- China

- /

- Other Utilities

- /

- SHSE:605580

Undiscovered Gems in Asia to Explore This October 2025

Reviewed by Simply Wall St

As global markets navigate a landscape of monetary policy easing and trade tensions, Asia's small-cap sector presents intriguing opportunities amid broader economic shifts. In this environment, identifying stocks with robust fundamentals and growth potential becomes crucial for investors seeking to capitalize on the region's dynamic market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| MSC | 29.29% | 6.15% | 15.10% | ★★★★★★ |

| Q P Group Holdings | 17.07% | -2.56% | -2.55% | ★★★★★★ |

| Toukei Computer | NA | 5.63% | 13.86% | ★★★★★★ |

| Shandong Sacred Sun Power SourcesLtd | 18.69% | 12.95% | 39.68% | ★★★★★★ |

| Uju Holding | 34.04% | 5.58% | -25.17% | ★★★★★★ |

| CTCI Advanced Systems | 33.93% | 20.38% | 21.25% | ★★★★★☆ |

| Shandong Keyuan Pharmaceutical | 6.93% | -1.26% | -7.03% | ★★★★★☆ |

| Pizu Group Holdings | 41.45% | -2.37% | -15.01% | ★★★★☆☆ |

| Hollyland (China) Electronics Technology | 6.78% | 17.88% | 19.84% | ★★★★☆☆ |

| TSTE | 38.15% | 4.63% | -6.91% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Precision Tsugami (China) (SEHK:1651)

Simply Wall St Value Rating: ★★★★★★

Overview: Precision Tsugami (China) Corporation Limited is an investment holding company that focuses on the manufacture and sale of computer numerical control machine tools in Mainland China, with a market capitalization of HK$12.98 billion.

Operations: The primary revenue stream for Precision Tsugami (China) comes from the manufacture and sale of CNC high precision machine tools, generating CN¥4.26 billion. The company's net profit margin is a key financial indicator to consider when evaluating its performance.

Precision Tsugami (China) stands out as an intriguing player in the machinery sector, with a robust earnings growth of 63% over the past year, outperforming its industry peers. The company is trading at 65.6% below its estimated fair value and remains debt-free, enhancing its financial flexibility. Recent corporate guidance highlights a profit increase to RMB 502 million for six months ending September 2025, driven by demand from sectors like new energy vehicles and AI. Additionally, Precision Tsugami's strategic share repurchase program aims to bolster net asset value and earnings per share further cementing its market position.

- Click to explore a detailed breakdown of our findings in Precision Tsugami (China)'s health report.

Understand Precision Tsugami (China)'s track record by examining our Past report.

Hengsheng Energy (SHSE:605580)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hengsheng Energy Co., Ltd operates in the coal-fired thermal power sector in China with a market capitalization of CN¥9.25 billion.

Operations: Hengsheng Energy's primary revenue stream is from its Power and Steam Industry segment, generating CN¥882.25 million. The company's market capitalization stands at CN¥9.25 billion.

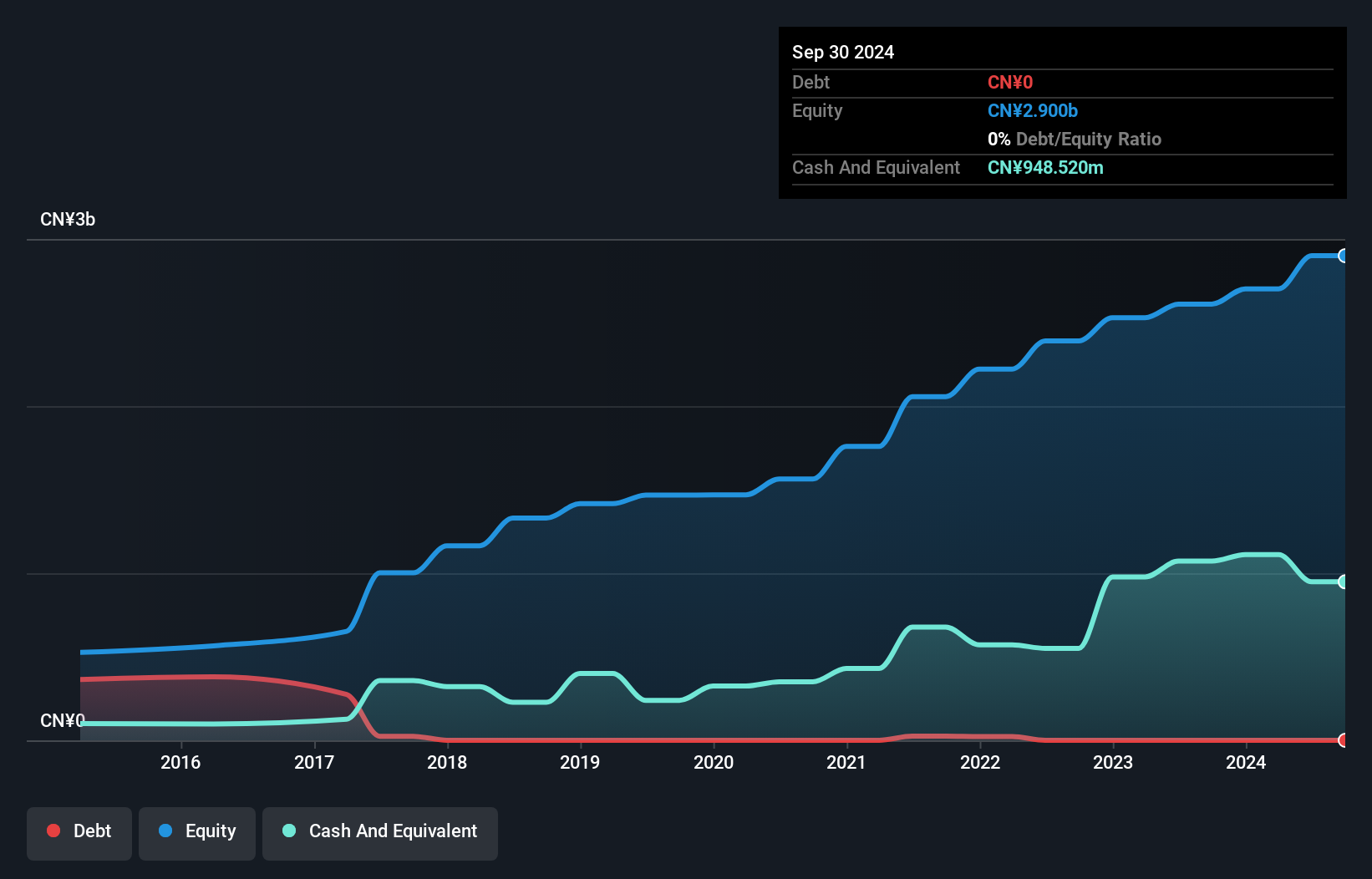

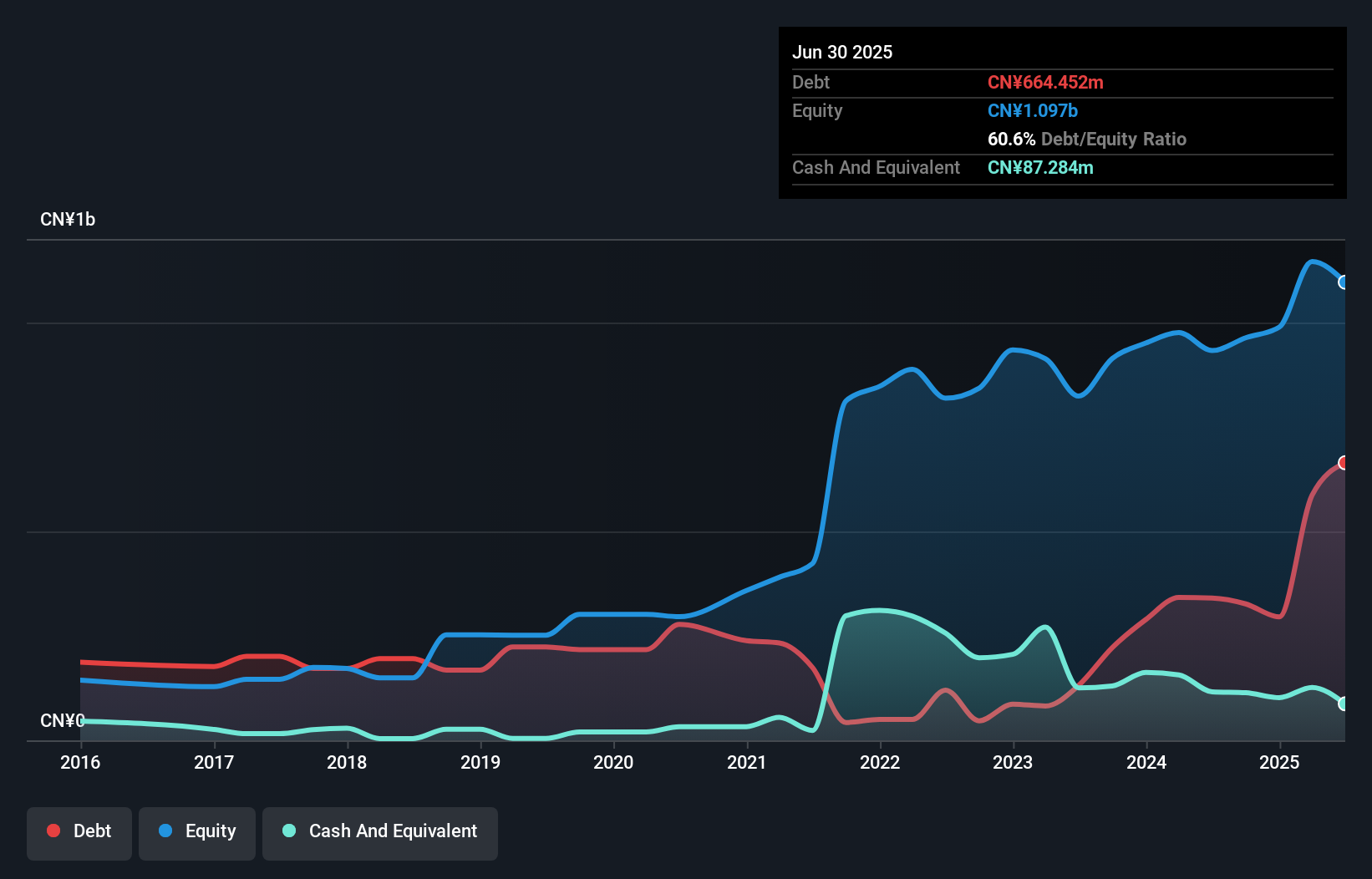

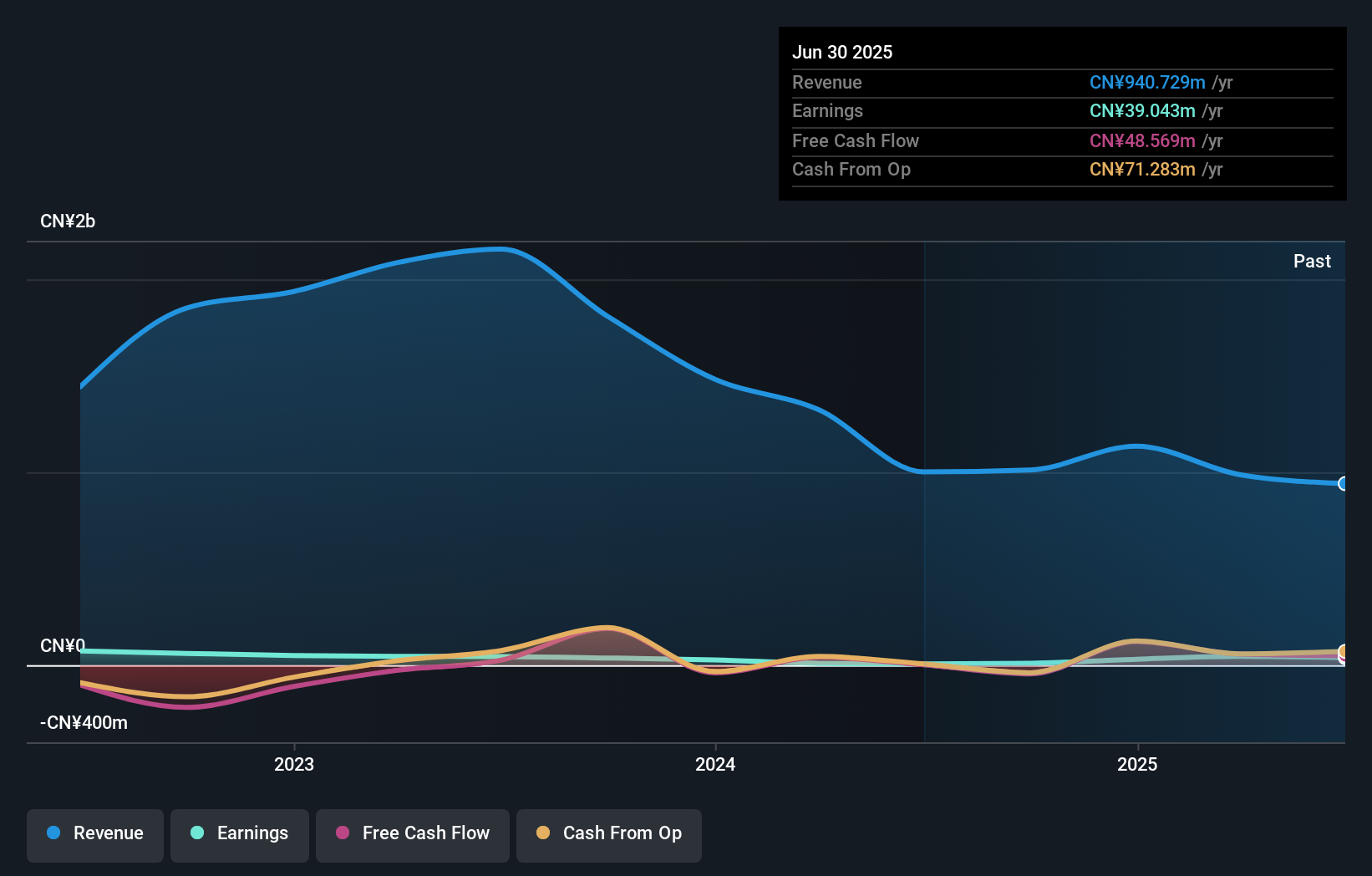

Hengsheng Energy, a dynamic player in the energy sector, has shown impressive growth with earnings up by 17.4% over the past year, outpacing its industry peers. The company's debt to equity ratio improved significantly from 93.8% to 60.6% over five years, although its net debt to equity remains high at 52.6%. A notable one-off gain of CN¥62.7M impacted recent financial results positively. For H1 2025, Hengsheng reported sales of CN¥460.58M compared to CN¥392.74M last year and net income rose from CN¥51.81M to CN¥68.76M, reflecting robust operational performance despite market volatility.

- Take a closer look at Hengsheng Energy's potential here in our health report.

Gain insights into Hengsheng Energy's past trends and performance with our Past report.

Wuxi Online Offline Communication Information Technology (SZSE:300959)

Simply Wall St Value Rating: ★★★★★★

Overview: Wuxi Online Offline Communication Information Technology Co., Ltd. operates in the technology sector, focusing on communication solutions, with a market cap of CN¥8.46 billion.

Operations: Wuxi Online Offline Communication Information Technology generates revenue primarily through its technology-driven communication solutions. The company has a market cap of CN¥8.46 billion.

Wuxi Online Offline Communication Information Technology has been making waves with significant earnings growth of 571.5% over the past year, outpacing the Wireless Telecom industry. The company's debt to equity ratio impressively dropped from 20% to 2.6% in five years, indicating a strong financial position. Recent earnings reveal a net income of CN¥10.72 million for the half-year ending June 2025, up from CN¥2.14 million previously, despite revenue dipping to CN¥333.7 million from CN¥528.57 million last year due to large one-off gains impacting results by CN¥27.3 million as of June 2025 end.

Next Steps

- Navigate through the entire inventory of 2370 Asian Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hengsheng Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605580

Proven track record with adequate balance sheet.

Market Insights

Community Narratives