- Germany

- /

- Life Sciences

- /

- XTRA:EVT

European Stocks Estimated Below Intrinsic Value In May 2025

Reviewed by Simply Wall St

As European markets continue to navigate the complexities of global trade tensions, with the pan-European STOXX Europe 600 Index rising for a fourth consecutive week, investors are keenly observing opportunities that may arise from shifting economic policies and central bank decisions. Amid these developments, identifying stocks that are potentially undervalued can be particularly appealing, as they may offer intrinsic value not yet fully recognized by the market.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Maire (BIT:MAIRE) | €10.05 | €19.61 | 48.7% |

| Qt Group Oyj (HLSE:QTCOM) | €57.10 | €110.13 | 48.2% |

| ILPRA (BIT:ILP) | €4.60 | €8.86 | 48.1% |

| SNGN Romgaz (BVB:SNG) | RON5.70 | RON11.14 | 48.8% |

| Rheinmetall (XTRA:RHM) | €1694.00 | €3261.00 | 48.1% |

| BAWAG Group (WBAG:BG) | €99.75 | €192.24 | 48.1% |

| Boreo Oyj (HLSE:BOREO) | €15.90 | €31.46 | 49.5% |

| dormakaba Holding (SWX:DOKA) | CHF716.00 | CHF1400.80 | 48.9% |

| About You Holding (DB:YOU) | €6.70 | €12.98 | 48.4% |

| Expert.ai (BIT:EXAI) | €1.342 | €2.60 | 48.3% |

We'll examine a selection from our screener results.

Colt CZ Group (SEP:CZG)

Overview: Colt CZ Group SE, along with its subsidiaries, is involved in the production and sale of firearms, ammunition products, and tactical accessories across multiple regions including the Czech Republic, Canada, the United States, Europe, Africa, Asia and other international markets; it has a market cap of approximately CZK38.85 billion.

Operations: The company's revenue is primarily derived from firearms and accessories, generating CZK15.73 billion, and ammunition products, contributing CZK7.23 billion.

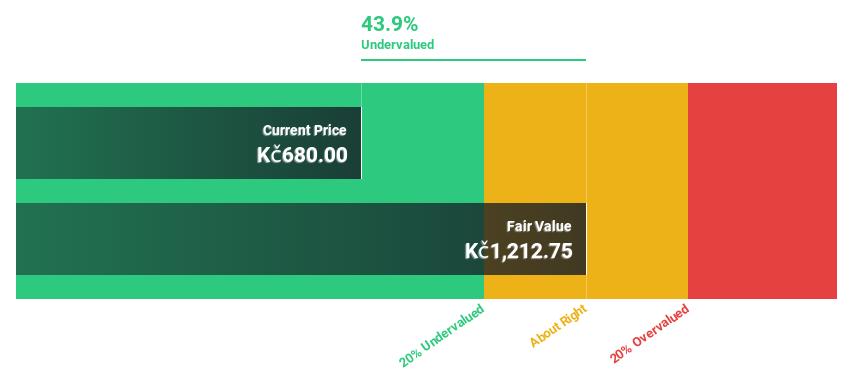

Estimated Discount To Fair Value: 33.9%

Colt CZ Group is trading 33.9% below its estimated fair value of CZK 1,040.12, with a current price of CZK 688, indicating significant undervaluation based on discounted cash flows. Despite recent earnings decline and shareholder dilution, the company is expected to achieve substantial annual profit growth of 54.6%, outpacing the Czech market's average growth rate. However, its debt coverage by operating cash flow remains inadequate while profit margins have decreased from last year.

- Upon reviewing our latest growth report, Colt CZ Group's projected financial performance appears quite optimistic.

- Dive into the specifics of Colt CZ Group here with our thorough financial health report.

Archicom (WSE:ARH)

Overview: Archicom S.A. operates in the real estate sector in Poland with a market capitalization of PLN2.57 billion.

Operations: The company's revenue segments include Supporting Companies at PLN263.44 million and Unclassified Activities in various cities: Lodz with PLN6.44 million, Cracow at PLN93.85 million, Poznan contributing PLN30.00 million, Warsaw with PLN99.31 million, and Wroclaw generating PLN472.76 million.

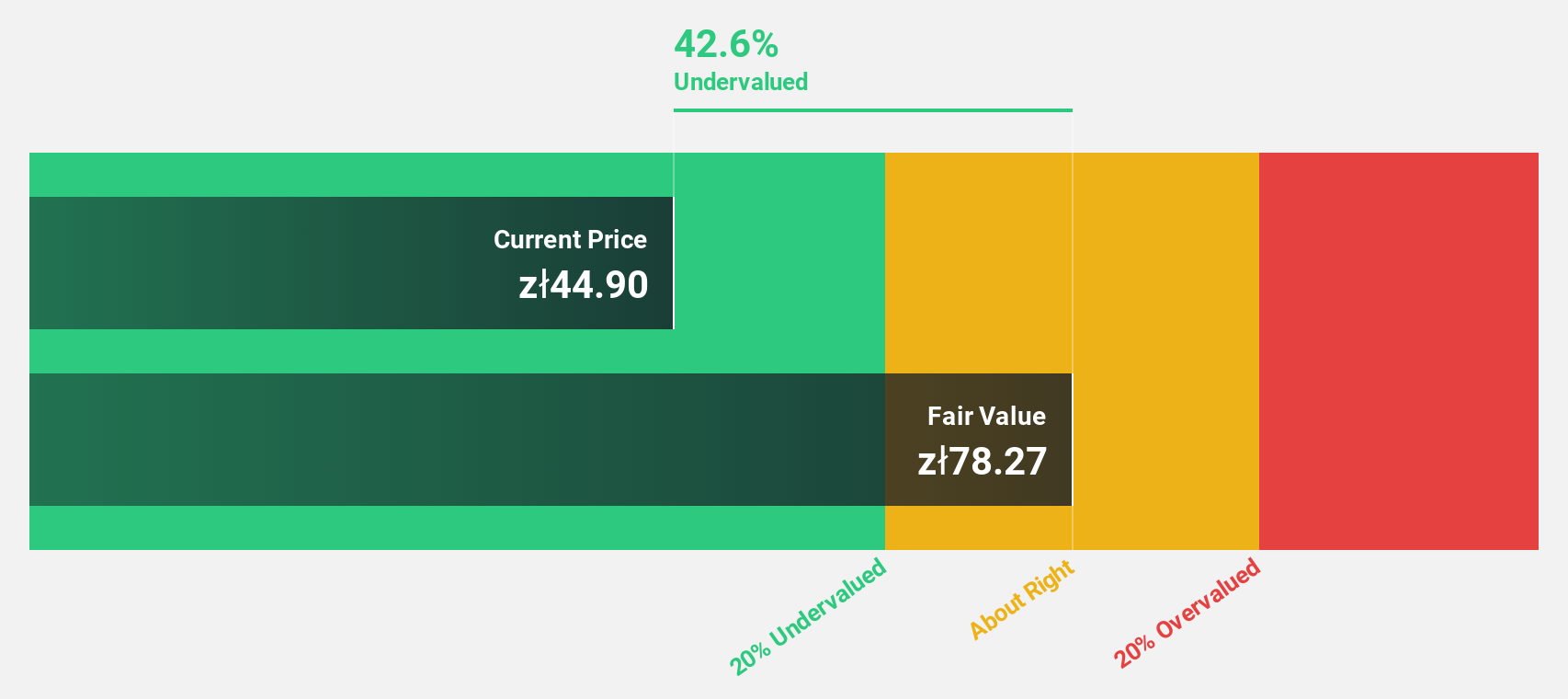

Estimated Discount To Fair Value: 27.8%

Archicom is trading 27.8% below its estimated fair value of PLN 60.84, with a current price of PLN 43.9, highlighting significant undervaluation based on discounted cash flows. Despite a revenue drop to PLN 742.03 million and net income decline to PLN 107.24 million in the last fiscal year, earnings are projected to grow significantly at 43.3% annually over the next three years, surpassing Polish market averages while facing challenges in debt coverage by operating cash flow and dividend sustainability.

- In light of our recent growth report, it seems possible that Archicom's financial performance will exceed current levels.

- Click here to discover the nuances of Archicom with our detailed financial health report.

Evotec (XTRA:EVT)

Overview: Evotec SE is a global drug discovery and development partner for the pharmaceutical and biotechnology industry, with a market cap of approximately €1.36 billion.

Operations: Evotec generates revenue from its Shared R&D segment, which contributes €596.96 million, and the Just - Evotec Biologics segment, which adds €192.47 million.

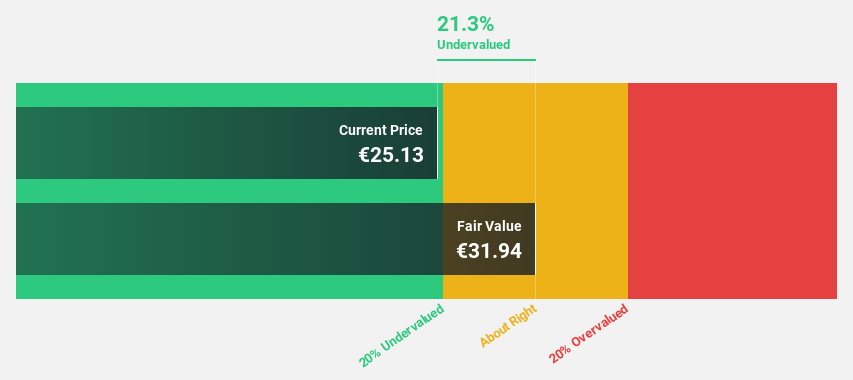

Estimated Discount To Fair Value: 32.2%

Evotec is trading at €7.65, significantly below its estimated fair value of €11.3, indicating undervaluation based on discounted cash flows. Despite a volatile share price and recent net losses, the company forecasts revenue growth of 9.9% annually, outpacing the German market average. Strategic partnerships with Peptone and Bristol Myers Squibb enhance its drug discovery capabilities, potentially supporting future profitability as it aims to become profitable within three years.

- Insights from our recent growth report point to a promising forecast for Evotec's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Evotec.

Make It Happen

- Click this link to deep-dive into the 171 companies within our Undervalued European Stocks Based On Cash Flows screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evotec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:EVT

Evotec

Operates as a drug discovery and development company in the United States, Germany, France, the United Kingdom, Switzerland, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives