- China

- /

- Water Utilities

- /

- SZSE:001210

Kingfore Energy Group Co., Ltd.'s (SZSE:001210) Shares Not Telling The Full Story

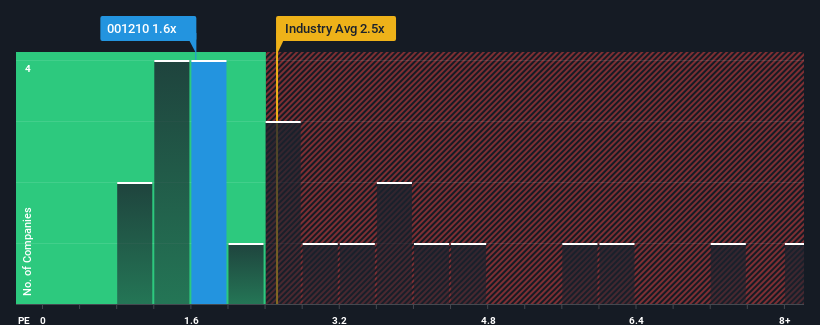

Kingfore Energy Group Co., Ltd.'s (SZSE:001210) price-to-sales (or "P/S") ratio of 1.6x might make it look like a buy right now compared to the Water Utilities industry in China, where around half of the companies have P/S ratios above 2.5x and even P/S above 5x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Kingfore Energy Group

How Kingfore Energy Group Has Been Performing

Revenue has risen firmly for Kingfore Energy Group recently, which is pleasing to see. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Kingfore Energy Group will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Kingfore Energy Group?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Kingfore Energy Group's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 21% gain to the company's top line. The latest three year period has also seen an excellent 39% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 13% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this in consideration, we find it intriguing that Kingfore Energy Group's P/S falls short of its industry peers. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

The fact that Kingfore Energy Group currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

Before you settle on your opinion, we've discovered 4 warning signs for Kingfore Energy Group (1 is a bit unpleasant!) that you should be aware of.

If these risks are making you reconsider your opinion on Kingfore Energy Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Kingfore Energy Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:001210

Kingfore Energy Group

Manufactures and sells energy saving products in China.

Excellent balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.