None And 2 Other Hidden Small Cap Treasures With Solid Foundations

Reviewed by Simply Wall St

As global markets navigate a mixed economic landscape, with U.S. consumer confidence dipping and major stock indexes experiencing fluctuations, small-cap stocks present intriguing opportunities for investors seeking growth potential amid uncertainty. In this environment, identifying stocks with solid foundations is crucial; these are companies that demonstrate strong fundamentals and resilience in the face of economic shifts, making them potential hidden treasures within the small-cap sector.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tokyo Tekko | 9.82% | 7.91% | 12.42% | ★★★★★★ |

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Global New Material International Holdings (SEHK:6616)

Simply Wall St Value Rating: ★★★★★★

Overview: Global New Material International Holdings Limited is an investment holding company that specializes in the production and sale of pearlescent pigments and functional mica fillers, serving markets both within the People’s Republic of China and internationally, with a market cap of HK$4.50 billion.

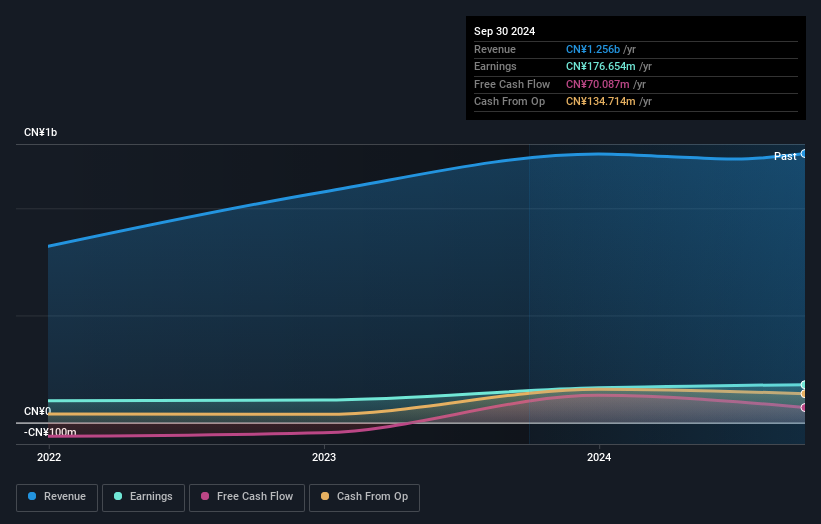

Operations: The company generates revenue primarily from its PRC business operations, amounting to CN¥1.11 billion. The net profit margin is a key financial metric to consider when evaluating the company's profitability.

Global New Material International Holdings seems to be carving a niche in the chemicals sector, with earnings growth of 0.9% over the past year, outpacing an industry decline of 21.5%. Their debt situation appears manageable, as interest payments are well covered by EBIT at 6.3 times, and their debt-to-equity ratio has slightly improved from 33.4% to 32.7% over five years. The company is free cash flow positive and boasts high-quality earnings, suggesting solid operational efficiency despite broader industry challenges. With forecasts predicting a robust annual earnings growth rate of over 31%, it could hold potential for future expansion in its market segment.

Xinjiang Xintai Natural Gas (SHSE:603393)

Simply Wall St Value Rating: ★★★★★☆

Overview: Xinjiang Xintai Natural Gas Co., Ltd. is involved in the transmission, distribution, and sale of natural gas in China, with a market cap of CN¥12.42 billion.

Operations: Xinjiang Xintai generates revenue primarily through the transmission, distribution, and sale of natural gas. The company's cost structure includes expenses related to infrastructure maintenance and operations necessary for delivering natural gas. It exhibits a notable trend in its net profit margin, reflecting efficiency in managing operational costs relative to its revenue streams.

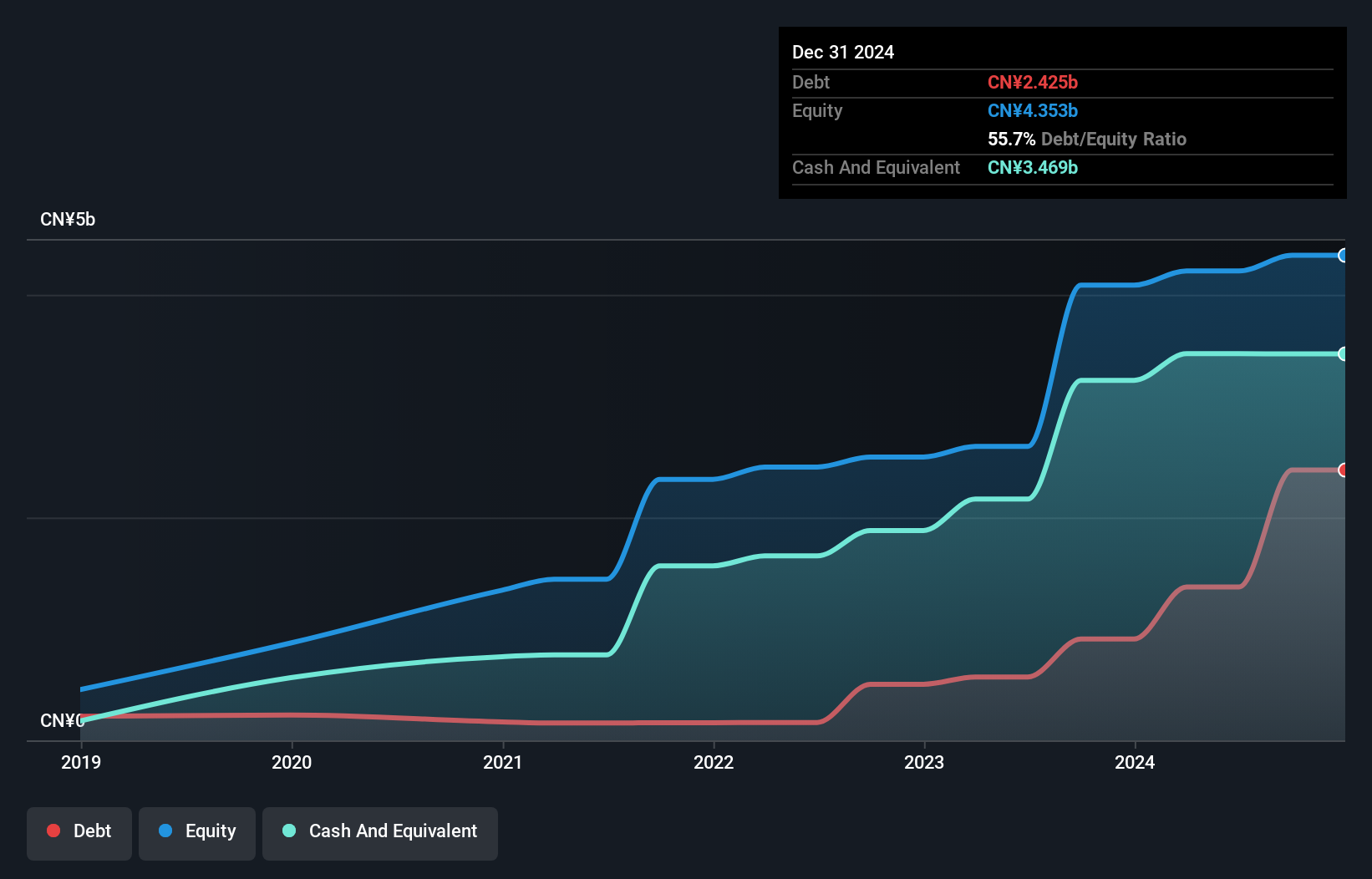

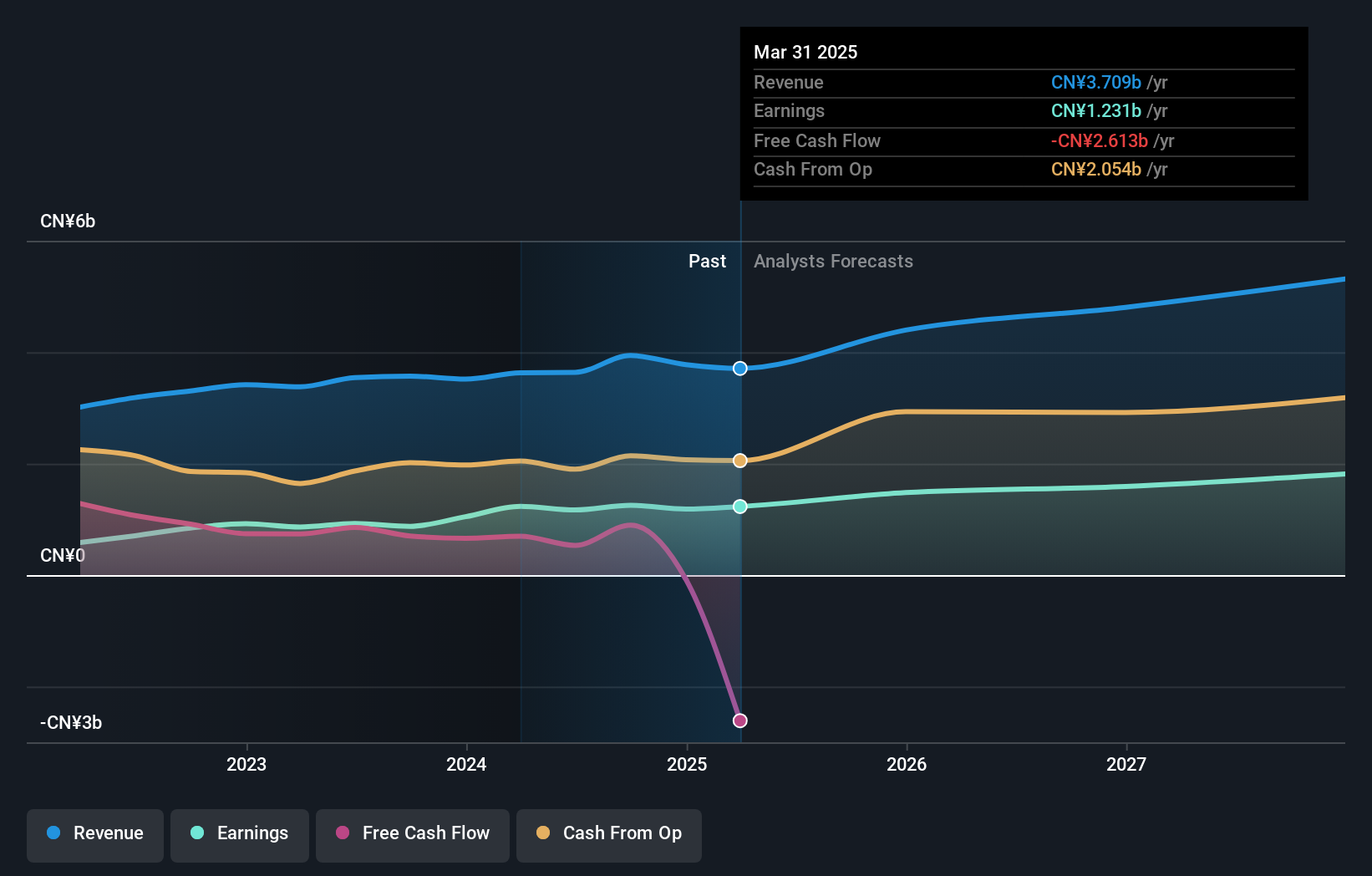

Xinjiang Xintai Natural Gas, a smaller player in the gas utilities sector, has been making waves with its impressive earnings growth of 43.1% over the past year, outpacing the industry's 15.9%. Its net income for the first nine months of 2024 reached CNY 881.86 million, up from CNY 676.91 million last year, while basic earnings per share rose to CNY 2.08 from CNY 1.6. The company's debt-to-equity ratio increased to 45.3% over five years but remains manageable with a satisfactory net debt to equity ratio of 13.6%, reflecting prudent financial management amidst robust performance metrics.

Zhengzhou Suda Industry Machinery Service (SZSE:001277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhengzhou Suda Industry Machinery Service Co., Ltd. operates in the machinery service sector and has a market cap of CN¥2.77 billion.

Operations: The company generates revenue primarily through its machinery service operations. Key financial metrics include a market capitalization of CN¥2.77 billion, highlighting its scale within the industry.

Zhengzhou Suda Industry Machinery Service, with its notable earnings growth of 19.5% over the past year, outpaced the Commercial Services industry average of 0.9%. The company reported net income of CNY 112.26 million for the first nine months of 2024, up from CNY 97.94 million in the previous year, reflecting strong performance despite a debt-to-equity ratio increase from 10.4% to 12.4% over five years. Its interest payments are comfortably covered by EBIT at a factor of 61x, and it maintains a favorable price-to-earnings ratio of 17x compared to the broader CN market's average of nearly double that figure (36x).

Summing It All Up

- Click this link to deep-dive into the 4627 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6616

Global New Material International Holdings

An investment holding company, produces and sells pearlescent pigment, functional mica filler, and related products in the People’s Republic of China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives