- China

- /

- Gas Utilities

- /

- SZSE:002700

The Market Doesn't Like What It Sees From Xinjiang Haoyuan Natural Gas Co., Ltd.'s (SZSE:002700) Earnings Yet As Shares Tumble 25%

Xinjiang Haoyuan Natural Gas Co., Ltd. (SZSE:002700) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. Looking at the bigger picture, even after this poor month the stock is up 72% in the last year.

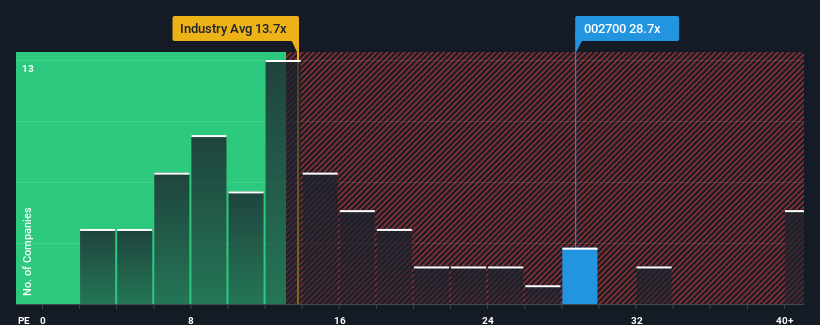

Even after such a large drop in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 37x, you may still consider Xinjiang Haoyuan Natural Gas as an attractive investment with its 28.7x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Earnings have risen firmly for Xinjiang Haoyuan Natural Gas recently, which is pleasing to see. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

See our latest analysis for Xinjiang Haoyuan Natural Gas

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Xinjiang Haoyuan Natural Gas' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 27%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

This is in contrast to the rest of the market, which is expected to grow by 37% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Xinjiang Haoyuan Natural Gas' P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Xinjiang Haoyuan Natural Gas' recently weak share price has pulled its P/E below most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Xinjiang Haoyuan Natural Gas revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with Xinjiang Haoyuan Natural Gas (including 1 which is concerning).

If you're unsure about the strength of Xinjiang Haoyuan Natural Gas' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002700

Xinjiang Wanjing Energy

Engages in the transmission, distribution, and sale of natural gas in China.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives