- Cyprus

- /

- Hospitality

- /

- CSE:LCH

Leptos Calypso Hotels Public Limited's (CSE:LCH) Shares Leap 33% Yet They're Still Not Telling The Full Story

Despite an already strong run, Leptos Calypso Hotels Public Limited (CSE:LCH) shares have been powering on, with a gain of 33% in the last thirty days. The annual gain comes to 140% following the latest surge, making investors sit up and take notice.

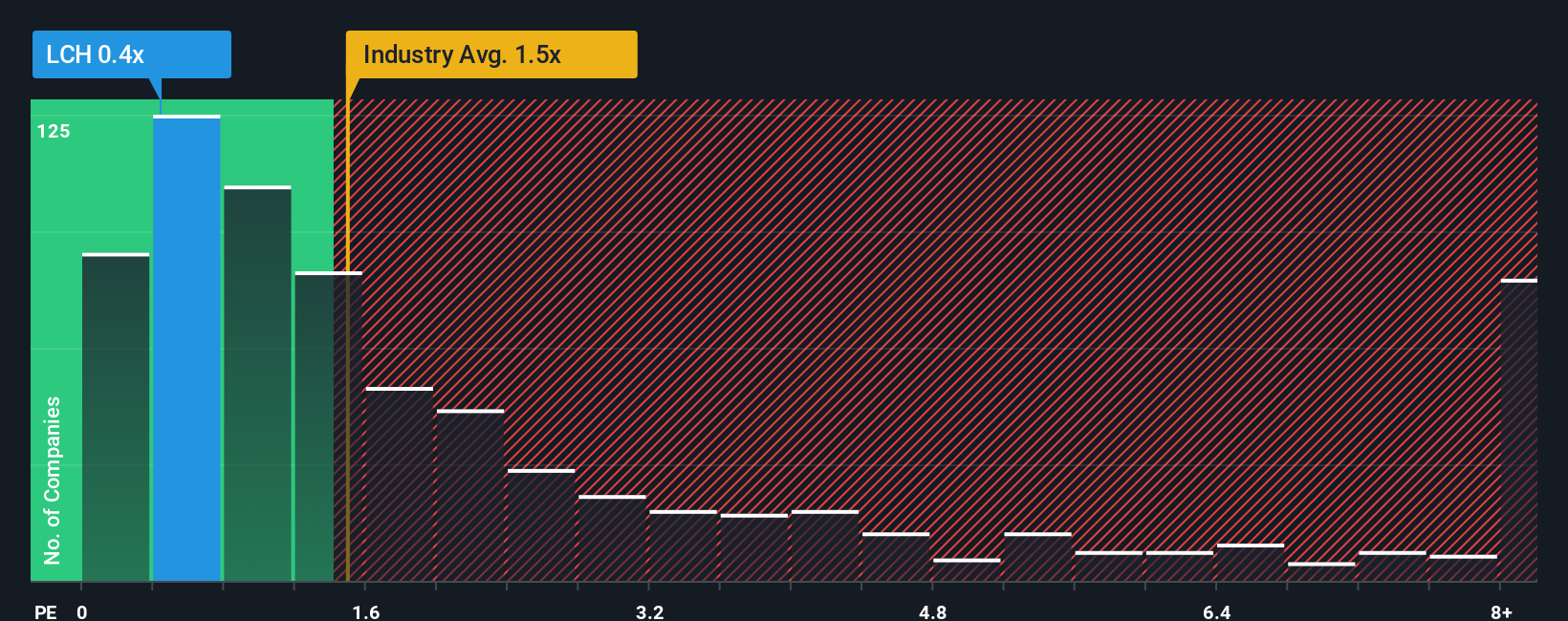

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Leptos Calypso Hotels' P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Hospitality industry in Cyprus is about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Leptos Calypso Hotels

What Does Leptos Calypso Hotels' P/S Mean For Shareholders?

Revenue has risen firmly for Leptos Calypso Hotels recently, which is pleasing to see. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Leptos Calypso Hotels' earnings, revenue and cash flow.How Is Leptos Calypso Hotels' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Leptos Calypso Hotels' is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 24% last year. Pleasingly, revenue has also lifted 214% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 16% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Leptos Calypso Hotels' P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Leptos Calypso Hotels' P/S

Its shares have lifted substantially and now Leptos Calypso Hotels' P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To our surprise, Leptos Calypso Hotels revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

Plus, you should also learn about these 3 warning signs we've spotted with Leptos Calypso Hotels (including 1 which makes us a bit uncomfortable).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CSE:LCH

Good value with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026