As global trade tensions and economic fluctuations continue to shape markets, China's equity scene presents a mixed landscape with notable resilience in specific sectors despite broader challenges. In this context, understanding the stability and potential yield from top Chinese dividend stocks becomes particularly pertinent for investors looking to navigate July 2024's complex investment terrain. A good dividend stock typically offers not just a steady income stream but also the promise of financial stability, which is especially valuable in times of market uncertainty like those currently impacting global economies.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Midea Group (SZSE:000333) | 5.05% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 4.39% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.71% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 7.13% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.79% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 6.09% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.58% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.84% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.89% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.76% | ★★★★★★ |

Click here to see the full list of 270 stocks from our Top Chinese Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Xinjiang East Universe GasLtd (SHSE:603706)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xinjiang East Universe Gas Ltd. (ticker: SHSE:603706) operates in natural gas sales, installation of natural gas facility equipment, and provides natural gas heating services, with a market capitalization of approximately CN¥2.97 billion.

Operations: Xinjiang East Universe Gas Ltd. generates its revenue primarily from three key activities: selling natural gas, installing natural gas facilities, and offering natural gas heating services.

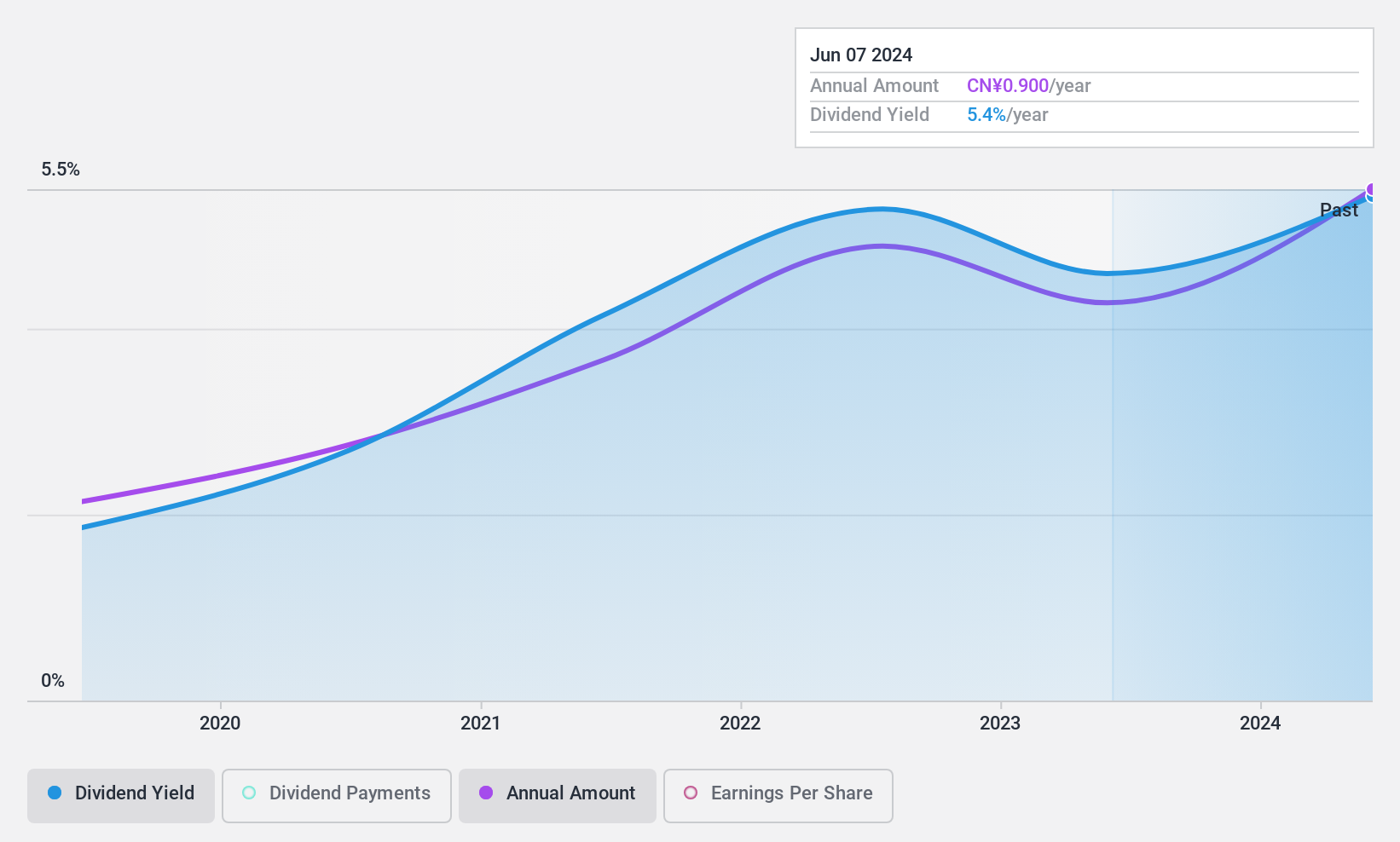

Dividend Yield: 5.6%

Xinjiang East Universe Gas Ltd. has shown a promising trend in dividend growth, albeit with a short history of only 5 years of payments. Recent financials indicate solid earnings growth, with net income rising to CNY 72.72 million from CNY 66.06 million year-over-year and sales increasing to CNY 487.6 million. The company maintains a healthy payout ratio at 84%, supported by earnings, and a cash payout ratio at 48.6%, suggesting dividends are well-covered by both profits and cash flow, though the dividend track record remains relatively unstable due to its brief history.

- Click here to discover the nuances of Xinjiang East Universe GasLtd with our detailed analytical dividend report.

- The analysis detailed in our Xinjiang East Universe GasLtd valuation report hints at an deflated share price compared to its estimated value.

Guangdong Hongtu Technology (holdings)Ltd (SZSE:002101)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Guangdong Hongtu Technology (Holdings) Co., Ltd. focuses on designing, developing, manufacturing, and selling precision aluminum alloy die castings and related accessories for the automotive, communication, and electromechanical sectors in China, with a market capitalization of approximately CN¥6.17 billion.

Operations: Guangdong Hongtu Technology (Holdings) Co., Ltd. generates its revenue primarily from the sale of precision aluminum alloy die castings and related accessories for various industries, including automotive, communication, and electromechanical sectors.

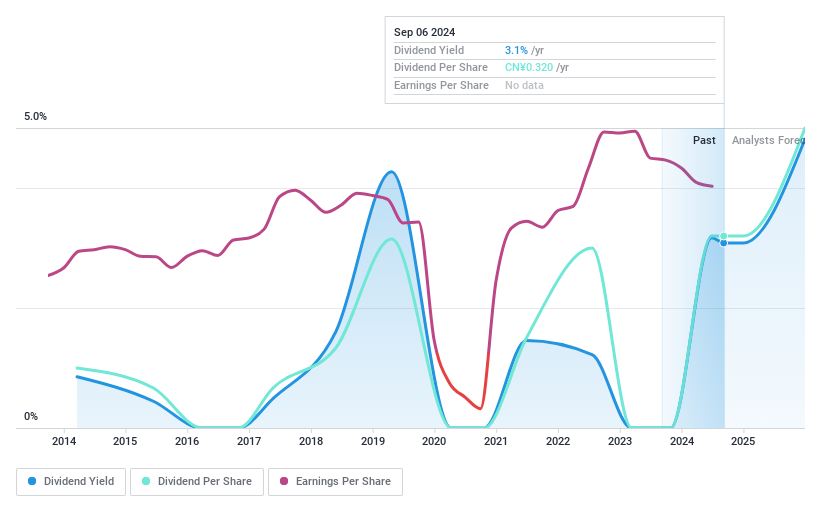

Dividend Yield: 3.1%

Guangdong Hongtu Technology's recent financials show a slight increase in net income from CNY 170.5 million to CNY 173.1 million, with sales rising to CNY 3.64 billion. Despite a stable dividend of CNY 3.20 per 10 shares, the company faces challenges with free cash flow, impacting dividend sustainability. Its Price-To-Earnings ratio at 16x is below the market average, suggesting potential undervaluation relative to peers. However, its dividends have shown volatility over the past decade and are not fully covered by earnings or cash flows, raising concerns about long-term reliability and growth in payouts.

- Navigate through the intricacies of Guangdong Hongtu Technology (holdings)Ltd with our comprehensive dividend report here.

- Our valuation report here indicates Guangdong Hongtu Technology (holdings)Ltd may be undervalued.

Shanghai Hanbell Precise Machinery (SZSE:002158)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shanghai Hanbell Precise Machinery Co., Ltd. is a company specializing in the development, manufacture, and sale of precision machinery such as compressors and vacuum pumps, with a market capitalization of CN¥8.35 billion.

Operations: Shanghai Hanbell Precise Machinery Co., Ltd. does not provide detailed revenue segmentation in the provided text.

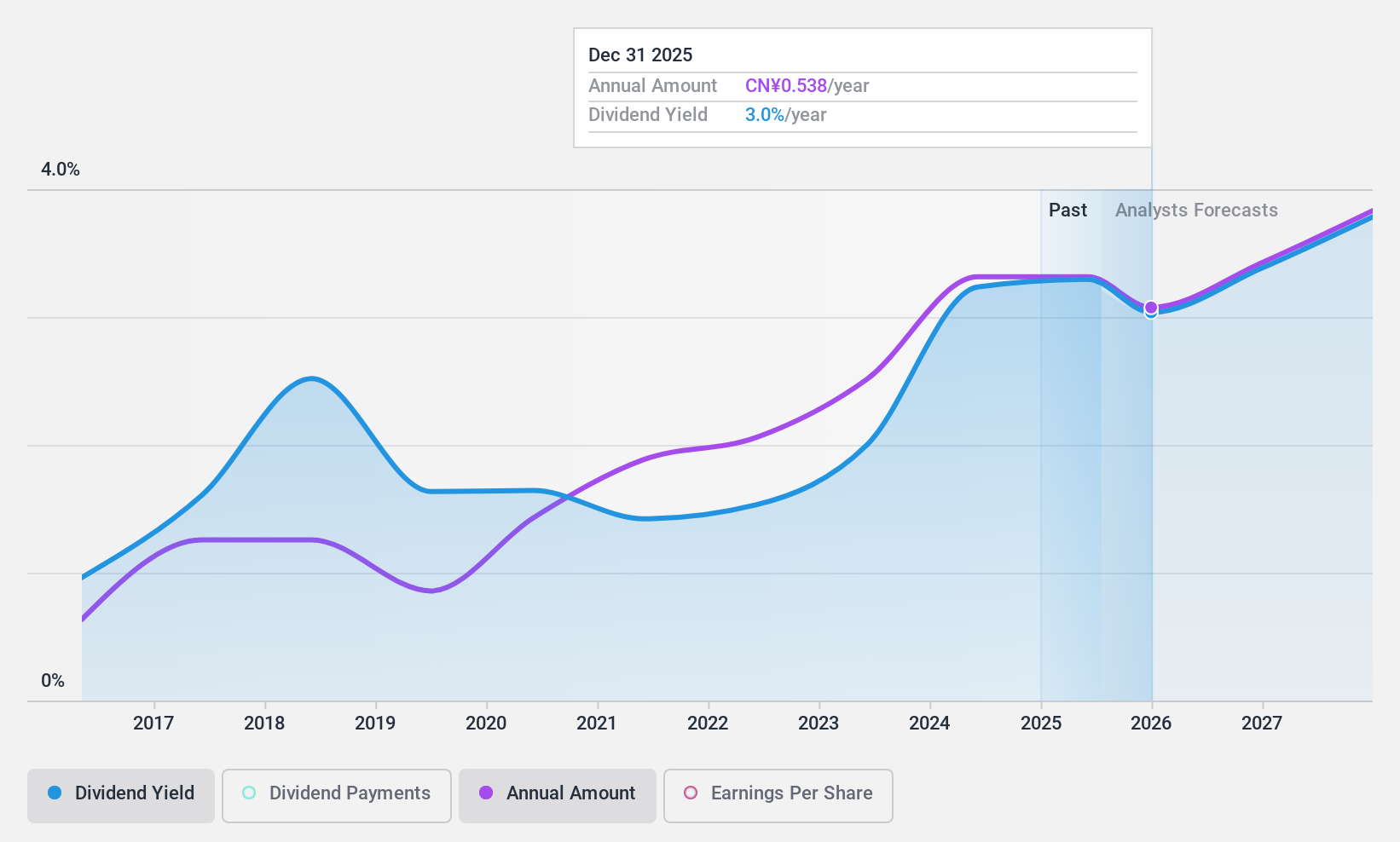

Dividend Yield: 3.4%

Shanghai Hanbell Precise Machinery reported a robust first half with sales up to CNY 1.83 billion and net income rising to CNY 453.35 million, reflecting year-over-year growth. The company declared a dividend of CNY 5.80 per 10 shares for 2023, maintaining its trend of increasing dividends, yet the history shows volatility in payouts over the last decade. Despite this inconsistency, both earnings and cash flow analyses suggest dividends are sustainably covered with payout ratios at 32.5% and cash payout ratio at 47.3%, respectively.

- Get an in-depth perspective on Shanghai Hanbell Precise Machinery's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Shanghai Hanbell Precise Machinery shares in the market.

Next Steps

- Navigate through the entire inventory of 270 Top Chinese Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Shanghai Hanbell Precise Machinery, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002158

Shanghai Hanbell Precise Machinery

Shanghai Hanbell Precise Machinery Co., Ltd.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives