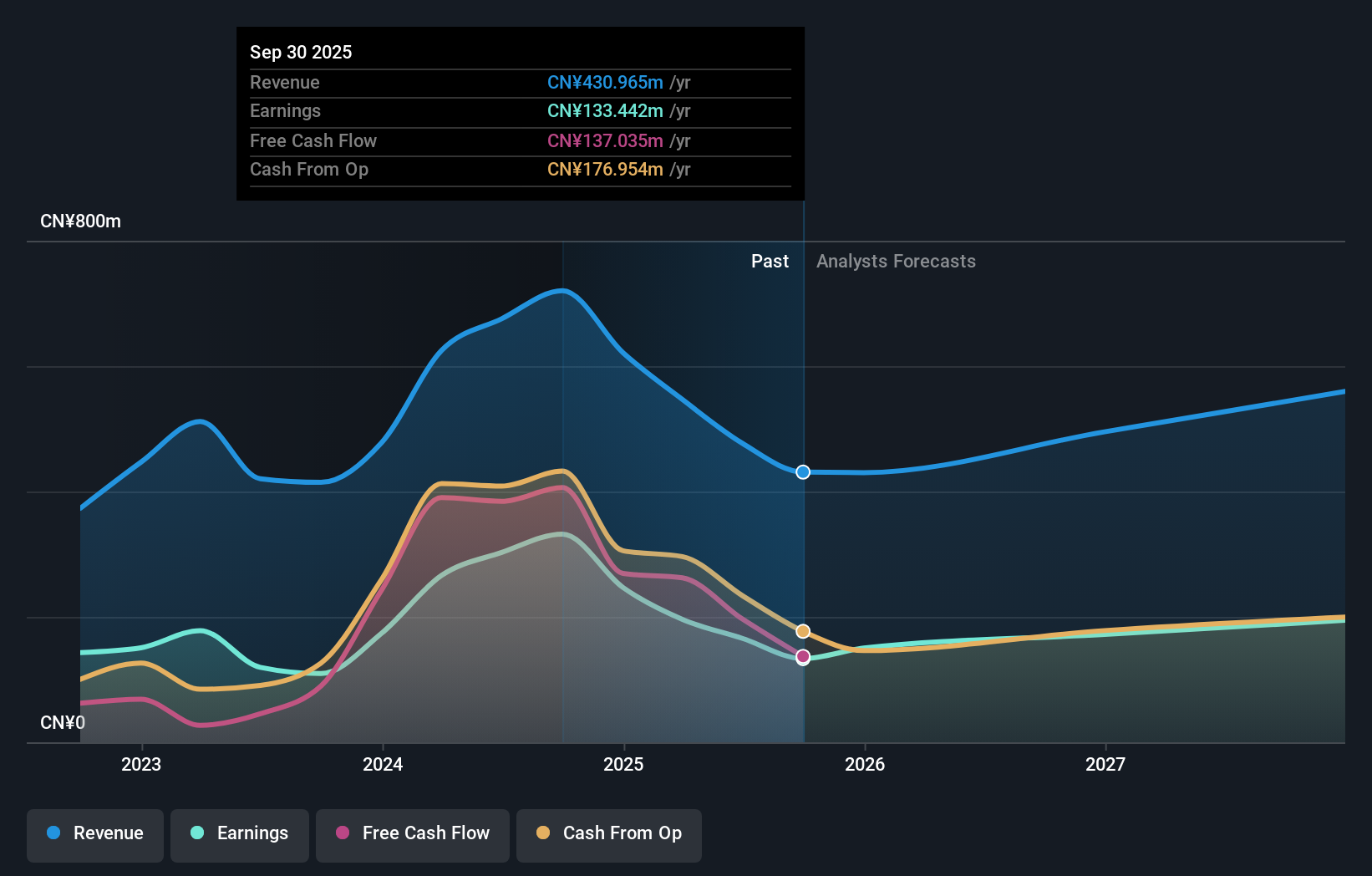

Overview: Innovita Biological Technology Co., Ltd. specializes in the research, development, manufacturing, marketing, and sales of POCT rapid diagnostic products with a market capitalization of approximately CN¥4.89 billion.

Operations: Innovita generates revenue primarily from its diagnostic kits and equipment, amounting to CN¥720.40 million. The company has a market capitalization of approximately CN¥4.89 billion.

Innovita Biological Technology, a nimble player in the medical equipment space, has shown impressive earnings growth of 203% over the past year, outpacing its industry significantly. Trading at 86% below its estimated fair value, it presents a compelling valuation story. The company is debt-free and has repurchased 1.16 million shares for CNY 49.08 million recently, indicating confidence in its future prospects. For the nine months ended September 2024, Innovita reported net income of CNY 244.61 million compared to CNY 86.54 million a year ago, with basic earnings per share rising to CNY 1.8 from CNY 0.64 previously.

V-ZUG Holding (SWX:VZUG)

Simply Wall St Value Rating: ★★★★★★

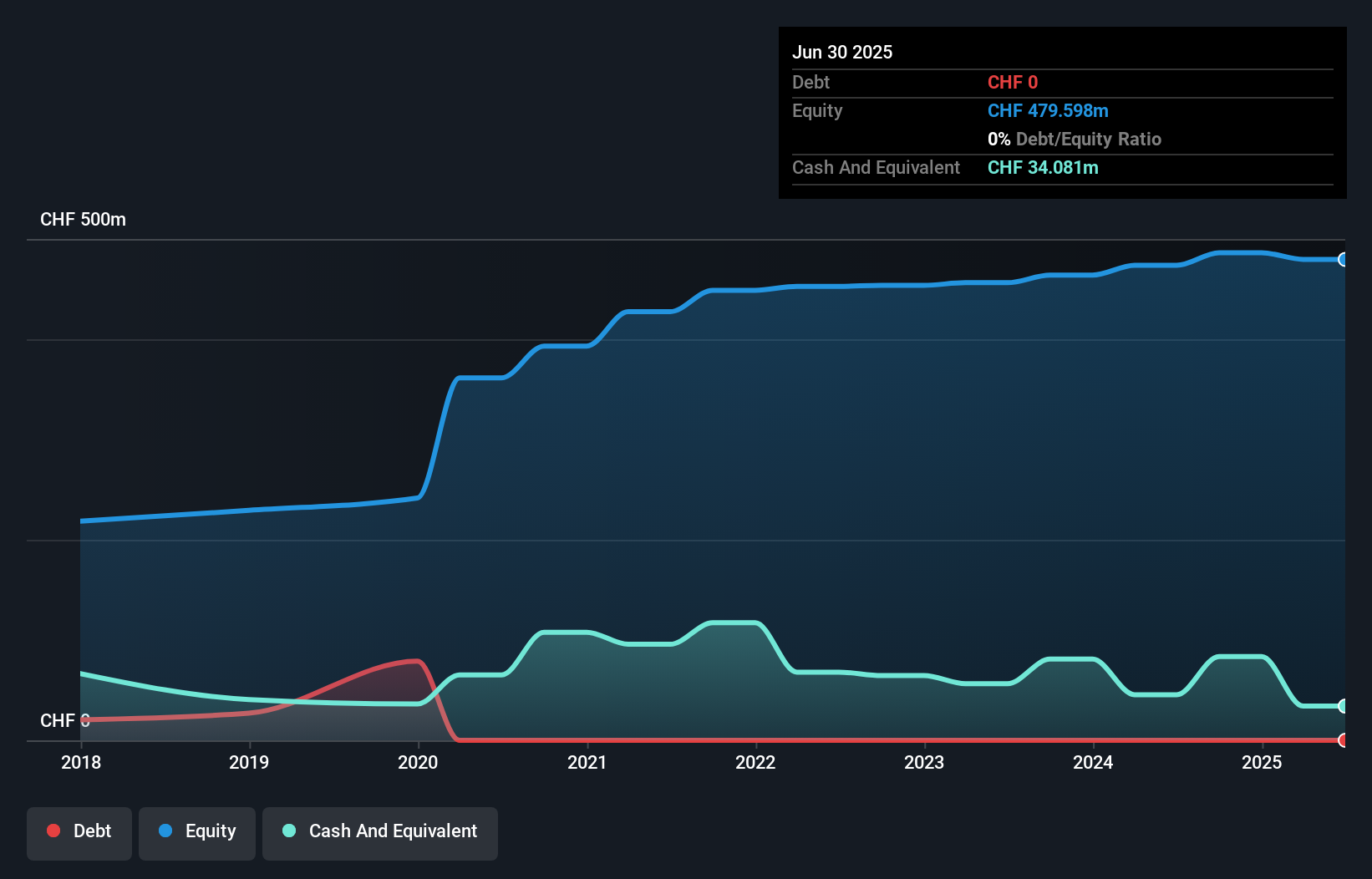

Overview: V-ZUG Holding AG is involved in the development, manufacture, marketing, sale, and servicing of kitchen and laundry appliances for private households both in Switzerland and internationally, with a market capitalization of CHF302.79 million.

Operations: V-ZUG derives its revenue primarily from the Household Appliances segment, generating CHF571.35 million. The company focuses on kitchen and laundry appliances for private households in Switzerland and internationally.

V-ZUG Holding, a notable player in the Consumer Durables sector, has shown impressive performance with earnings growth of 89.2% over the past year, outpacing the industry average of -4.7%. The company is debt-free, which eliminates concerns about interest coverage and positions it well for future financial flexibility. Despite trading at 63.5% below our estimated fair value, V-ZUG's high-quality earnings and recent guidance suggest improved profitability and net sales for 2024 compared to 2023. With a strategic leadership transition planned as Peter Spirig steps down and Christoph Kilian takes over as CEO in April 2025, V-ZUG aims to drive profitable growth both domestically and internationally under Kilian’s experienced leadership.

- Navigate through the intricacies of V-ZUG Holding with our comprehensive health report here.

Examine V-ZUG Holding's past performance report to understand how it has performed in the past.

Taking Advantage

- Click this link to deep-dive into the 4654 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:VZUG

V-ZUG Holding

Engages in development, manufacture, marketing, sale, and services of kitchen and laundry appliances for private households in Switzerland and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives