As the Asian markets navigate a landscape marked by technological enthusiasm and growth challenges, investors are keenly observing the region's dividend stocks for stability and potential income. In this context, identifying companies with strong fundamentals and consistent dividend payouts becomes crucial, especially as market dynamics evolve.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.39% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.63% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.89% | ★★★★★★ |

| NCD (TSE:4783) | 4.58% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.69% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.09% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.15% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.51% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.81% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.56% | ★★★★★★ |

Click here to see the full list of 1037 stocks from our Top Asian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Quality Houses (SET:QH)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Quality Houses Public Company Limited, with a market cap of THB14.03 billion, operates in Thailand's property development sector alongside its subsidiaries.

Operations: Quality Houses generates revenue primarily from its Real Estate Business, with THB4.80 billion from sales of land and houses and THB1.17 billion from condominium units, complemented by THB1.37 billion from its hotel operations and THB67 million from rental activities.

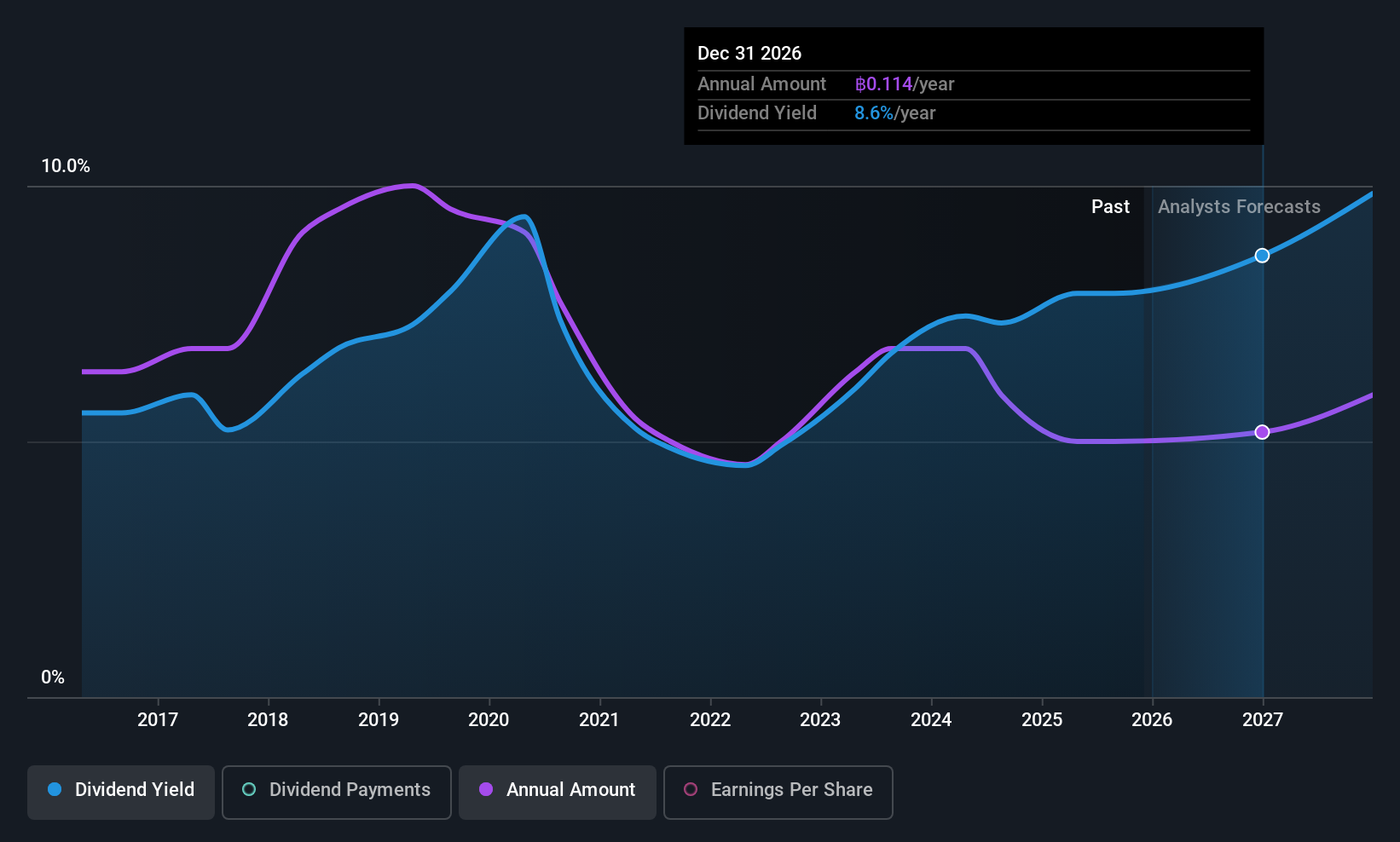

Dividend Yield: 8.4%

Quality Houses' dividend payments are well-supported by earnings and cash flows, with a payout ratio of 63.6% and a cash payout ratio of 46.3%. Despite being in the top 25% for dividend yield in Thailand at 8.4%, its dividend history has been volatile over the past decade. Recent buyback activities amounted to THB 2.11 million, while interim dividends were approved for September 2025, highlighting ongoing shareholder returns despite declining revenues and net income this year.

- Unlock comprehensive insights into our analysis of Quality Houses stock in this dividend report.

- Our valuation report unveils the possibility Quality Houses' shares may be trading at a premium.

ENN Natural GasLtd (SHSE:600803)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ENN Natural Gas Co., Ltd. operates in China, focusing on natural gas distribution, trading, storage, transportation, production, and engineering with a market cap of approximately CN¥67.48 billion.

Operations: ENN Natural Gas Co., Ltd.'s revenue is primarily derived from its activities in natural gas distribution, trading, storage, transportation, production, and engineering within China.

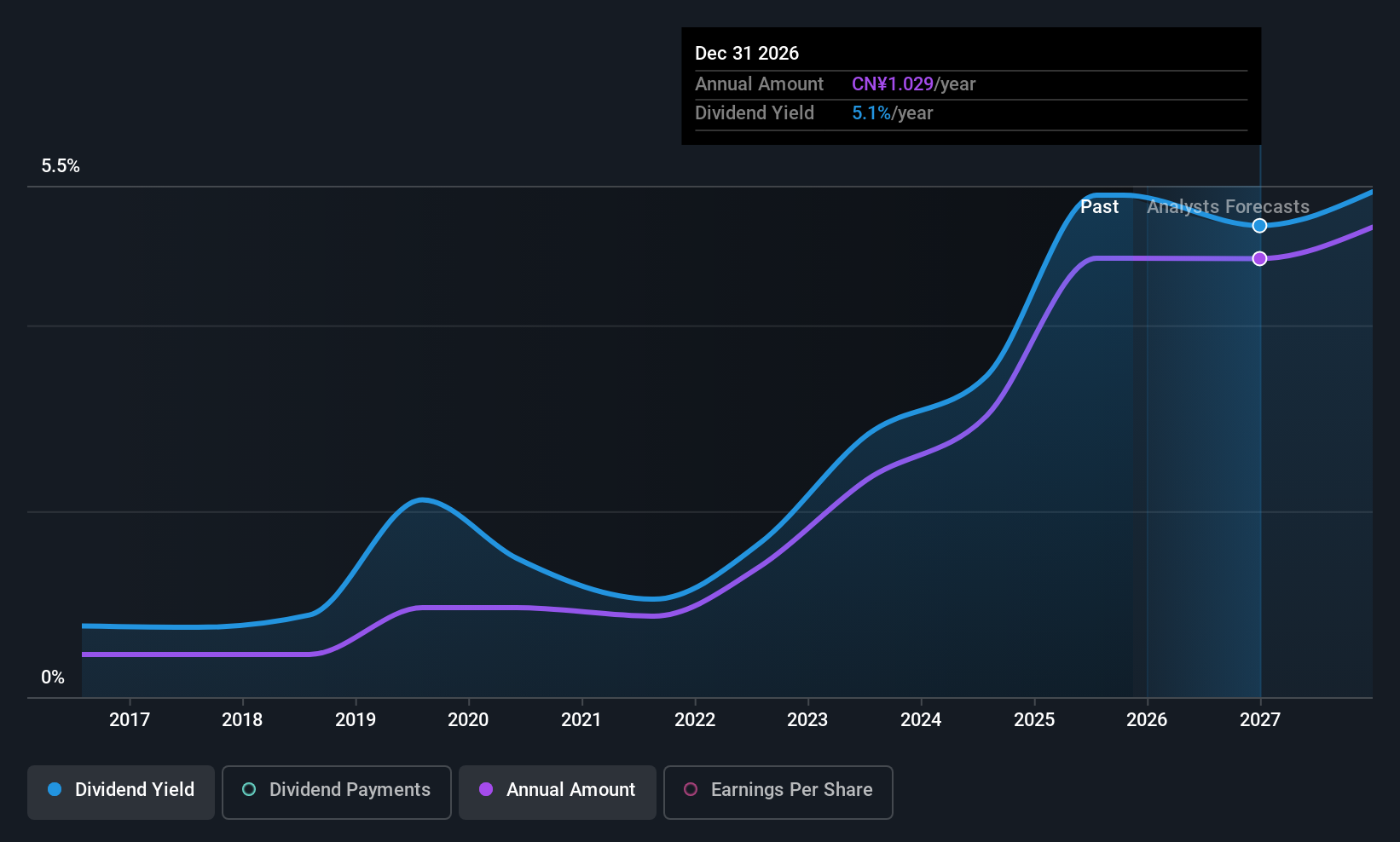

Dividend Yield: 4.7%

ENN Natural Gas Ltd.'s dividends are supported by earnings and cash flows, with payout ratios of 56.3% and 63.2%, respectively. The dividend yield is in the top 25% in China at 4.69%, though its history shows volatility over the past decade despite growth. Recent earnings for nine months ending September 2025 indicate a slight decline in revenue to ¥95.86 billion and net income to ¥3.43 billion, underscoring challenges amidst dividend sustainability concerns.

- Click here to discover the nuances of ENN Natural GasLtd with our detailed analytical dividend report.

- Our expertly prepared valuation report ENN Natural GasLtd implies its share price may be lower than expected.

ZCZL Industrial Technology Group (SHSE:601717)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ZCZL Industrial Technology Group Company Limited, with a market cap of CN¥41.84 billion, manufactures and sells coal mining and excavating equipment for the coal mining industry in China, Germany, and internationally.

Operations: ZCZL Industrial Technology Group's revenue is primarily derived from the Manufacture of Coal Mining Machinery, contributing CN¥21.02 billion, and Automotive Parts, contributing CN¥18.94 billion.

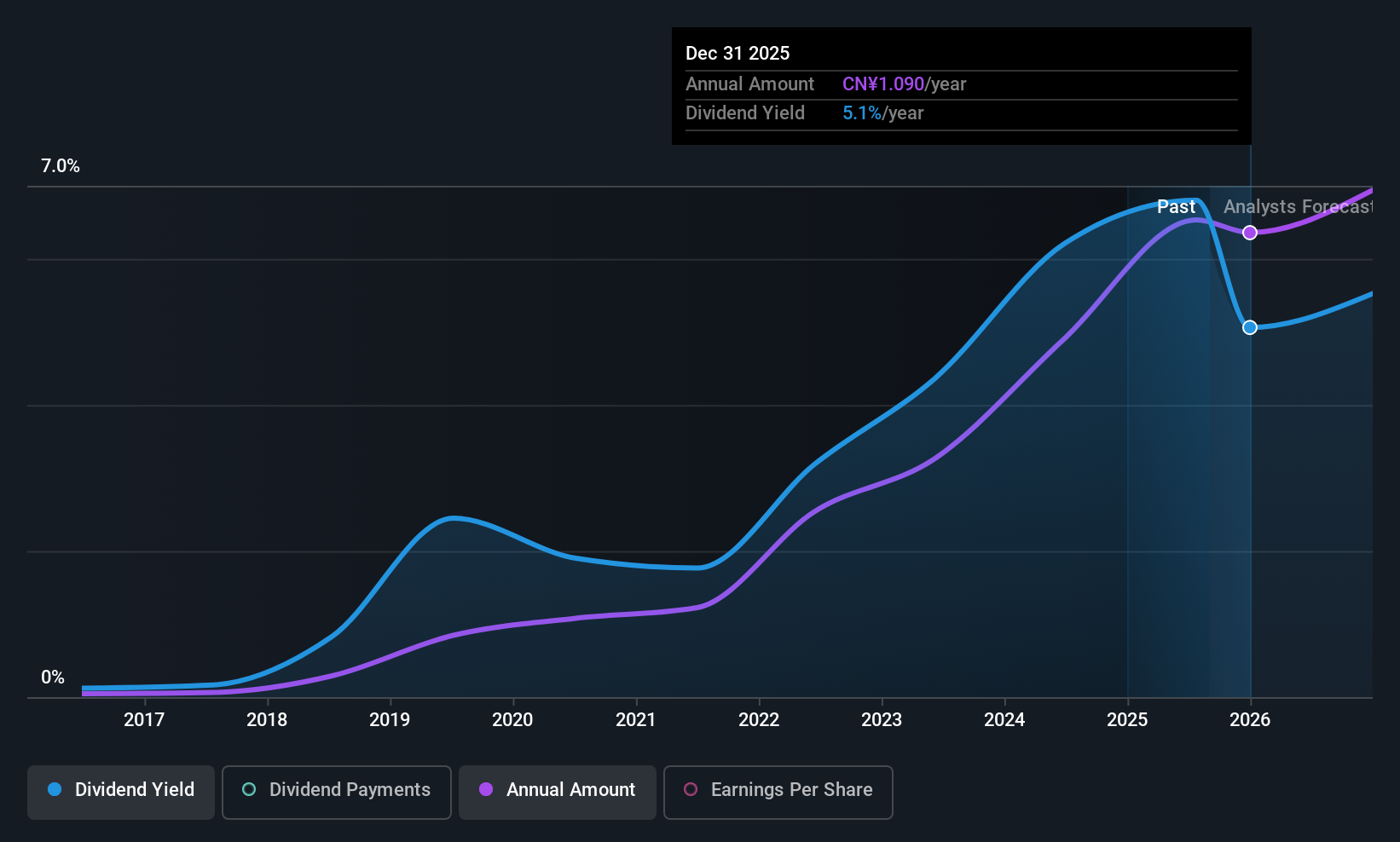

Dividend Yield: 4.7%

ZCZL Industrial Technology Group's dividend yield of 4.66% ranks in the top 25% in China, yet its history is marked by volatility and unreliable growth over the past decade. Despite a low payout ratio of 43.7%, indicating coverage by earnings, the cash payout ratio remains high at 325.3%, raising sustainability concerns. Recent earnings show robust growth with net income rising to ¥3.64 billion for nine months ending September 2025, reflecting strong financial performance amidst recent board changes and a company rebranding effort.

- Click to explore a detailed breakdown of our findings in ZCZL Industrial Technology Group's dividend report.

- Our valuation report unveils the possibility ZCZL Industrial Technology Group's shares may be trading at a discount.

Next Steps

- Unlock more gems! Our Top Asian Dividend Stocks screener has unearthed 1034 more companies for you to explore.Click here to unveil our expertly curated list of 1037 Top Asian Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZCZL Industrial Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601717

ZCZL Industrial Technology Group

Manufactures and sells coal mining and excavating equipment for coal mining industry in the People’s Republic of China, Germany, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026