- China

- /

- Electric Utilities

- /

- SHSE:600969

13% earnings growth over 3 years has not materialized into gains for Hunan Chendian International Developmentco.ltd (SHSE:600969) shareholders over that period

While not a mind-blowing move, it is good to see that the Hunan Chendian International Developmentco.,ltd (SHSE:600969) share price has gained 24% in the last three months. Unfortunately the return over three years isn't so good. Specifically, the stock price is down 15% whereas the market is down , having returned (-13%).

After losing 11% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Hunan Chendian International Developmentco.ltd

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Hunan Chendian International Developmentco.ltd became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. So it's worth looking at other metrics to try to understand the share price move.

Revenue is actually up 6.9% over the three years, so the share price drop doesn't seem to hinge on revenue, either. This analysis is just perfunctory, but it might be worth researching Hunan Chendian International Developmentco.ltd more closely, as sometimes stocks fall unfairly. This could present an opportunity.

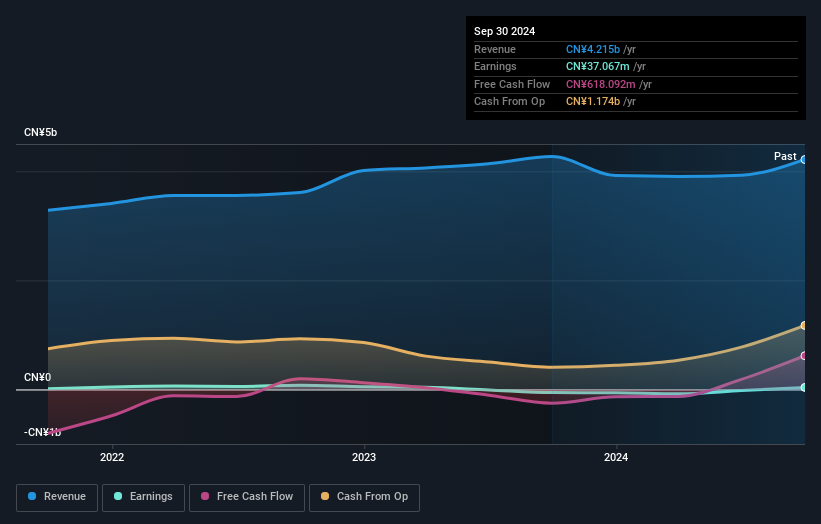

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Hunan Chendian International Developmentco.ltd shareholders are up 5.7% for the year. But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 0.8% per year over five year. This could indicate that the company is winning over new investors, as it pursues its strategy. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Hunan Chendian International Developmentco.ltd (at least 2 which are significant) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hunan Chendian International Developmentco.ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600969

Hunan Chendian International Developmentco.ltd

Engages in power supply and water supply services in China.

Good value very low.

Market Insights

Community Narratives