Minerva Insurance Company Public Ltd (CSE:MINE) Stock Rockets 30% But Many Are Still Ignoring The Company

Those holding Minerva Insurance Company Public Ltd (CSE:MINE) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 32% over that time.

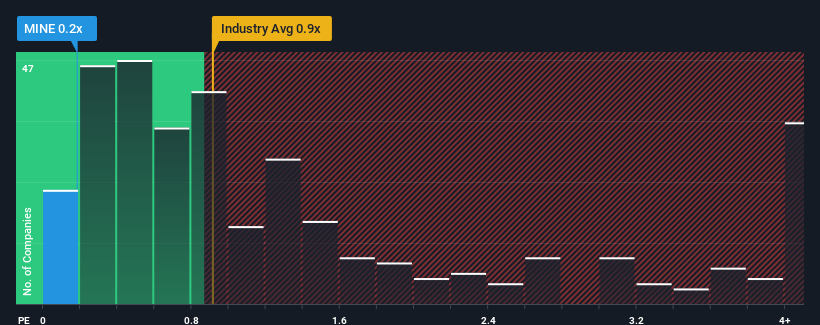

Even after such a large jump in price, when close to half the companies operating in Cyprus' Insurance industry have price-to-sales ratios (or "P/S") above 0.9x, you may still consider Minerva Insurance Company as an enticing stock to check out with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Minerva Insurance Company

What Does Minerva Insurance Company's Recent Performance Look Like?

Minerva Insurance Company certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. Those who are bullish on Minerva Insurance Company will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Minerva Insurance Company will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Minerva Insurance Company's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 42% last year. The strong recent performance means it was also able to grow revenue by 55% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is predicted to deliver 16% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this in consideration, we find it intriguing that Minerva Insurance Company's P/S falls short of its industry peers. It may be that most investors are not convinced the company can maintain recent growth rates.

The Final Word

Despite Minerva Insurance Company's share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Minerva Insurance Company revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. revenue trends suggest that the risk of a price decline is low, investors appear to perceive a possibility of revenue volatility in the future.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Minerva Insurance Company that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CSE:MINE

Minerva Insurance Company

Engages in the general insurance business in Cyprus.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives