- China

- /

- Gas Utilities

- /

- SHSE:600635

Does Shanghai Dazhong Public Utilities(Group)Ltd (SHSE:600635) Have A Healthy Balance Sheet?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Shanghai Dazhong Public Utilities(Group) Co.,Ltd. (SHSE:600635) does carry debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Shanghai Dazhong Public Utilities(Group)Ltd

What Is Shanghai Dazhong Public Utilities(Group)Ltd's Net Debt?

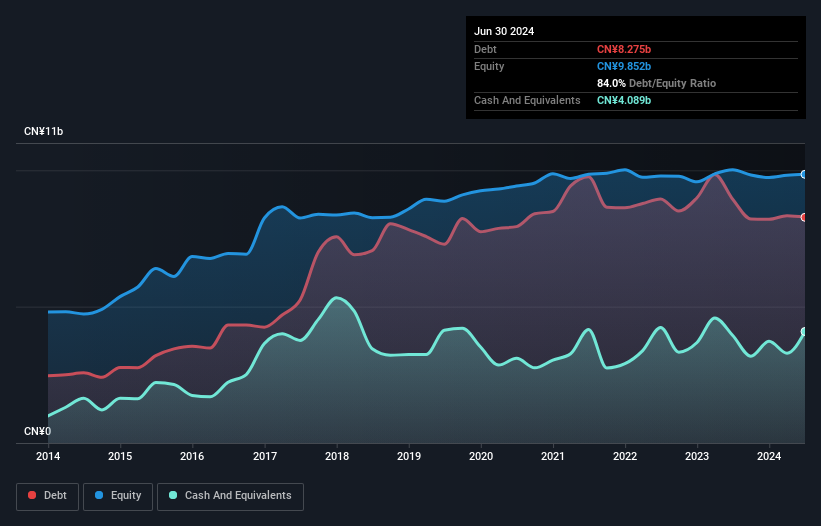

The image below, which you can click on for greater detail, shows that Shanghai Dazhong Public Utilities(Group)Ltd had debt of CN¥8.28b at the end of June 2024, a reduction from CN¥8.94b over a year. However, it does have CN¥4.09b in cash offsetting this, leading to net debt of about CN¥4.19b.

A Look At Shanghai Dazhong Public Utilities(Group)Ltd's Liabilities

According to the last reported balance sheet, Shanghai Dazhong Public Utilities(Group)Ltd had liabilities of CN¥7.98b due within 12 months, and liabilities of CN¥5.07b due beyond 12 months. On the other hand, it had cash of CN¥4.09b and CN¥1.44b worth of receivables due within a year. So it has liabilities totalling CN¥7.52b more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of CN¥9.08b. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

As it happens Shanghai Dazhong Public Utilities(Group)Ltd has a fairly concerning net debt to EBITDA ratio of 6.6 but very strong interest coverage of 16.5. This means that unless the company has access to very cheap debt, that interest expense will likely grow in the future. Importantly Shanghai Dazhong Public Utilities(Group)Ltd's EBIT was essentially flat over the last twelve months. We would prefer to see some earnings growth, because that always helps diminish debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is Shanghai Dazhong Public Utilities(Group)Ltd's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the most recent three years, Shanghai Dazhong Public Utilities(Group)Ltd recorded free cash flow worth 62% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

Neither Shanghai Dazhong Public Utilities(Group)Ltd's ability handle its debt, based on its EBITDA, nor its level of total liabilities gave us confidence in its ability to take on more debt. But the good news is it seems to be able to cover its interest expense with its EBIT with ease. It's also worth noting that Shanghai Dazhong Public Utilities(Group)Ltd is in the Gas Utilities industry, which is often considered to be quite defensive. Looking at all the angles mentioned above, it does seem to us that Shanghai Dazhong Public Utilities(Group)Ltd is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 4 warning signs for Shanghai Dazhong Public Utilities(Group)Ltd (2 are a bit unpleasant) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600635

Shanghai Dazhong Public Utilities(Group)Ltd

An investment holding company, engages in pipeline gas supply and sewage treatment activities in the People’s Republic of China.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026